Subscribers questions

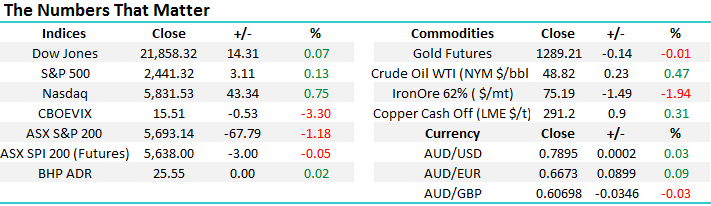

This week we’ve had a multitude of questions around how we see stocks gyrating during this current period of significant geo-political global uncertainty. As we said in the Weekend Report MM clearly have absolutely no idea what either Donald Trump or Kim Jong-un are thinking / planning. We are certainly not alone with this lack of clarity as was illustrated perfectly by last Thursdays record breaking volatility “bets” in the US creating a greater than 40% surge in the Fear Index (VIX) – in simple English a huge amount of money was spent on option insurance premium to protect against a dramatic downturn in stocks.

However, we do have a clear “best guess preferred scenario” on how stock markets will trade through August / September and beyond, as most subscribers have probably gathered.

1. Our definite opinion is the US S&P500 will correct back towards at least the 2350 area, (around 4% lower) but a few % lower would not surprise.

2. What is harder to forecast is the nature of this correction with 2 very different potential paths as the most likely candidates.

We are looking for a correction from US stocks to the impressive 25% rally since July 2016, nothing unusual to see markets correct after this degree of advance. Historically after such a move a pullback comes in one of two forms:

1. A relatively quiet sideways choppy style correction as was experienced in May -June 2016.

2. A more violent quick snap style fall followed by a bounce and then sideways trading as everyone regains their breath.

Either way we feel it’s unlikely US stocks will really regain their bullish MOJO until late October / early November. The local ASX200 is likely to be a bit tougher to call but similar initial weakness we think is highly likely and whichever style correction unfolds in the US the opportunity to buy local stocks 3-4% lower remains a strong possibility.

US S&P500 Weekly Chart

Question 1

“I was just wondering about your thoughts on AGL which I used to own? My thinking is: 1 Healthy dividend has been announced 2. Stock price down from earlier year highs 3. Fairly good prospects - Profit / power price hikes. Appreciate your thoughts.” Thanks– George T.

Morning George, thanks for an excellent and timely question on a stock we have not discussed in a while. As you point out AGL pays a healthy 3.12%, mostly franked dividend, in fact it pays a 50c (80% franked) dividend in 9 days’ time.

AGL obviously sells and distributes gas and electricity and the stock has corrected ~16% since April as the “yield play” utilities sector has underperformed the market due to rising interest rates. AGL reported strong numbers last week showing earnings growth of 14% on FY16 which was above guidance, however the market seemed to focus on an increase in capital expenditure with the company outlining a number of projects and the potential for entry into offshore markets is thought the be more risky. All in all, we have no issue with the company but the increasing interest rate environment + a period of higher capex makes it hard to imagine outperformance for a while although a “safety” style bid would potentially emerge if the market suffered a bad downturn.

We see value in AGL as a stable yield stock but would want to enter under $24 to feel comfortable.

AGL Energy (AGL) Weekly Chart

Question 2

“Hi MM, have your views changed regarding VTG based on the latest arrangements with Telstra.” - Thanks Richard.

Morning Richard, VTG who run retail stores for Telstra has certainly been on a rollercoaster ride since 2015, rallying strongly and then giving back all the gains plus more to become one of the worst performing stocks in the market. Vita Group’s shares recently fell aggressively following details of negotiations with partner Telstra showed that the telco giant plans to cut VTG’s remuneration by 30% over the next three financial years. Plus, TLS plans to restructure its retail store network into clusters, potentially reducing the footprint for VTG.

MM has no interest in VTG primarily because of its dependency on the struggling telco goliath TLS who we believe will continue to look for any way to squeeze their providers / partners concern and this is likely to hang over VTG’s head for some time.

