The post budget bulls emerge (Z1P, ARB, BIN, STA)

WHAT MATTERED TODAY

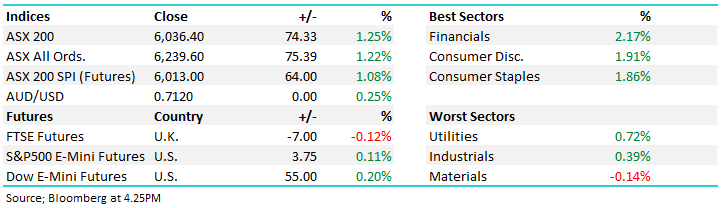

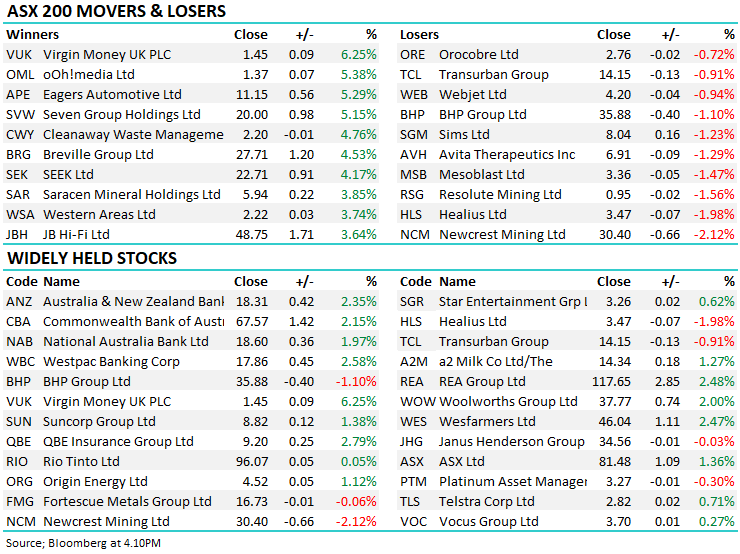

A strong session for the ASX today as the market tracked from bottom left to top right – exactly what we want to see and it was particuarly impressive given the backdrop of a weak lead from overseas markets and continued rhetoric from Trump on twitter throughout our day. The budget clearly front and centre and we delve further into the main beficiaries below. Broad based buying as you’d expect today, the only sector to lag were the materials while the influental financials were best on ground adding more than 2%.

Asian markets were a mixed bag while US Futures were fairly muted, although they did rally from an early -0.4% sell-off. All up, a good day for Aussie stocks with the market back up through 6000.

By the close, the ASX 200 was up by +74pts / +1.25%. Dow Futures are trading up 55pts/+0.20%

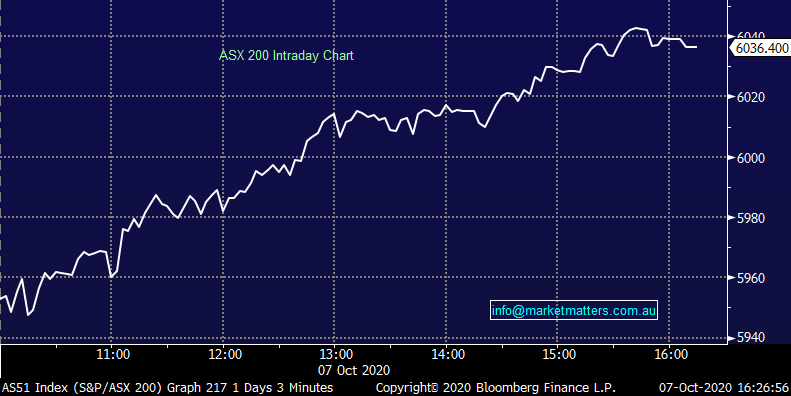

ASX 200 Chart

ASX 200 Chart

CATHCING MY EYE

Budget – more winners: Lots of research out about the budget today with the consensus being that it’s bullish for many stocks and there is a distinct lack of losers – the market certainly felt that way today as it roared ahead. The basis of the budget is to invigorate a private-sector led recovery with getting people back to work a center piece. Here’s the lowdown from a sector perspective

Banks: Greater support for individuals and businesses will mean lower bad debts which is a positive for banks, offset to a degree by an outlook for lower interest rates which hurt margins: We remain positive the banks

Retailers: Tax cuts help discretionary spending while the prospect of a job / and security of employment are also key drivers for people to open their wallet: JB Hi-Fi (JBH), Harvey Norman (HVN), Super Retail (SUL), ARP Corp (ARP), Adore Beauty (ABY) – soon to list, to name a few.

