Should we chase oil & the market?

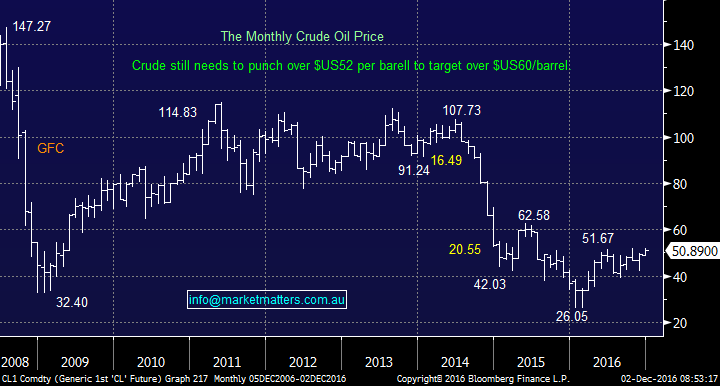

The oil price has dominated the financial news over the last 48-hours as OPEC finally managed to reach a deal to limit production in an effort to eliminate the excess inventory sitting in storage. OPEC members were clearly backed into a corner with many economies struggling with high debt, low growth and quite simply, they needed a higher Oil price to avoid continuing economic hardship.

The obvious question to ask now is, how high can / will the oil price go? This is the first cut by OPEC in 8-years which in theory should bring global oil supply and demand back into balance by early 2017. However if the oil price rallies too hard the US shale gas producers will flick the switch back on which should keep a lid on price gains.

We still believe oil can spike up towards $US60/barrel but we would be sellers into this strength. Let’s now look at our holding in Origin Energy taking our view on oil into account.

Crude Oil Monthly Chart

Origin Energy (ORG) rallied strongly yesterday as expected following the OPEC news gaining 8.75%. We now have a target for ORG over $7 which is likely to coincide with the oil price spiking towards $US60/barrel. Technically we will be a seller if ORG breaks back under $6.09 prior to challenging $7 - a healthy stock should rally on good news.

On a risk reward basis ORG is 50-50 here in terms of $6 support and $7 target hence not very attractive to initiate fresh positions.

Origin Energy (ORG) Monthly Chart

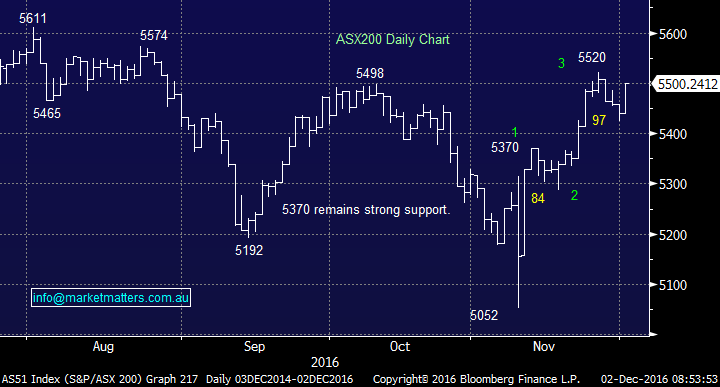

The ASX200 rallied strongly yesterday surprising many people that do not follow the seasonal / statistical characteristics' of our market. We mentioned in yesterday's report that the ASX200 had a very strong start to December in 2015, it actually rallied 100-points (1.9%) on day 1. However after the early gains the market was smacked 7% before making a significant low on the 15th and then rallying very strongly thereafter, making a fresh high for December plus a major top in early January.

We have no reason to suspect that 2016 will be any different seasonally at this point in time. We are keen buyers for a Christmas rally but we want weakness into the middle of the month to get excited.

ASX200 Daily Chart

Summary

- We would not chase either crude oil or the ASX200 at current levels

- Our preferred scenario is for crude oil to challenge $US60/barrel and ORG tests $7 but the risk / reward is not attractive to buy oil stocks at current levels.

- We remain bullish the ASX200 into 2017 but seasonally we are entering a poor 2 weeks for stocks, hence we would be patient with any buying for a potential Christmas rally.

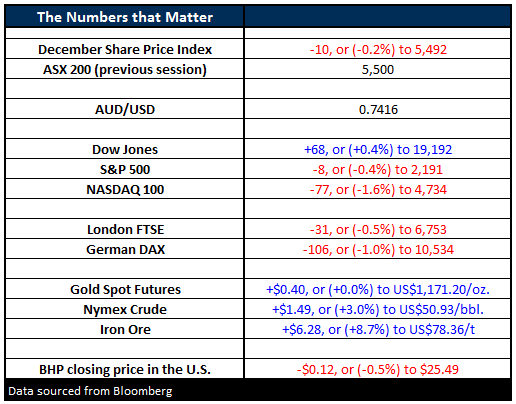

Overnight Market Matters Wrap

- A mixed session in the US overnight with the Dow up 68 points (+0.4%) to 19,192 and the S&P 500 down 8 points (-0.4%) to 2,191. The Tech sector was the weakest link, with the NASDAQ 100 off 77 points (-1.6%) to 4,734.

- Commodities were strong with crude oil rallying 3% to US$50.93/bbl. and Iron Ore recovered from yesterday sharp decline and put on 8.7% to US$78.36/t.

- The December SPI Futures is indicating the ASX 200 to open 10 points lower, towards the 5,490 level this morning

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 02/12/2016. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here