Vita Group Ltd (VTG) Weekly Chart

Question 3

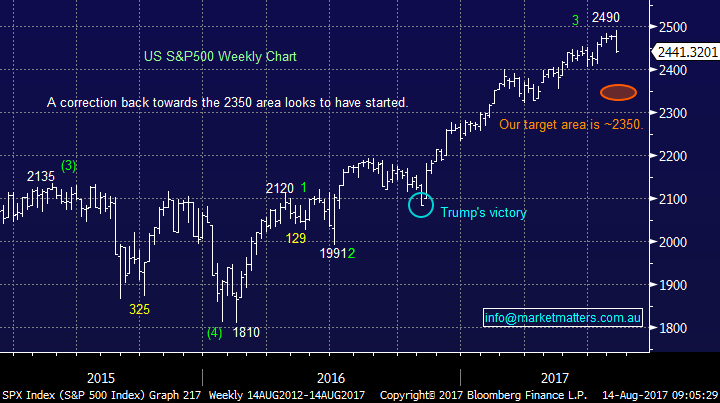

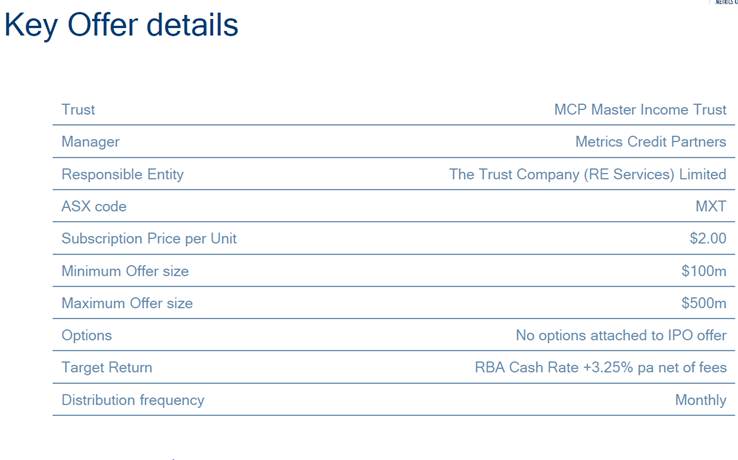

“Hi, I like your new income portfolio as it provides good ideas for SMSFs. I am frustrated with the poor term deposit and bond rates so would like to know what you think about the MCP Master Income Trust IPO which has now launched. Do you think that it would provide some safety in a falling share market?” - Thanks Graeme.

Hi Graeme, we certainly feel for Australian investors and retirees who have been relying on term deposits for income with interest rates remaining at all-time lows for many months. While we believe rates have bottomed it feels unlikely we will see a dramatic kick higher in rates over the short-term hence we understand why you have been scouring for alternatives.

The MCP Master Trust will be the first ASX-listed investment trust offering exposure to corporate lending with a minimum goal of achieving the RBA cash rate + 3.25%. The trust initially will have exposure to over 50 individual investments with a near-term target of 75-100 individual investments. Shaw and Partners, a shareholder in Market Matters - has been appointed Co Manager to the IPO. Key offer details are below.

MM likes the logic behind the Trust and we are assessing whether or not this is a suitable candidate for the MM Income Portfolio – we suspect it will be.

