The “Yield Play” is Back for Now

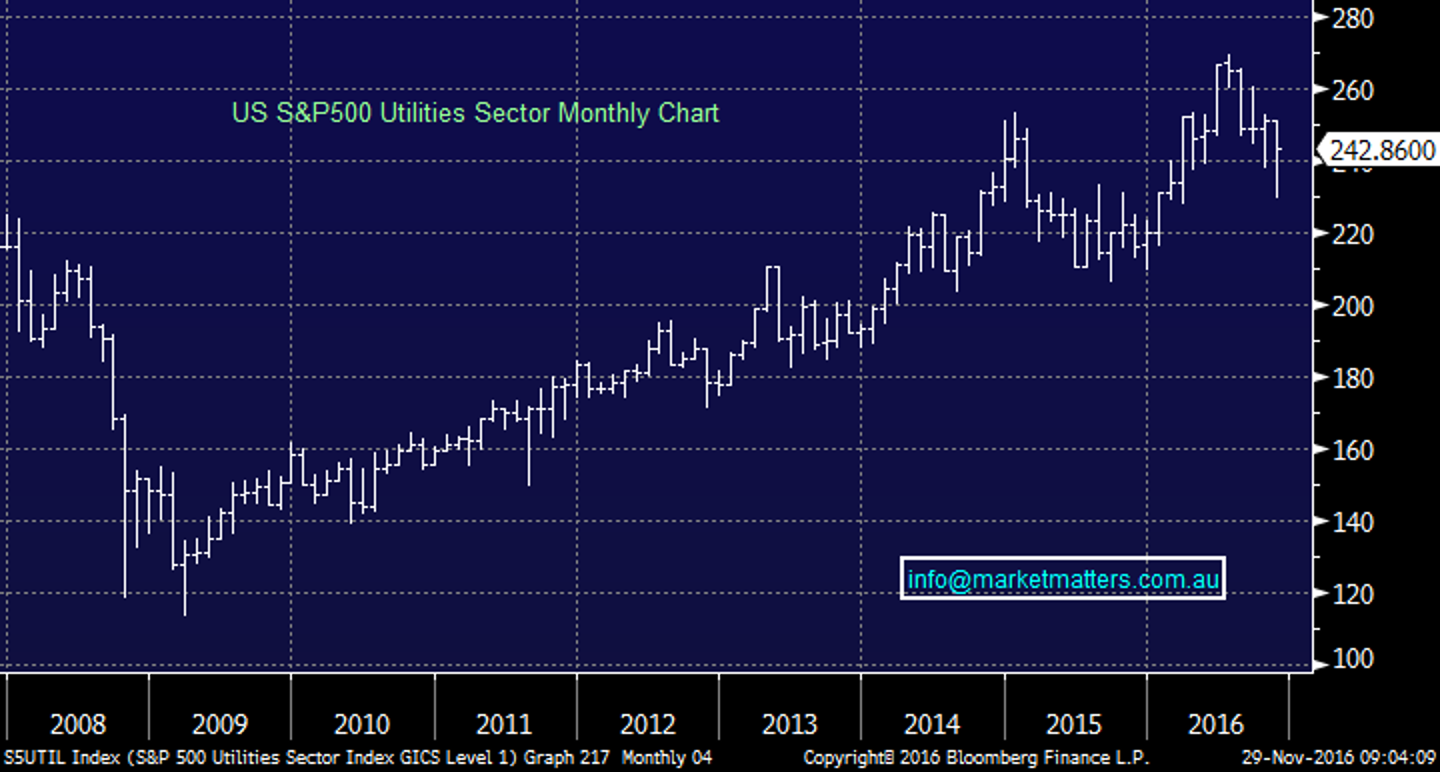

Last night was a relatively quiet on Wall Street, with the one thing catching our eye… The strong performance from the Utilities Sector, gaining over 2% on a down day. In a similar but less dramatic fashion to our local "yield play" / utilities sector, the American Utilities have corrected 14.9% over the last 4-months. Our view recently, which led to the purchase of Transurban (TCL) and Westfield (WFD) as the sector had fallen too far, too fast.

Medium-term however, we believe the "yield play" has probably topped out and has definitely finished a period of outperformance. The recent correction in the US Utilities sector only represents about 25% of the strong gains from the 2009 lows, when the market embraced interest rates in what would be lower from longer - much longer! We see a 10% minimum downside for the US Utilities from this morning's close, which coincides with our overall opinion that global interest rates, led by the US, are going higher. Hence at this stage, we believe this is a corrective bounce, not continuation of the bullish trend.

