Time for a snap back?

The local market only gaining 28-points yesterday was a disappointment compared to most global indices but today the market is looking to open up another ~30-points. The price action intra-day yesterday told a tale which we believe is likely to follow through into 2017 - BHP fell 59c from its early highs, banks gave up much of their gains but the "yield-play" stocks rallied hard e.g. Sydney Airports (SYD) +20c plus other poor performers in 2016 got an obvious bid tone e.g. Age Care stocks.

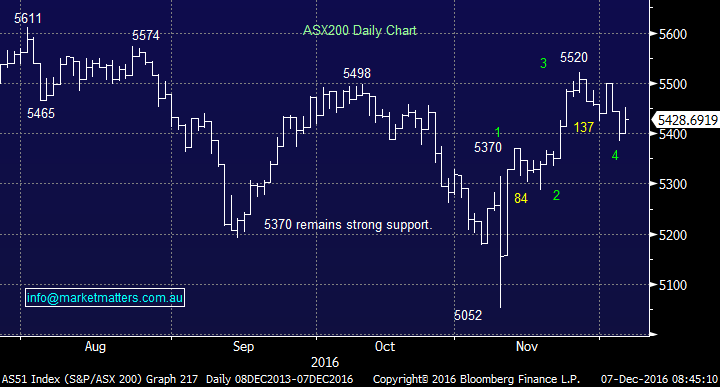

As we enter the strongest seasonal few weeks of the year for the Australian stock market we ask ourselves what is likely to drive this market higher. Technically the ASX200 remains positive at least targeting the 5550-5600 area but history tells us never to underestimate how far the market can squeeze over the Christmas period hence the phrase the "Santa Claus rally". As we have mentioned before the Christmas rally is usually characterized by an absence of selling but when a sector receives a decent bid the share price movement can be fairly dramatic.

ASX200 Daily Chart

Fund managers remain overweight cash and with just over 3 weeks left in 2016 the million dollar question is what parts of the market would they like to look better after a choppy year. The heavy weight banking and resource sectors are very close to their highs of the year but as we know the previously much loved yield play has been hit ~25% from their August highs as the market started pricing in higher interest rates for 2017/18.

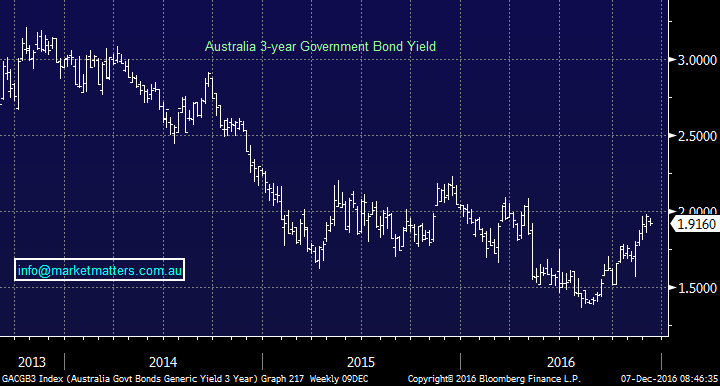

Markets are factoring a 100% chance the Fed raises US interest rates this month (Thursday 15th) but many economists still believe Australia may be forced to cut rates again towards 1% in 2017. Recent local economic data has been on the weak side implying strongly that higher rates for Australia are still a distant thought – today’s weak GDP print should confirm this.

Our view at MM is local bond rates are headed higher with the 3-years, which have already risen from 1.3% to 2% headed towards 2.4% medium-term BUT we believe that the psychological 2% area will hold into 2017 which is likely to return some short-term confidence to the embattled "yield play" group of stocks.

Australian 3-year Bonds Weekly Chart

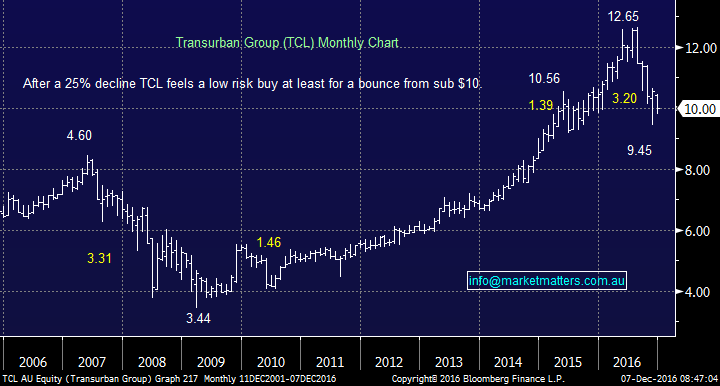

We believe the yield play stocks are likely to recover nicely into 2017 BUT we have no interest being owners for the medium term - we are currently long Westfield (WFD) and Transurban (TCL) within this group.

Our current targets for these two stocks are TCL ~ $10.80 and WFD ~$9.60.

