Will the ECB make our “yield play” call correct?

Last night global equities surged on speculation that the ECB (European Central Bank) will continue with its bond buying program hence keeping a lid on interest rates short-term. The Dow rallied almost 300-points to another all-time high led by the "yield play" stocks - REIT's and Telco's. Our call for the yield play yesterday remains on track:

"We believe the yield play stocks are likely to recover nicely into 2017 BUT we have no interest being owners for the medium term - we are currently long Westfield (WFD) and Transurban (TCL) within this group." - MM 7/12/2016.

With the Christmas rally apparently unfolding a few days earlier than is the seasonal norm we have updated how we see this very important few weeks unfolding, we reiterate it's vital to keep our finger on the pulse as excellent portfolio selling opportunities are looming:

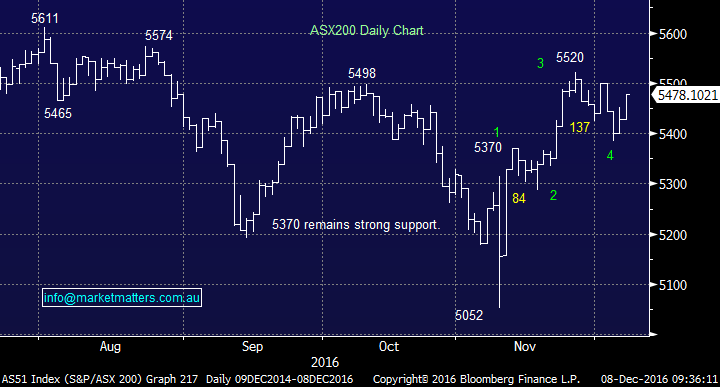

- Our minimum target of 5550 for the ASX200 should be challenged in the next 24-hours with the overnight futures pointing to an open this morning ~5530, a fresh high since late August.

- The normal weekly range for the ASX200 will be satisfied this morning.

- If we assume that 5383 is the ASX200's low for December the lowest monthly range of the entire 2016 still targets a break of 5600 in coming weeks, with 5700 not out of the question.

Hence there is no change with our short-term bullish call for the local stock market BUT it should be remembered we are looking to sell into this current strength, especially as we are sitting on only ~5% cash i.e. we are aggressively long stocks.

Five of the fourteen stocks in our portfolio which have our targets clearly in their sights are listed below with our current sell levels shown:

Transurban (TCL) - $10.80, Westfield (WFD) - $9.60, Ansell (ANN) - $25.20, Westpac (WBC) $32.50 and Origin (ORG) $7.

Please note if the market continues to unfold in line with our forecast we will likely be sitting on 30-50% cash by the first week of 2017, even if some of the stocks do not reach our specific targets.

ASX200 Daily Chart

Overseas indices are also gaining a significant December spring in their step, led by Europe for a pleasant change. This week the German DAX has bullishly broken out of a 5-month trading range with an ultimate target now ~ 20% higher.

This picture implies the EU will hold together in 2017 and perhaps some of the money which has poured into US stocks will find its way across the Atlantic into the European market.

German DAX Monthly Chart

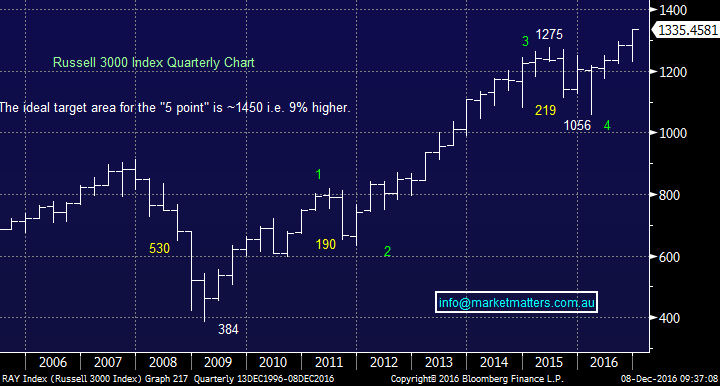

US equities continue to fit our roadmap for 21016/7 which is both exciting and ominous looking forward. The Russell 3000, the benchmark of the entire US stock market, remains perfectly on track for our 1450 target area ~9% higher, with the potential to challenge the 1500 psychological area.

Short-term US stocks are not as clear but as they make fresh explosive all-time highs almost daily the picture is clearly bullish at present. We will update here as clarity kicks in but overall we simply anticipate a rally to the end of December followed by a correction in the first few months of 2017.

Russell 3000 Index Quarterly Chart

Summary

- We remain bullish the ASX200 into 2017 with an initial target around 5550-5600 very close at hand but our preferred scenario is a test of 5650-570

- We believe the "yield play" group will recover over the coming weeks BUT we intend to sell our WFD and TCL holdings into reasonable strength.

- We remain bullish global equities into 2017 but although we see further ~10% upside from US stocks we believe strongly this will be followed by a 25% correction over the next few years.

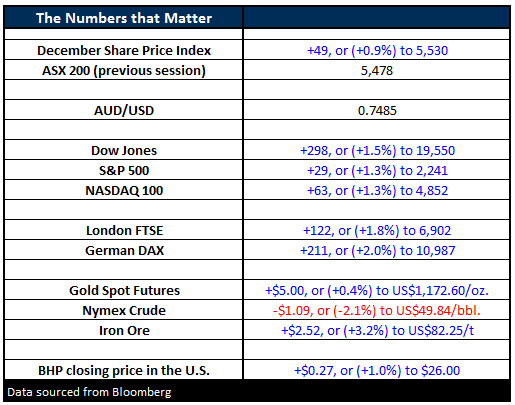

Overnight Market Matters Wrap

- The US markets rallied overnight with the Dow surging to a record high, confirming the seasonal trend of a ‘Christmas Rally’

- The Dow closed 298 points higher (+1.6%) at 19,550, while the S&P 500 rallied 29 points higher (+1.3%) to 2,241.

- Oil retreated by 2.1% to US$49.84 while Iron Ore followed suite with the Dow and closed 3.2% higher to US$82.25/t.

- The December SPI Futures is indicating the ASX 200 open 50 points higher this morning, testing the 5,530 level.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 08/12/2016. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here