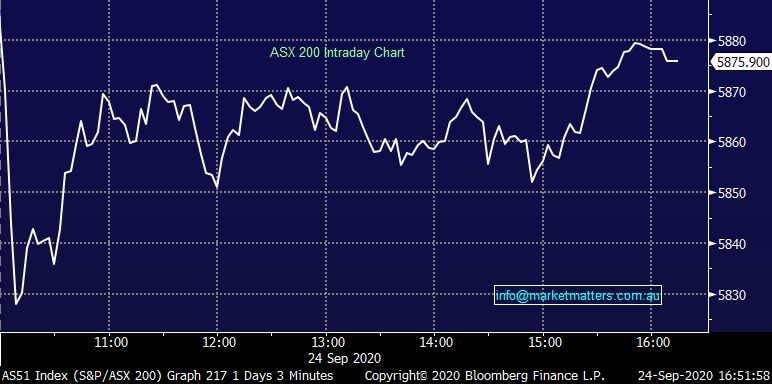

ASX down but shows resilience, Westpac settles for $1.3b (WBC, BKW, GMG, LLC)

WHAT MATTERED TODAY

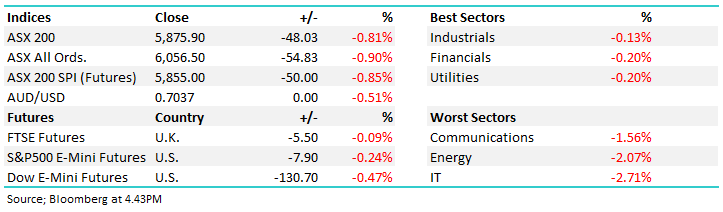

Obviously a weak session locally coming on the back of a decent sell-off overseas, however considering the +140pts we added yesterday independent of US leads plus the ~2% decline that played out overnight & another -0.40% in US Futures during our time zone today, the ASX off by -0.81%/-48pts feels like a win. As we’ve written umpteen times over the past couple of months, the markets 5700/6200 trading range remains intact and while it does, we need to be respectful of it. Of course, there’s been a lot more action under the hood, today it was decent underperformance from the IT stocks thanks largely to news that Afterpay (APT) was transitioning its CFO (never taken well by the market), the sector down -2.71% while the broader Industrials & Financials were off -0.13% & -0.20% a piece i.e. relative outperformers.

The banks were interesting today, they opened lower and did better throughout the session, the sticker shock of Westpac’s $1.3bn settlement announced this morning prompted selling early however as we suggested this morning, it was within the realms of expectations and importantly, it’s now behind them – Harry covers more on it below.

Property stocks caught a bid today, particularly Abacus (ABP) +3.61% which resides in the MM Income Portfolio. We’ve recently increased our exposure to the sector and now hold both ABP and CLW as more defensive yield style investments - both continue to look good for further gains.

Asian markets were lower across the board today, Japan down -1.11% the best of them while Hong Kong shares lost -1.83%. US Futures opened down -0.50% around our open, rallied to be slightly higher before rolling off into our close.

By the close, the ASX 200 was off -48pts / -0.81% to 5875. Dow Futures are trading down -111pts/-0.42%

ASX 200 Chart

ASX 200 Chart

CATHCING MY EYE

Westpac (WBC) -0.12%: traded largely in line with the rest of its big 4 peers today – a good result on the day it was hit for the largest fine in corporate history. Westpac settled its dealings with AUSTRAC today for a whopping $1.3b, admitting to 23 million breaches of the money laundering and terrorism financing laws 6 months after the issues were raised.

The fine is $400m more than the bank had provisioned for in the first half of the year – the market was largely prepared for that though and while it’s a little more than hoped, it also means a line in the sand has been drawn, the bank can move past the distraction and the market has one less thing to concern itself over. It remains a tough environment out there for banks with little change in sentiment despite the rebound in the economy. Westpac declined to pay a half year dividend but could now look to pay one at the full year results out later in the year given the fine is not crippling the capital position, which remains strong

Westpac (WBC) Chart

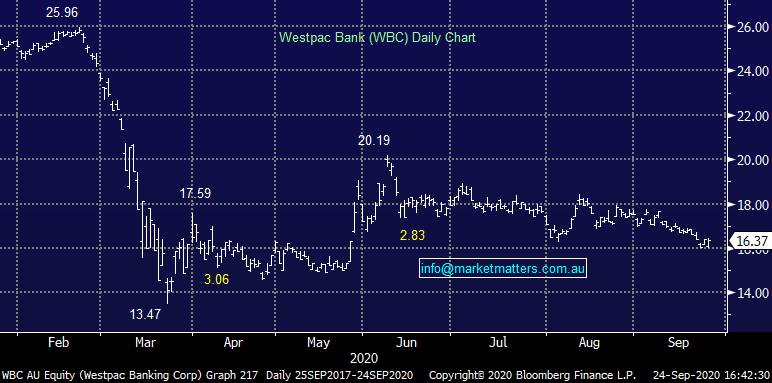

Brickworks (BKW) -0.95%: reported a largely inline result today – EBITDA at $281m vs the market at $277.2m was a beat despite the fall of 19% on FY19. The building materials manufacturer noted local demand had remained supported throughout the year even throughout COVID lockdowns while September has seen sales increase as stimulus measure targeted at construction come into effect. US earnings were higher, though largely driven by an acquisition which more than offset temporary shutdowns at their Pennsylvanian plant. While operationally the report was solid, earnings were still driven by strong contributions from the property portfolio. Looking ahead, Brickworks looked to alleviate fears over US expansion which has seen it undertake a number of acquisitions over the last few years. While COVID may have slowed progress on some fronts, they have worked to upgrade plants to improve earnings as we come out of the pandemic. An interesting business, leveraged to the rebound in economic activity, one to watch.