Transurban (TCL) Monthly Chart

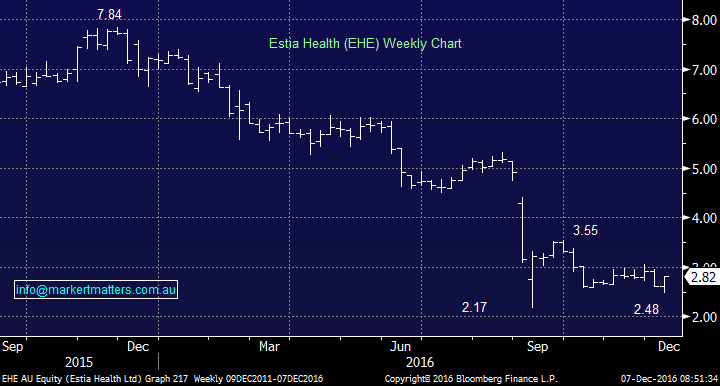

We mentioned earlier the Aged Care stocks recovered strongly yesterday, with the main 3 gaining ~10%. Unfortunately we received no decent risk / reward buy signal before the advance - we have been targeting Estia Health (EHE) as a buy around $2. However considering the stock has fallen from close to $8 yesterday’s bounce does not make us feel compelled to chase current strength.

Estia Health Ltd (EHE) Weekly Chart

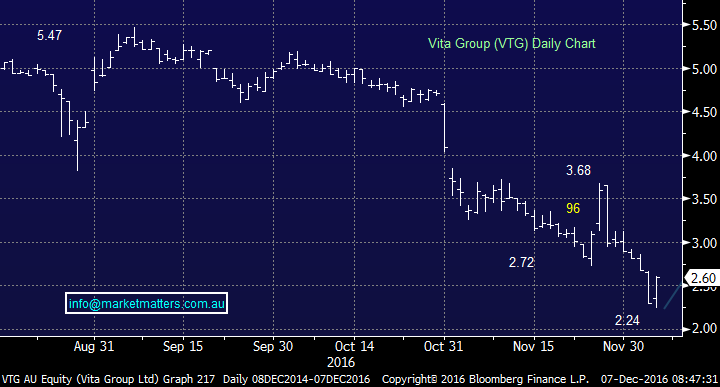

However one stock that has generated the buy signal we have been waiting for is Vita Group (VTG) - we first wrote about this on the 30th November. VTG shares have fallen fairly hard as the company has renegotiated some components of its partnership with Telstra (TLS) which has unsettled investors. Importantly, the company has confirmed that any changes should be ‘at least’ neutral in terms of earnings. We are now bullish targeting a rally towards $3.50, with stops under $2.24, which is excellent 2.5-1 risk / reward.

Solid timing for the dividend hungry investor as VTG pays an attractive 5.37% fully franked dividend with the first half in early March 2017.

* Please watch for alerts*

Vita Group (VTG) Daily Chart

Summary

- We remain bullish the ASX200 into 2017 with an initial target around 5550-5600.

- We believe the "yield play" group will recover over the coming weeks BUT we intend to sell our WFD and TCL holdings into reasonable strength.

- We are buyers of VTG around the $2.60 level targeting $3.60 with stops under $2.20.

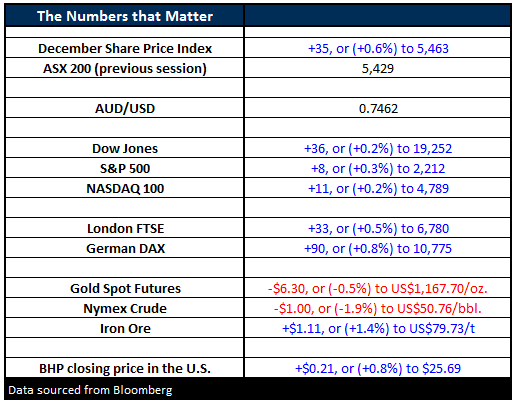

Overnight Market Matters Wrap

- A quieter, but overall positive session was experienced overnight in the US as economic data continues to dominate the headlines. This time, the US trade deficit recorded an increase in October at US$42.6b, its biggest in more than 18 months.

- The Dow closed 36 points higher (+0.2%) at 19,252, while the broader S&P 500 rose 8 points (+0.3%) to 2,212.

- Crude oil gave back 2% to settle at US$50.76/bbl, while Iron Ore rallied 1.4% higher to US$79.73/t. BHP in the US closed an equivalent of 0.7% higher at $25.65 from Australia’s previous close.

- We expect the financials to dominate the ASX 200 today, as investors digest Australia’s 3Q GDP at 11.30am.

- A solid open towards the 5,460 level is expected this morning in the ASX 200, as indicated by the December SPI Futures.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/12/2016. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here