Should we buy regional banks for yield?

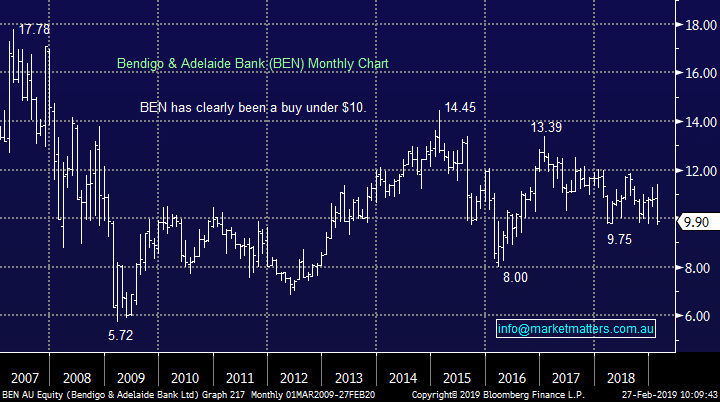

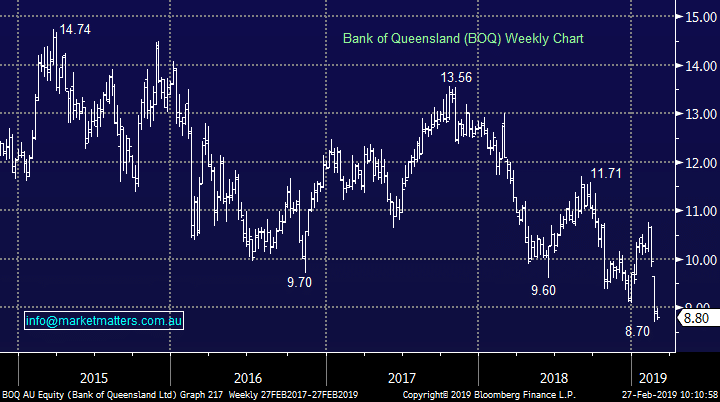

We’ve seen a wave a selling in the two regional banks since Bendigo released first half results on the 11th February - Bendigo Bank (ASX:BEN) has fallen from $11.15 pre-results to close yesterday at $9.83, a fall of nearly 12% while Bank of QLD (ASX:BOQ) initially fell in sympathy with BEN however the selling kicked up a notch when they downgraded guidance a few days later showing similar trends to their southern cousins. BOQ has now fallen from $10.66 the day before BEN reported, to close yesterday at $8.81, a drop of ~17%. Over the same period, the sector generally has been fairly flat while CBA has more of less held its $2.00 per share dividend.

Bendigo Bank (ASX:BEN) Chart

Bank of QLD (ASX:BOQ) Chart

Bank of QLD (ASX:BOQ) Chart

BEN goes ex-dividend today on 1st March for 35cps fully franked and it’s forecast to pay another 35cps in September, putting it on a yield of 7.12% fully franked, or 10.17% gross.

BOQ goes ex-dividend on the 24th April and should pay 38cps fully franked while its forecast to pay another 38cps in October, putting it on a yield of 8.62% fully franked, or 12.32% gross.

Firstly, were the results that bad and secondly, are these yields sustainable?

BEN goes ex-dividend today on 1st March for 35cps fully franked and it’s forecast to pay another 35cps in September, putting it on a yield of 7.12% fully franked, or 10.17% gross.

BOQ goes ex-dividend on the 24th April and should pay 38cps fully franked while its forecast to pay another 38cps in October, putting it on a yield of 8.62% fully franked, or 12.32% gross.

Firstly, were the results that bad and secondly, are these yields sustainable?