There’s lots of green on the screen

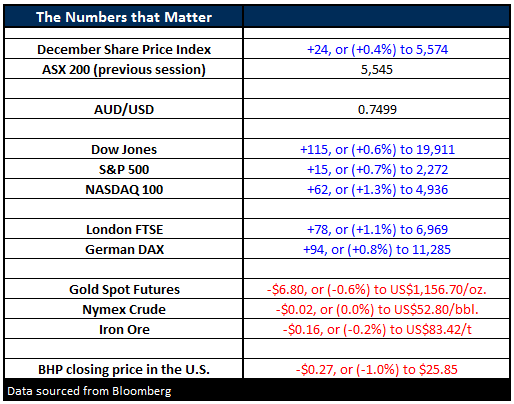

My Bloomberg this morning is telling me that the local ASX200 may have got it wrong yesterday when it fell 0.3%, following Asian indices lower after lunch - typically they all turned around and rallied to close up after we had closed and gone home. This morning The Dow is again up well over 100-points as the tech stocks regain their "mojo" with the NASDAQ rallying 1.2% to make fresh highs for 2016.

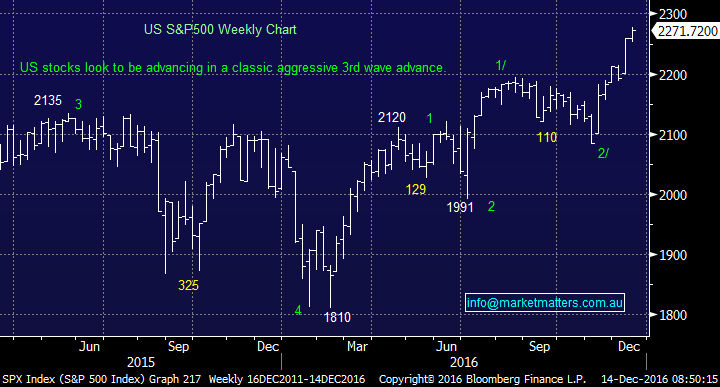

We often quote that the NASDAQ is the leading US index hence when it's on fire don't fight the trend. Until further notice we are sticking with our interpretation that US stocks are in the relatively early stages of an aggressive "3rd wave rally" - a break under 2190 would end this interpretation. Many pundits are quoting that the Relative Strength Indicators (RSI) are the highest in over 20-years and a pullback is inevitable, on balance we believe they are wrong for now. Two huge factors are currently at play driving stocks higher to a fresh level of equilibrium - quickly!

- Investors are embracing the forecasted "Trumponomics" i.e. aggressive fiscal spending will strongly stimulate US / global economic growth.

- Fund managers have been caught on their highest levels of cash in history, since the US election some of this $$ has sent the S&P500 surging 9.3%.

Slowly but surely "Fear of missing out" (FOMO) is coming into play as fund manager returns, hence their bonuses, will look relatively paltry compared to the index.

Markets are now factoring in a 100% possibility of a rate rise this Wednesday, and a 66% chance next June, for now higher interest rates are not concerning investors. Undoubtedly there will be some negative surprises for stocks in 2017 but the falls are likely to be from higher levels. Currently our best guess is this advance for US equities has another 10% upside before alarm bells should be ringing.

US S&P500 Weekly Chart

Importantly moving onto our local market, we are likely to test the 5611 high of 2016 but individual sectors of our market are looking tired. The underperformance that we have become accustomed to over recent years unfortunately feels likely to continue into 2017.

ASX200 Monthly Chart

This morning the futures market is telling us that the local market is set to open up ~30-points but still below where we were trading at lunch time yesterday. Currently the two most influential sectors of our market, the resources and banks are looking a little tired.

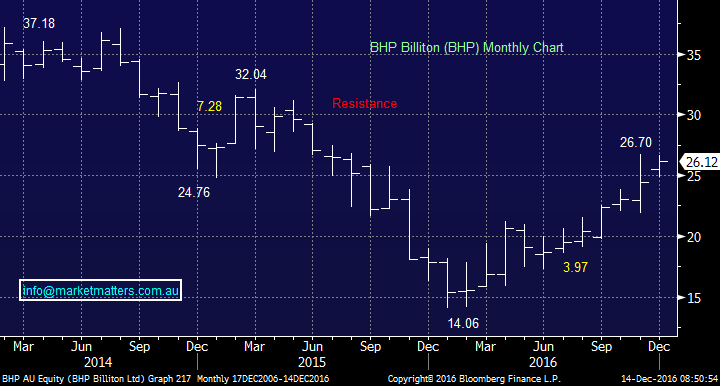

We have been calling a pullback for the resources sector over recent weeks and nothing has unfolded to alter this view. Yesterday BHP reversed down 54c intra-day closing on its low and today it is set to open down 28c even after a strong night in the US. Short-term we still believe the resources sector is likely to pullback.

BHP Billiton (BHP) Monthly Chart

The local banking sector has enjoyed a solid rally since Donald Trump's victory, with the overall banking index gaining ~12%. However it should be noted that the index is less than 2% from our initial target area and some profit taking feels likely - even during a strong night for US stocks the US banks only gained 0.1%.

Ideally we will take profit on two of our bank holdings as we approach 2017 i.e. Westpac (WBC) ~$33 and Macquarie (MQG) ~$90.

Westpac (WBC) Daily Chart

If we are going to get a classic strong rally by the ASX200 in the last 2 weeks of December our opinion is the heavy lifting will be done by the underperformers of the last 2 quarters - it should be noted that the strength that we have witnessed over the last 2 weeks is unusual hence creating a little doubt around whether it can continue into 2017.

We are holding 3 stocks that fit very closely into this category, all of which rallied nicely yesterday, while the ASX200 was down:

- CSL $95.03 - CSL has pulled back 24% since July as the highly valued stocks have been sold on mass. Yesterday it was up an impressive 3.2%, we believe it’s now headed back over $100, conversely we are buyers of weakness under $90.

- Westfield (WFD) $8.95 - WFD rallied 1.5% as the real estate sector enjoyed a strong day. We remain bullish short-term targeting $9.50 which would be regaining around 40% of its losses since July.

- Transurban (TCL) $10.23 - TCL gained 1% yesterday and we continue to forecast $10.80 for this bounce since the recent 25% decline.

We reiterate that we expect to be out of TCL and WFD by 2017 and hopefully WBC / MQG.

Summary

- We remain bullish US stocks anticipating ~10% further gains. However we anticipate the strength will come from the stocks / sectors that have been beaten up this financial year.

- We expect to sell into this strength with TCL, WFD, MQG and WBC in the cross hairs.

Overnight Market Matters Wrap

- The US continued to rally hitting record highs earlier in the session as the FOMC meeting gets under way – a Rate Hike tomorrow morning looks on the cards!

- The Dow had a range of +/- 107 points, a high of 19,954, a low of 19,846 and a close of 19,911, up 115 points, or +0.58%. Similarly, the broader S&P 500 closed 15 points higher, or +0.65% at 2,272.

- The resources underperformed overnight, with Gold down 0.6% and iron ore off 0.2%. We expect further underperformance in our sector today after BHP closed an equivalent of 1.06% lower in the US to $25.85 from Australia’s previous close.

- The December SPI Futures is indicating a stronger open in the ASX 200, up 30 points around the 5,575 level this morning, however we feel this may consolidate sideways before trading lower by the afternoon.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/12/2016. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here