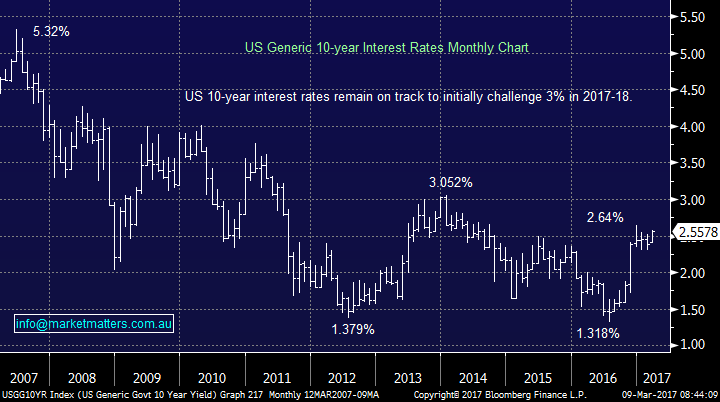

Oil gets whacked, watch BHP today!

Please read today's report in full as we anticipate 2 transactions this morning.

Markets have been relatively quiet on an index level over recent trading sessions, with sectors following their usual seasonal paths i.e. banks strong and resources drifting. The overall indices should regain some short-term direction after this Friday’s US Jobs Report which is likely to confirm the strength of the US economy and hence next week’s interest rate hike in the US.

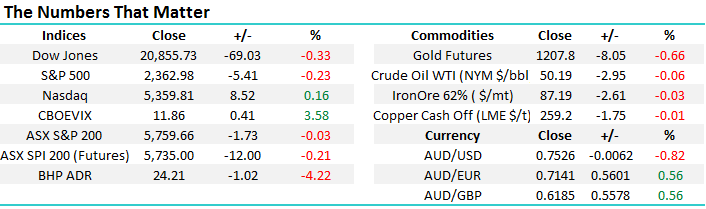

Going into Friday’s number, US Treasuries have endured their longest losing streak in 5 years as yields move higher on anticipation of at least 3 interest rate rises in 2017, up from a foreseen 2-3 hikes only a few weeks ago i.e. the market is noticeably repositioning itself.

Locally, a large beneficiary of increasing US interest rates are the "Big Four" Australian banks and unsurprisingly, they keep chugging along nicely with both NAB and WBC hitting 18-month highs yesterday. CBA went ex-dividend $1.99 fully franked just over 2 weeks ago and investors are now looking forward to their nice payday on the 4th of next month. Conversely ANZ, NAB and WBC have their large dividends looming in May which will be slowly, but surely getting the attention of the huge number of Australian income hungry investors - this is simply why we switched part of our CBA holding to ANZ at the end of February, and in line with our logic over the last 5 days ANZ has advanced 1.8% compared to CBA 0.5%. As we have said a number of times, the banks historically love March and April so just ride the wave and stay long.

We remain bullish US 10-year yields over coming weeks targeting a break over December's 2.64% and until this occurs, the recent sector comparative performances is likely to continue i.e. on a relative basis banks strong and resources weak. This is great news for the MM portfolio which is long the financial sector and looking to buy the resources into the current weakness.

When we consider our planned buying into the resources sector, a quote by Baron Rothschild, which he used to describe the secret to his success, comes to mind:

"I never buy at the bottom and I always sell too soon." - Baron Rothschild 1840-1915 (he amassed an incredible fortune from banking).

This thought process was illustrated with our initial recent purchase of Evolution Mining (EVN), with a smaller position than was liquidated in Newcrest Mining (NCM) a few weeks earlier i.e. we are looking to accumulate into weakness.

US 10-year yield Monthly Chart

Please read today's report in full as we anticipate 2 transactions this morning.

Markets have been relatively quiet on an index level over recent trading sessions, with sectors following their usual seasonal paths i.e. banks strong and resources drifting. The overall indices should regain some short-term direction after this Friday’s US Jobs Report which is likely to confirm the strength of the US economy and hence next week’s interest rate hike in the US.

Going into Friday’s number, US Treasuries have endured their longest losing streak in 5 years as yields move higher on anticipation of at least 3 interest rate rises in 2017, up from a foreseen 2-3 hikes only a few weeks ago i.e. the market is noticeably repositioning itself.

Locally, a large beneficiary of increasing US interest rates are the "Big Four" Australian banks and unsurprisingly, they keep chugging along nicely with both NAB and WBC hitting 18-month highs yesterday. CBA went ex-dividend $1.99 fully franked just over 2 weeks ago and investors are now looking forward to their nice payday on the 4th of next month. Conversely ANZ, NAB and WBC have their large dividends looming in May which will be slowly, but surely getting the attention of the huge number of Australian income hungry investors - this is simply why we switched part of our CBA holding to ANZ at the end of February, and in line with our logic over the last 5 days ANZ has advanced 1.8% compared to CBA 0.5%. As we have said a number of times, the banks historically love March and April so just ride the wave and stay long.

