Trump is now the trillion dollar man!

US equities have now increased in value by over a trillion dollars since Donald Trump won the race to the White House, certainly not what most pundits were forecasting before the US presidential vote. Last night, global equities continued their advance albeit with reduced momentum after the European Central Bank (ECB) pledged to extend Quantitative Easing (QE) into 2017, plus importantly stating they will add to the stimulus if the proposed reduction to €60bn per month from €80bn per month in asset purchases fails to strengthen the European economy.

Our favourite major index at present, the German DAX, surged 1.75% after Mr Draghi's statement for the ECB, but we reiterate our target for this European bellwether index is ideally another ~15% higher. We will continue to keep our finger on the "indices pulse" into the end of 2016 as we believe getting the next few months correct, will largely determine many investors success over the next few years.

German DAX Monthly Chart

In the US, the weaker indices of recent years are slowly playing catch up with last night a classic example - the NYSE Composite Index was up 0.3%, whereas the NASDAQ was only up 0.15%, after struggling to be positive all night. Weaker indices slowly catching up with the stronger ones is a classic sign that a market top is forming on the horizon.

While we remain bullish short-term and still see another ~8% gains in US stocks prior to some significant weakness, the risk / reward is no longer present for fresh buying.

NYSE Composite Index Monthly Chart

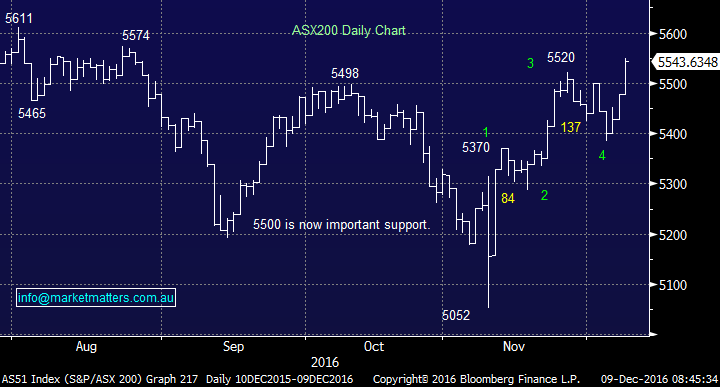

The local ASX200 is enjoying an excellent December as we expected, but considering December's range is still only 167-points and it is the seasonally strongest month of the year. We remain bullish, targeting a break of the year's high at 5,611, before we all sing "Auld Lang Syne" at the end of this month.

However short-term, we can see some consolidation and for the traders we would advocate buying the next ~30-point pullback. For the investors, we still have our sellers hat firmly on our head looking to significantly increase our cash position into 2017.

ASX200 Daily Chart

Our view into 2017 is that the heavyweight index stocks that have enjoyed a great run of late, are likely to come under renewed pressure and this is where we are likely to concentrate our profit taking e.g. Westpac and Origin.

At this stage, we envisage concentrating any buying next year into stocks that have been battered, but which we believe have some excellent growth prospects moving forward e.g. Vita Group (VTG) and Healthscope (HSO).

Summary

- We remain bullish the ASX200 into 2017, with our initial target around 5,550-5,600 achieved, but our preferred scenario remaining a test of 5,650-5,700.

- We are looking to significantly increase our cash position into 2017 as we believe a period of consolidation minimum is overdue.

- We remain mildly bullish global equities into 2017 but although we see further ~8% upside from US stocks we believe strongly this will be followed by a 25% correction over the next few years.

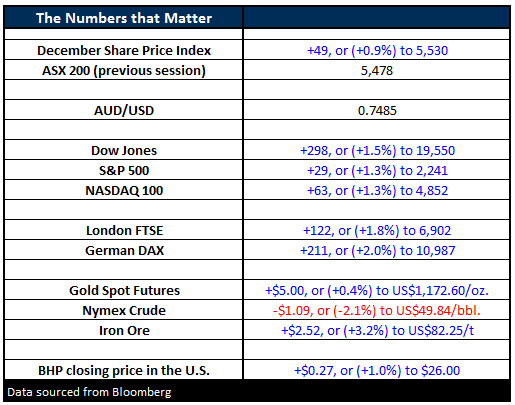

Overnight Market Matters Wrap

- Major global share markets ascended further overnight, thanks to the European Central Bank mentioning that it will prolong its loose monetary policy into next year.

- Germany’s DAX rallied 1.5%, while the Dow closed 65points higher (+0.3%) at 19,615 and the S&P 500 up 5 points (+0.2%) to 2,246.

- Oil had a break from its recent slide and rallied 2.1% higher to US$50.84/bbl while Iron Ore had a breather and closed 0.6% lower to US$81.78/t.

- The December SPI Futures is indicating the ASX 200 to open marginally higher this morning, testing the 5,560 level.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 09/12/2016. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here