Infrastructure: We covered infrastructure in today’s income note – click here, the upshot being that more money for immediate infrastructure development will help a broad cross section of companies

Property / Builders: The decision to extend first-home deposit plan should support property developers and residential builders like Stockland (SGP), Mirvac (MGR), James Hardie (JHX)

Miners: More infrastructure = more demand for raw materials while lower interest rates support higher dividend paying stocks, a current theme across the mining sector. BHP, RIO, Oz Minerals (OZL) and the like to benefit

Manufacturing: A plan to boost local manufacturing with a focus on healthcare should help Resmed (RMD), Cochlear (COH) and CSL, plus other companies like Bluescope (BSL)

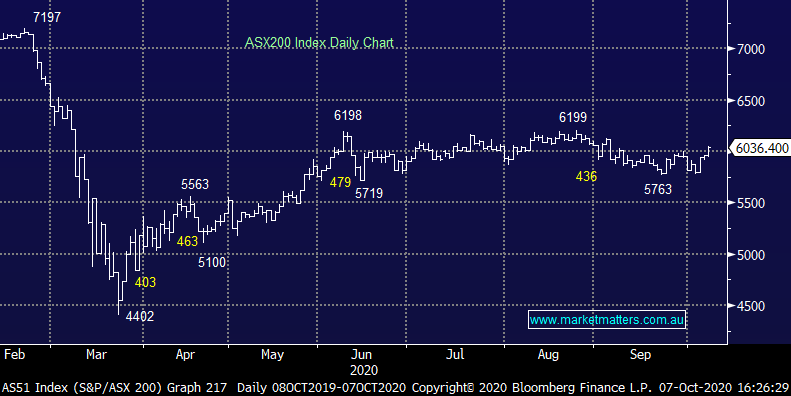

One stock worth singling out today is Bingo Industries (BIN) which is held in our growth portfolio. They benefit from increased infrastructure spend, support for new house construction and finally a specific budgetary allocation to improving recycling volumes , a key growth area for BIN which has a suite of key assets in this area.

MM remains bullish BIN

Bingo Industries (BIN) Chart

There are a bunch of other beneficiaries and as suggested above, a distinct lack of losers.

A stimulatory budget, although it clearly needed to be. Lets see if it’s enough to get businesses spending again which will be key to the economic recovery.

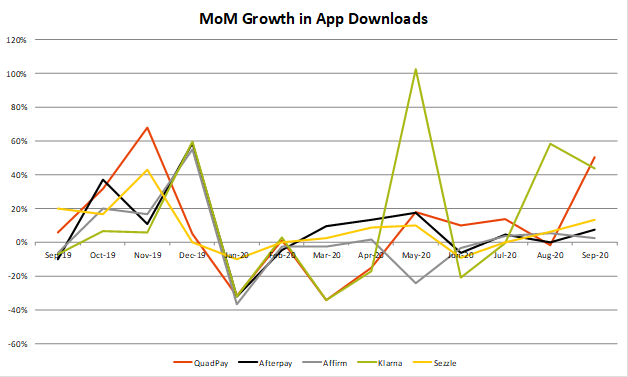

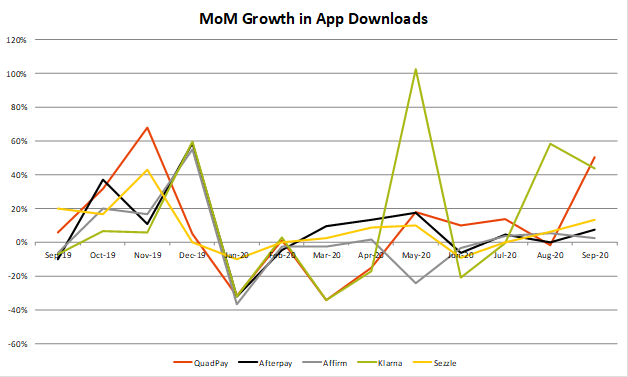

BNPL: Following up our video last week with Jono Higgins – click here, we track data around AP downloads across the US BNPL space given generally website views and app downloads underpin greater user traction and volumes = higher revenues. QuadPay which was acquired by Z1P recently has a significant app based presence and virtual card with downloads an indicator of future volumes. The chart below shows QuadPay continuing to grow and accelerate (through a slower period) into the strongest seasonal period for online retail sales in the USA. The next quarter is tipped to deliver a strong tailwind for the sector.