US S&P Utilities Sector Monthly Chart

We have 4 holdings that come under the umbrella of the "yield play" - Transurban (TCL), Westfield (WFD) and the Telco's, Vocus (VOC) / TPG Telecom (TPM). We are going to look at these 4 holdings individually, to ensure subscribers are clear on our thoughts.

Firstly the overall index is now consolidating around the 5,500, with the potential to extend the current pullback towards 5,435. We will remain bullish while the index is over 5,370, this period of consolidation is almost healthy for the "yield play" as we saw in the US last night.

ASX200 Daily Chart

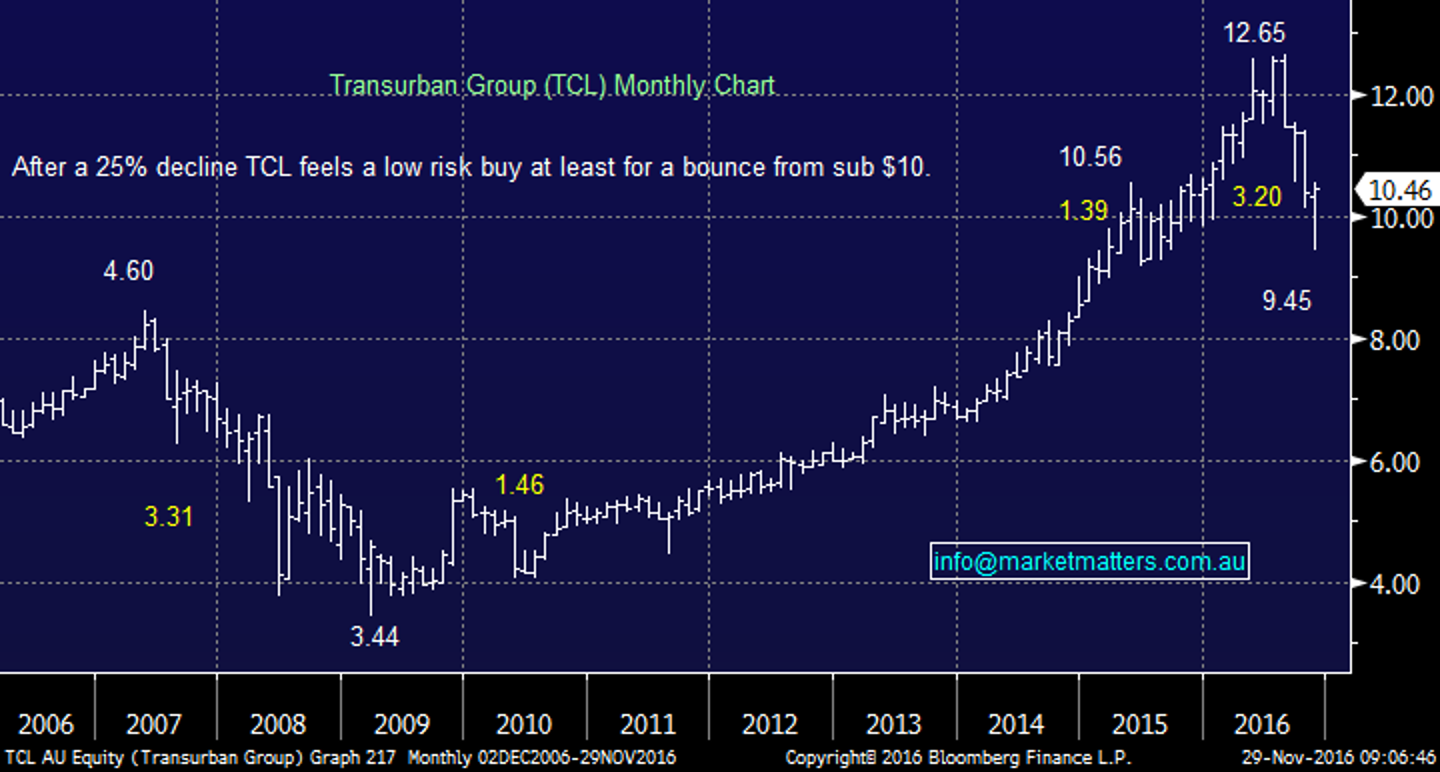

- Transurban (TCL) $10.46

Our purchase of TCL at $9.82 is currently showing a healthy 6.5% profit, our initial target is around $10.80, with stops now under $10.04.