We remain bullish US 10-year yields over coming weeks targeting a break over December's 2.64% and until this occurs, the recent sector comparative performances is likely to continue i.e. on a relative basis banks strong and resources weak. This is great news for the MM portfolio which is long the financial sector and looking to buy the resources into the current weakness.

When we consider our planned buying into the resources sector, a quote by Baron Rothschild, which he used to describe the secret to his success, comes to mind:

"I never buy at the bottom and I always sell too soon." - Baron Rothschild 1840-1915 (he amassed an incredible fortune from banking).

This thought process was illustrated with our initial recent purchase of Evolution Mining (EVN), with a smaller position than was liquidated in Newcrest Mining (NCM) a few weeks earlier i.e. we are looking to accumulate into weakness.

US 10-year yield Monthly Chart

This morning, following oils 5.4% fall overnight, plus weakness in most other commodities BHP is set to open around $24.25 i.e. down about $1, but note it is trading ex-dividend this morning ~52c fully franked. Hence taking the dividend into account BHP is likely to fall around 2% on today's open, a correction of over 13% since its high in January.

We have been targeting a pullback in BHP towards the $24 region for many weeks and today will be buying BHP under $24.30.

BHP Billiton (BHP) Weekly Chart

This morning, following oils 5.4% fall overnight, plus weakness in most other commodities BHP is set to open around $24.25 i.e. down about $1, but note it is trading ex-dividend this morning ~52c fully franked. Hence taking the dividend into account BHP is likely to fall around 2% on today's open, a correction of over 13% since its high in January.

We have been targeting a pullback in BHP towards the $24 region for many weeks and today will be buying BHP under $24.30.

BHP Billiton (BHP) Weekly Chart

The two other stocks we continue to watch closely within the resources space are RIO Tinto (RIO) and Fortescue (FMG) with different underlying reasons:

1. RIO $61.39 - We remain keen buyers of RIO under $59, or around 4% below yesterdays close.

2. FMG $6.50 - We are short FMG via options as a trade and are looking for an ideal area to take profit, this currently is around the $6 region or 7.5% below yesterday's close.

Assuming we buy BHP today, we will still buy RIO under $59, but we will not be chasing at higher levels. With our FMG position we will consider liquidation under its recent $6.23 swing low for a good profit.

RIO Tinto (RIO) Weekly Chart

The two other stocks we continue to watch closely within the resources space are RIO Tinto (RIO) and Fortescue (FMG) with different underlying reasons:

1. RIO $61.39 - We remain keen buyers of RIO under $59, or around 4% below yesterdays close.

2. FMG $6.50 - We are short FMG via options as a trade and are looking for an ideal area to take profit, this currently is around the $6 region or 7.5% below yesterday's close.

Assuming we buy BHP today, we will still buy RIO under $59, but we will not be chasing at higher levels. With our FMG position we will consider liquidation under its recent $6.23 swing low for a good profit.

RIO Tinto (RIO) Weekly Chart

Lastly, moving back to our accumulation of a position within the gold sector - We are happy with the recent purchase of EVN (4% weighting) and are now turning our attention to Regis Resources (RRL) which we have been a targeting in the $3 region, a 17% correction from its February high.

Today we will allocate 2.5% of our portfolio into RRL under $3 with a view to increasing the position to 4% if further weakness unfolds - the stock may open nicely for us ~2.95.

Regis Resources (RRL) Weekly Chart

Lastly, moving back to our accumulation of a position within the gold sector - We are happy with the recent purchase of EVN (4% weighting) and are now turning our attention to Regis Resources (RRL) which we have been a targeting in the $3 region, a 17% correction from its February high.

Today we will allocate 2.5% of our portfolio into RRL under $3 with a view to increasing the position to 4% if further weakness unfolds - the stock may open nicely for us ~2.95.

Regis Resources (RRL) Weekly Chart

Conclusion

We have a number of clear and important conclusions that are likely to lead to some activity in the MM portfolio today!

Conclusion

We have a number of clear and important conclusions that are likely to lead to some activity in the MM portfolio today!

- We are buyers of BHP under $24.30.

- We are buyers of RIO under $59.

- We will consider taking profit on our FMG trading position, via options, under the recent $6.23 low.

- Today we will allocate 2.5% of our portfolio into RRL under $3.

- Risk was certainly being taken off the table overnight in the US, with the Dow off 0.33% and the S&P 500 down 0.23%.

- Oil fell nearly 5% and listed producers were weaker overnight as US stockpiles unexpectedly surged.

- US private employers hired more people than economists expected and this increased the likelihood of a rate rise and boosted the US$.

- Iron ore fell 2.9% and nickel was down more than 4% - Note BHP trades ex-dividend today (52.16c/share), however we see further weakness in this name and will underperform the broader market.

- The March SPI Futures is indicating the ASX 200 to open 24 points lower this morning around the 5,735 area.