Managing Positions

The market has been very active / interesting over recent days, culminating in a positive decision from OPEC last night which sent crude oil soaring over 8% - BHP is set to open up $1 this morning, even with a substantially weaker iron ore price overnight. This morning we are going to cover a few topics but predominantly the highly requested stops / exit strategies around our existing portfolio. We understand a number of you are shell-shocked after the collapse of Vocus (VOC) this week, a very uncomfortable move for all of us, however it's no reason to panic and walk away from a successful strategy

Although we’re reticent to jump on the Buffet bandwagon, it’s interesting to note a few months ago Warren Buffett lost $1.4bn (on paper) when Wells Fargo tumbled in the US, importantly he did not panic but just reassessed and in this case it appears he stuck with his position. Importantly he did not walk away from a winning strategy, but simply learnt from the experience. Similarly, we look to learn from all positions, both winners and losers. The main takeaway from our VOC experience is to generally avoid ASX200 companies involved in mergers and acquisitions, unfortunately the transition phase historically appears to rarely unfold as smoothly as planned on paper.

Firstly looking at the ASX200 as a whole, yesterday’s weakness courtesy of large resources completed a similar correction that was experienced in the middle of November. We are bullish from current levels with stops under 5370. Investors are already talking about a "Santa Claus Rally," but seasonally this does not usually commence until around the 15th-17th of December (another 2-weeks’ time). Buying a few days early is usually ok, but not a week early e.g. last year the ASX200 fell 370-points / 6.8% after a strong opening day for December, prior to rallying 422-points / 8.6% from the 15th to form a major top on the first trading day of January 2016.

ASX200 Daily Chart

When initiating a position / trade or investment alike, all the scenarios need to be considered, but predominantly when the reason for the position no longer exists - this is time to exit, or plan an exit. Selling is in our opinion most investors’ worse quality e.g. how many people held BHP from $46 down to $14.

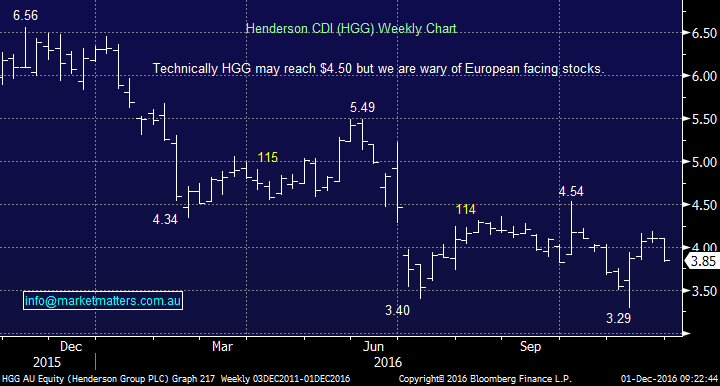

Deciding to exit a position, after an unusual event, does not always mean press the sell button now, it often requires careful thought and planning just like entering a position e.g. We were caught long Henderson Group (HGG) after the surprise BREXIT result, but as opposed to panicking down close to $3.50 we were patient managing to exit well over $4, close to 20% higher.

Unfortunately in the case of VOC, patience was paying off as the stock rallied ~13% from its recent low until their profit update this week, sending us back to the drawing board.

Henderson Group (HGG) Weekly Chart

We currently hold 11% cash which we are looking to substantially increase if we get an anticipated Christmas rally later in December. Below is today’s thoughts around our current holdings, but obviously just like the market these can be fluid over time.

1. Transurban (TCL) - we remain short-term bullish, targeting ~$10.80, a break of $10 would concern.

2.Westfield (WFD) - we remain short-term bullish, targeting $9.40/50, a break of $8.60 would concern.

3. QBE Insurance (QBE) - we remain very comfortable with our QBE position, targeting $12 and potentially $15, a break of $10.35 would concern.

4.Macquarie Group (MQG) - we remain comfortable with our MQG position, targeting close to $90, a break of $81 would now concern.

5. Ansell (ANN) - we remain bullish ANN targeting ~$25, a break of $21 would concern.

6. Healthscope (HSO) - we remain keen on HSO initially targeting $2.55, we are looking to average our position close to $2.10.

7. Mantra Group (MTR) - MTR is frustrating us as its received selling courtesy of the Dreamworld disaster, we still like the position and theme but patience feels likely to be required.

8.Westpac Bank (WBC) - We still expect WBC to test the $32/3 area, a break back under $30.50 would concern.

9. Origin Energy (ORG) - ORG should rally ~5% today, similar to US energy stocks overnight. We have been targeting ~$6.20 and then $7, the first target should be reached today. We will monitor the position very carefully in this area and a break back under $6.09 would now concern.

10. Suncorp (SUN) - SUN has been the sleeping giant within our portfolio, we remain comfortable targeting higher prices but a break back under $12 would now concern.

11. Vocus Communications (VOC) - The big one which everybody knows we are uncomfortable with, as we wrote earlier in the week we were looking to exit close to $6.50 - this level now feels like a distant memory. It should be remembered that VOC is not going broke, the company is forecasting FY17 revenue of around $1.9bn and Net profit after tax between $205m and $215m.

Simply, the integration of M2 and Nextgen is going slower than anticipated, but once this is bedded down VOC is likely to rally nicely. If we use the lower end of guidance as out benchmark, the stock is now trading on an est. P/E of 13.6x for 17 earnings and is paying a 4% grossed up yield – based on a 55% payout ratio. In other words it's at the cheap end of the scale and once the acquisitions get healthily integrated the stocks should be rerated.

12. CSL Ltd (CSL) - CSL has been drifting for the last 5-months like most growth stocks. We think this dumping of the quality end of town is close to complete and potentially they will lead the Christmas rally. We will still look to lighten our holding near the $110 area but any averaging can wait until sub $90.

13 Commonwealth Bank (CBA) - CBA remain strong, we initially are targeting $80 but $85 would not surprise. A break back under $75 would concern us.

Summary

We remain positive equities into 2017, but as we have experienced this week increased volatility is anticipated. We will look to increase our cash holdings in line with the outlined targets for the 13 listed holdings.

Overnight Market Matters Wrap

- The US share markets closed with little change overnight, with the Dow up 2 points to 19,123, while the S&P 500 closed 6 points lower at 2,199.

- The energy market was the spotlight, with Oil Futures settling 8.3% higher to US$48.99 as OPEC ministers agreed to cut output production for the first time in 8 years.

- BHP is expected to outperform the broader market after the OPEC news after rallying an equivalent of 4% to $25.42 in the US from Australia’s previous close.

- The ASX 200 is expected to open ~17 points higher this morning, testing the 5,460 level as indicated by the December SPI Futures.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/12/2016. 10.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here