Here’s MoM growth rates. Quad continuing growth every month since COVID

Source: Jono Higgins, Shaw and Partners

This drops down to strong growth in customer numbers for both Z1P and Quad

Source: Jono Higgins, Shaw and Partners

Z1P rallied +4.74 today to close at $7.29

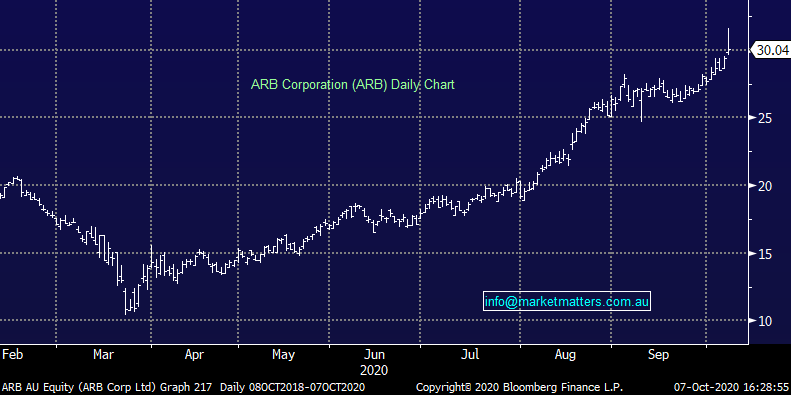

ARB Corporation (ARB) +2.14%: traded higher today on the back of a solid first quarter update as demand for 4WD accessories spikes. ARB, which manufactures a broad offering of car accessories aimed at the off-roading and camping market, has seen revenue 17.7% higher than last year, dropping down to an unaudited pre-tax profit of $29.7m – even before adding in government benefits totalling nearly $10m.

The market currently sits at $85.2m PBT for the full year vs the current run rate of $118.8m. While there’s no guarantee ARB will get to that figure, the update highlights the shift in the market as a number of new customers look at the off road/grid holiday to replace their usual cross boarder trips. The company noted the order book remained strong though the outlook was still uncertain, they expect to give a more detailed update at the AGM next week. Vehicle & parts demand has been pretty significant benefactor of the changes brought on by COVID, and I can’t see it slowing down anytime soon. ARB did punch through to all-time highs today, though not very convincingly so, finishing well off the high. I suspect it is due for some consolidation.

ARB Corp (ARB) Chart

Strandline (STA) +2.38%: This is a small mineral sands hopeful that was mentioned in the Resource Roundtable a few weeks ago – click here. Today they had a positive announcement about one of their assets in Tanzania. While the announcement is not a material near term catalyst, it does point to the sum of the parts value in STA. Andrew Hines covers the stock at Shaw and has a 52c target on it, which implies strong upside from the 21.5c close today. His quick take here: We retain our Buy recommendation and $0.52ps price target. Strandline is enjoying strong momentum following a series of positive announcements and we expect that trend to continue as the Coburn approaches FID. Upcoming catalysts include the remaining offtake agreements, potential strategic equity investments, and finalisation of the project finance debt facilities. The market had forgotten about Strandline’s Tanzanian assets and the announcements of the Framework Agreement with the Tanzanian government and the release of the Tajiri scoping study highlight the upside.

Strandline (STA) Chart

BROKER MOVES

- Syrah Rated New Buy at Foster Stockbroking; PT A$1.07

- Baby Bunting Rated New Buy at EL & C Baillieu; PT A$5.50

- Mayne Pharma Cut to Market-Weight at Wilsons

- Bingo Industries Cut to Hold at Morningstar

- GUD Holdings Cut to Sell at Morningstar

- Northern Star Raised to Outperform at RBC; PT A$16.50

- Mayne Pharma Cut to Hold at Bell Potter; PT 32 Australian cents

- Saracen Mineral Raised to Hold at EL & C Baillieu; PT A$6.02

- Northern Star Raised to Hold at EL & C Baillieu; PT A$14.78

- Rio Tinto Raised to Buy at Investec; PT 5,210 pence

OUR CALLS

We sold PPT and bought IFL in the Income Portfolio today.

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.