5 sleeps until Christmas

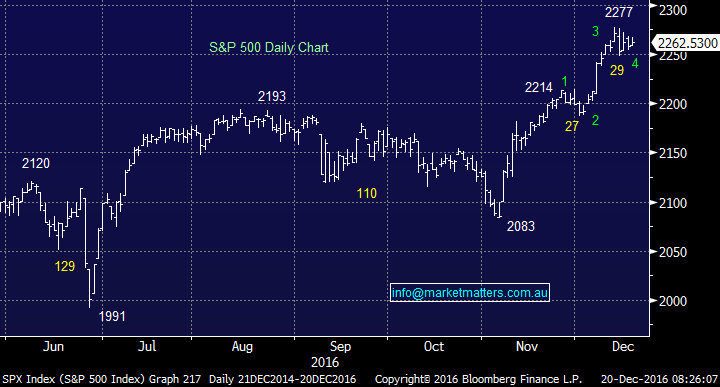

With two young kids this coming Sunday is not surprisingly the topic de jour in my house but we should not forget that stock markets are in their seasonally strongest fortnight and we anticipate some activity shortly. US stocks are continuing to digest the Fed's forecast of 3 not 2 interest rate hikes in 2017 in a bullish manor. The S&P500 remains only 0.7% below its all-time high and we are still expecting a 2-3% rally before we all start singing "Auld Lang Syne" in twelve days time.

US S&P500 Daily Chart

Yesterday the local market surprised many by rallying strongly, after opening in the red, to be up over 40-points for most of the day prior to closing up 29-points (0.53%). This was a classic "Santa rally" day with an absence of selling allowing the market to advance strongly.We continue to target a break of the 5611 high for 2016 over next fortnight.

ASX200 Daily Chart

Importantly now moving onto the specific stocks within our MM portfolio to ensure subscribers have their fingers clearly on the pulse of our thoughts over the coming trading days.

Banks

CBA - likely to maintain / reduce this position with the next dividend looming in February.

MQG - Looking to take profit ~$90 region.

WBC - Looking to take profit ~$33.

Yield Play

TCL - Looking to take profit ~$10.80.

WFD - Looking to take profit over $9.50.

Insurance

QBE - Likely to hold QBE with a medium term target ~$15.

SUN - Likely to hold QBE with a medium term target over $15.50

Healthcare

HSO - We are likely to hold this position and add closer to $2.

CSL - We like CSL but not our entry level, we are buyers under $90 but will reduce ~$105.

Tourism

MTR - We like tourism over the medium term but given our more cautious stance will consider selling MTR closer to $3.50.

Telco

VOC - Our disaster for 2016, fortunately unlike many we only experienced the one. We are looking for an opportunity to exit

Energy

ORG - We are looking to take profit ~$7.

Short-term

VTG - We are looking to take profit ~$3.40.

Summary

We remain short-term bullish stocks but are still planning to reduce exposure over the next fortnight.

** Please watch for alerts**

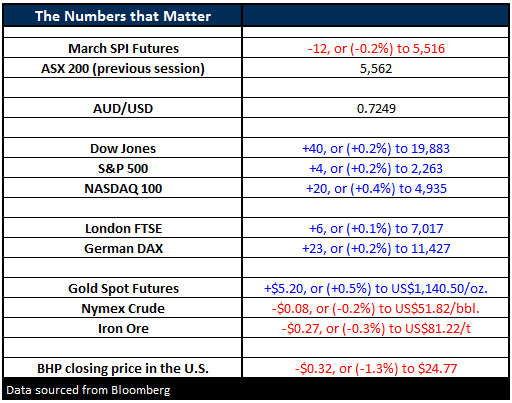

Overnight Market Matters Wrap

- A consolidation continues across Europe and the US as investors wind down ahead of Christmas and New Years’ break.

- Both the Dow and S&P 500 closed marginally higher, up 0.2% at 19,883 and 2,263 respectively.

- The major miners are expected to underperform the broader market, with BHP ending its US session down to an equivalent of $24.77 (-1.3%) from Australia’s previous close.

- The December SPI Futures is indicating the ASX 200 to open marginally higher, testing the 5,570 level.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/12/2016. 8.40AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here