Transurban (TCL) Monthly Chart

2.Westfield (WFD) $9.08

We bought WFD at $8.40 and this is also showing a healthy 7.5% paper profit. Our initial target is $9.45, with stops now under $8.75.

Westfield (WFD) Monthly Chart

Vocus Communications (VOC) $5.76

Vocus is the main position in our portfolio we want to exit, our ideal target is ~$6.50, but above $6 we may be tempted to sell half our holding. As we write, VOC are holding their AGM and it seems they have just released guidance that was around 6-9% below consensus expectations, however the stock has been hit hard in recent months leading into this. The company still expects low double digit earnings growth in FY17.

Vocus Communications (VOC) Weekly Chart

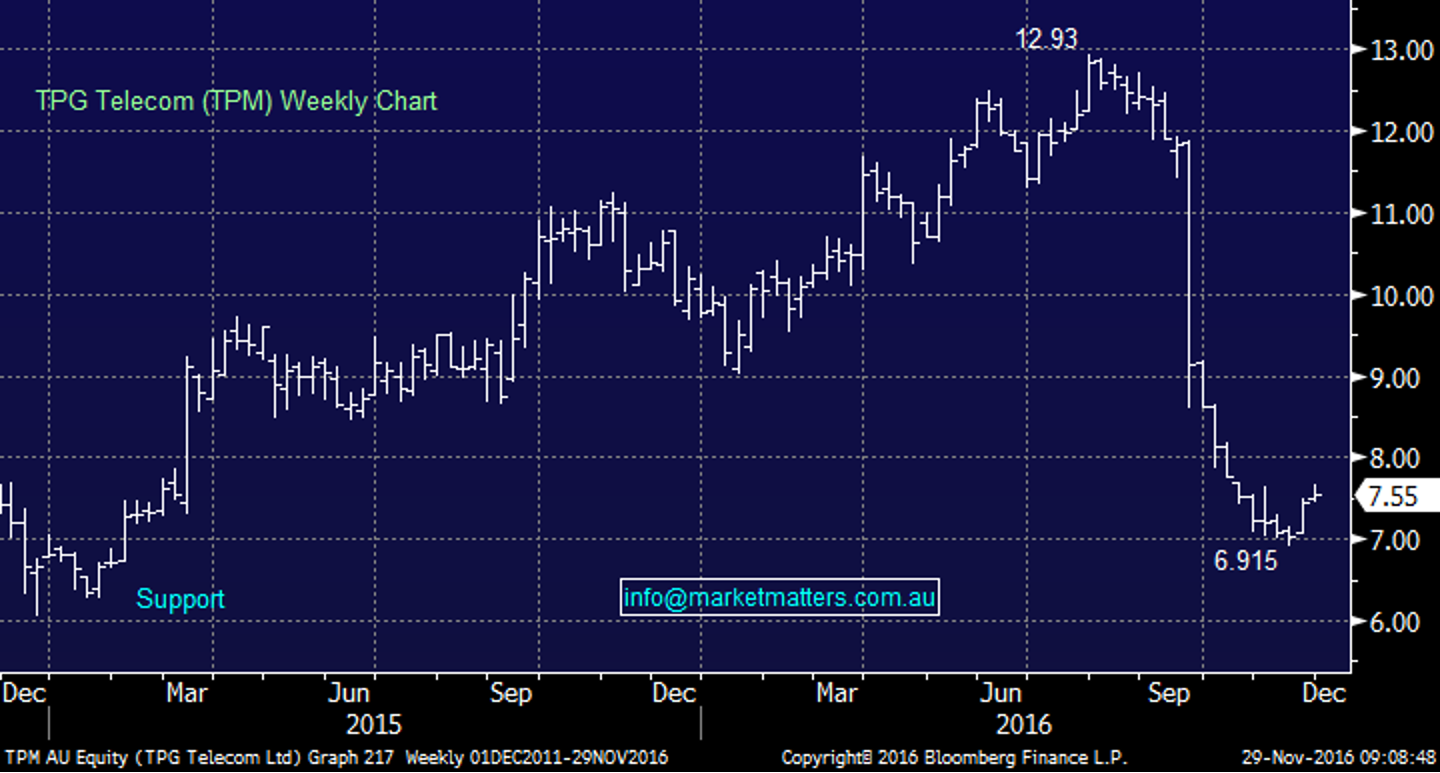

TPG Telecom (TPM) $7.55

We bought TPM as a trade ~$7.15 targeting over $8, with stops under $6.90. This position is on track nicely, but obviously correlated to the previous three. However, as trade we will treat this position independently.