Brickworks (BKW) Chart

BROKER MOVES

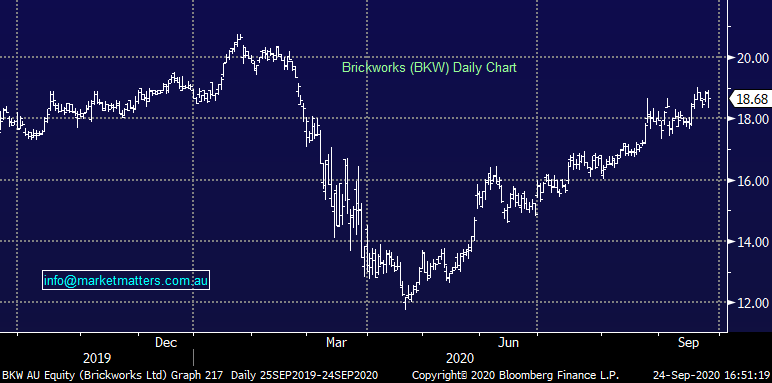

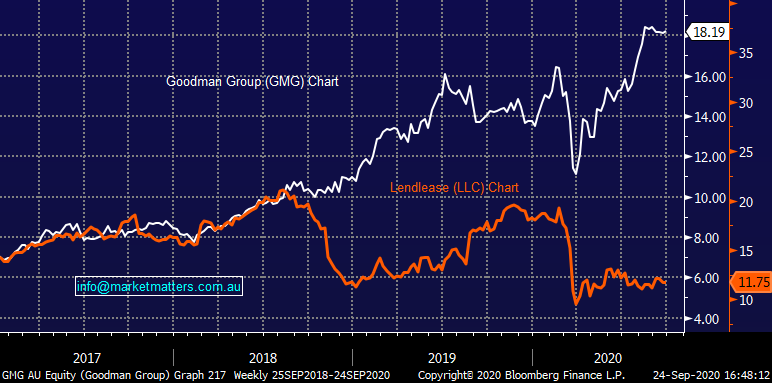

Goldman’s penned a bullish note on Lend Lease (LLC) yesterday saying that their plan to alter capital allocation and return targets should see it generate a sustainable growth rate in line with peer Goodman Group. Goodman is obviously a very strong comp in the sector and the performance gap is stark (as shown below). Goldmans went on to say they see an EPS growth rate of about 7%/yr. They have a $16.37 PT on the stock. Plenty of upside if LLC can capture the GMG growth trajectory!

Goodman Group (White) – Lend Lease (LLC) Orange

Elsewhere:

· Service Stream Raised to Buy at Bell Potter; PT A$2.30

· Domain Holdings Cut to Sell at Morningstar

· AusNet Cut to Sell at Morningstar

· Treasury Wine Raised to Outperform at Credit Suisse; PT A$12.30

· Resolute Mining Raised to Buy at EL & C Baillieu; PT A$1.32

OUR CALLS

No changes today

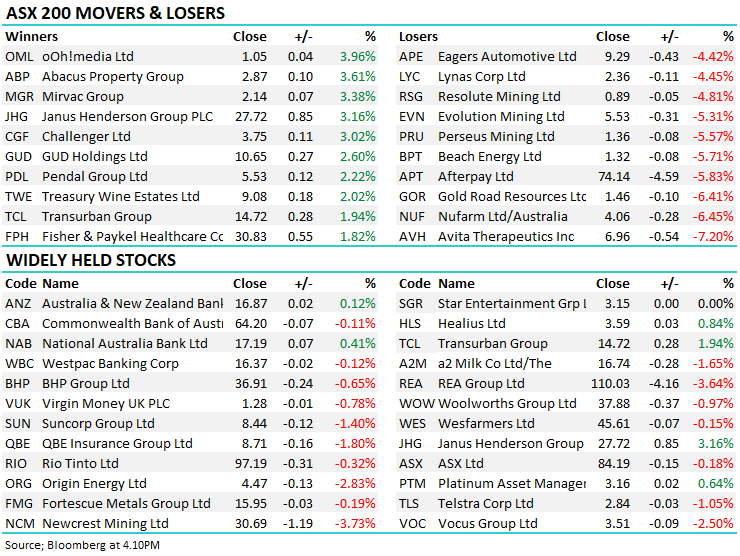

Major Movers Today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.