RBA target cash rate Monthly Chart

Question 4

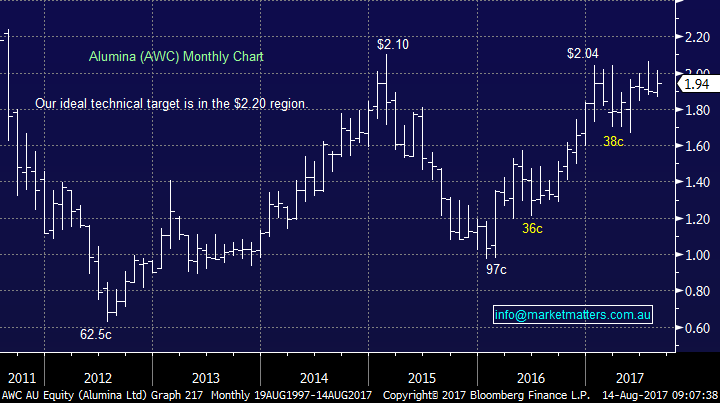

“Hi Good afternoon James and MM Team, I would like to ask a question around Alumina Limited (AWC.AX) as aluminium prices hit the highest level in 3 years and we get this underperformance on AWC relative to Alcoa Corporation (40% ownership). Alcoa came out with in-line results around a fortnight ago with initial reaction being negative but since then, the stock has surged 10% threatening the $US40 level. However, during the same period, AWC made a short-term low of $1.87 before surging over $2 as I type this email. To what extent, do you think the strong $AUD have played into this relative underperformance and also AWC reports interim earnings on the 23rd of August where dividends are expected to increase in-line with increasing profits as a result of stable aluminium prices and improvements over the last 9 months – does MM share this view as well given the estimated yield on AWC indicated within your Income Portfolio is almost 9% taking into considering 4c (FF) already been distributed in middle of March this year. Short term prices to look at is $2.07 and $2.10 which is the 5 years peak but if we get surprise on the upside and breaks this $2.10 then what’s MM targeting $2.50 - $2.60?” - Thanking you in advance. Regards, Tianlei J.

Hi Tianlei, thanks for another well thought out and very relevant question. The market is looking for AWC to pay a nice fully franked dividend at the end of this month as you say which is one of the reasons the stock sits in our income portfolio.

Obviously there always is risk when a company reports but following Alcoa’s average set of numbers expectations have clearly dropped for AWC which we like and increases the chance of an upside surprise. In terms of the dividend, and according to Shaw’s very good Resource Analyst – Peter O’Connor, since 1 January 2017 AWC has received US$127.9m of dividends, distributions and capital returns, net of contributions, from AWAC (~$50m), of which US$50.2m was paid to shareholders as part of the 2016 final dividend. These receipts include payment of 50% of 2Q net income in July 2017 but do not include a distribution of excess cash for the same period. Indicative 1H AWC dividend potential based on the above cashflow is ~US4c a tad lower given $56m contribution form AWC back to AWAC in 1H17 for Suaralco and Point comfort works (flagged Feb 2017). This flows into Peter’s expectations for a dividend of around 13cps over the next 2 years, putting it on a yield of 6.7% FF.

The strong $A is likely to have an adverse impact on AWC’s performance, and the stock may ‘tread water’ ahead of their result in the next few weeks, however we continue to like the stock.

MM’s initial target for AWC remains ~$2.20, or over 13% above Fridays close.

Alumina Ltd (AWC) Monthly Chart

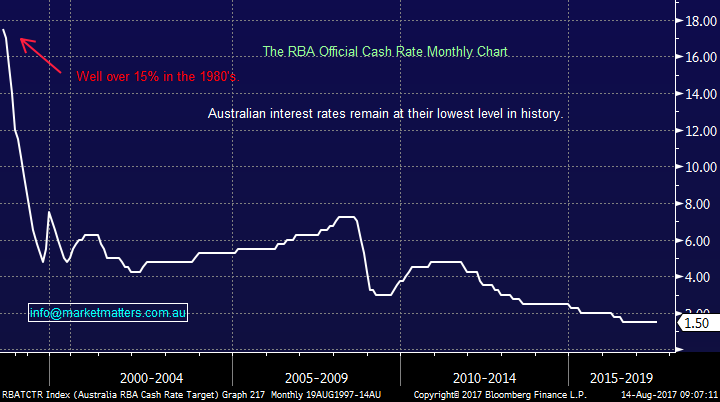

Overnight Market Matters Wrap

The US closed with little change last Friday, however all three major indices lost more than 1% for the week, as investors remain concerned that Korean peninsula tensions could escalate to war. The S&P 500 remains less than 2% from all-time highs.

· Weak US inflation led investors to scale back expectations that the US Federal Reserve will be able to increase rates as quickly as previously expected.

· The ‘safe haven’ asset, Gold continued to climb, up towards $US1289.35/oz last Friday, along with most commodities and metals (apart from copper) were ahead on the LME while iron ore fell close to 2% lower.

· The September SPI Futures is indicating the ASX 200 to open with little change, testing the 5700 level once again this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/08/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here