TPG Telecom (TPM) Weekly Chart

Summary

We are comfortable with our positions / entry into WFD and TCL. Due to their correlation with the "yield play" theme, we will be keen to exit at least one position at our initial target. Ideally after exiting one, we will then be able to run the other with a trailing stop - If only things were often that easy!

VOC and TPM will be treated independently as they have their own reasoning i.e. a trade and exiting a bad position at an optimum price.

*Watch for alerts.

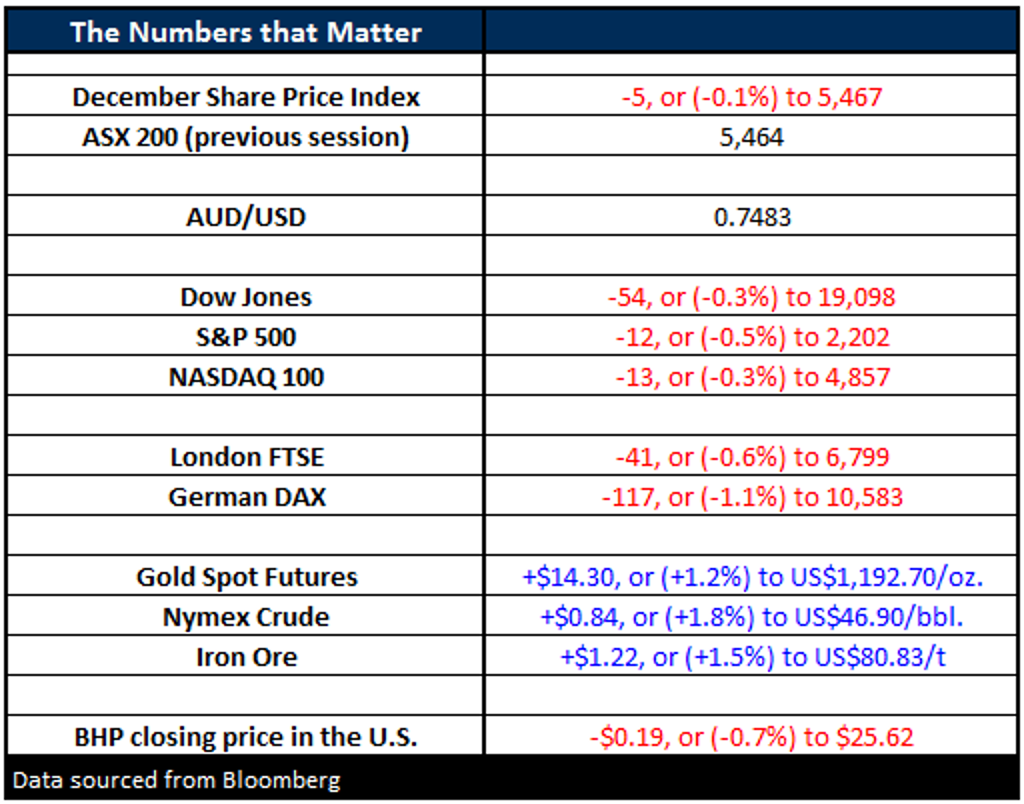

Overnight Market Matters Wrap

- A quiet and expected action overnight, where investors took risk off the table and had a breather after a great run to the upside since the Trump election win.

- The Dow closed 54 points lower (-0.3%) at 19,098, while the broader S&P 500 closed 12 points lower (-0.5%) at 2,202.

- The Volatility index (VIX) managed to rise 6.6%, yet still in the complacency level (so no threat.. just yet!).

- Despite Iron Ore rallying further, BHP is expected to underperform the broader market, after closing at an equivalent of $25.62 in the US, down 0.7% from the previous close in Australia.

- Domestically, the ASX 200 is expected to open with little change again this morning, around 5,464 as indicated by the December SPI Futures.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/11/2016. 9.30AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.