Some hits and misses but the market rallies again (SEK, CSL, ANZ, CGF, RIO)

Over the last few days MM has slowly been losing confidence in our 5500-target for the ASX200, the feeling was illustrated by the following two points in Tuesday’s morning report:

1 “The market has a distinct feel about it that investors are either caught short, or at least underweight equities.”

2 “Our preference remains a pullback towards 5500 in the coming weeks / months however the currently strong banking sector, which makes up over 30% of the local market, makes our target level feel a long distance away at present.”

On Tuesday, following these comments we switched our 5% RIO Tinto (RIO) holding into 5% Bank of Queensland (BOQ) and topped up our Westpac (WBC) position by allocating an additional 2.5% of the MM Growth Portfolio. The key here is that we currently like banks, which has proved correct over both the last 1 and 12-months, and importantly the “big four” banks alone represent over a quarter of the ASX200, hence the phrase we often quote:

“The market won’t fall without the banks” – MM.

For example, since reporting positively this week ANZ Bank (ANZ) has rallied strongly to test its 3-month high, we feel strongly that the banking sector is one area fund managers are underweight / short. While we don’t think it will be one-way traffic for the sector their recent solid profit numbers and of course excellent dividend should remain very supportive e.g. ANZ is yielding 5.26% fully franked. Simply it’s hard to imagine the ASX200 falling 4-5% if the banks remain strong.

ANZ Bank (ANZ) Weekly Chart

However, the good news is hopefully MM subscribers are enjoying our 37.5% exposure to the banking sector which has rallied 3.93% over the last month compared to the index which has gained just 0.35%. While we still hold 21% in cash the current volatile reporting season is throwing up a number of opportunities and we believe there is strong possibility we will find 1 or 2 solid buying opportunities over the next week – today we will look at 3 of yesterday’s big movers for that potential golden nugget.

As we alluded to earlier while our preference technically remains a pullback towards 5500 in the coming weeks / months its becoming harder to imagine even if US stocks do fall ~5%.

ASX200 Daily Chart

The highly regarded Bank of America Global Fund Manager Survey has just come out and 3-points instantly caught our eye:

1. Asset allocation to cash rises to a 9-month high of 4.9% but stocks remain firm – note the average over the last 10-years is 4.5%.

2. Record high number of investors believing stocks are overvalued i.e. 46% in August.

3. Long NASDAQ (tech stocks) tops the most crowded trade for the last 4-months.

Basically, there are a number of concerning statistics evolving for stocks BUT just like we are experiencing locally if cash levels are too high any pullback / weakness relatively quickly encounters buying.

US Stocks

US equities have another quiet night although the S&P futures finished well off their highs. As said yesterday tops in equity markets often take a long time to “rollover” but bottoms tend to vanish in a flash e.g. The tops in June and Nov 2015 compared to the 3 respective spike lows in Aug 2015, Dec 2016 and July 2016.

We remain bearish US stocks targeting a correction of ~5% as sell signals emerge.

US S&P500 Weekly Chart

1 Seek Ltd (SEK) $17.26

Online jobs company SEK shares fell -3.2% yesterday but the stock did manage to recover from a far worse -8.2% early in the session. Their result which headlined with a net profit of $340m simply failed to live up to strong market expectations. SEK was the latest high profile / high valuation stock to fall following disappointing earnings following Domino’s (DMP) earlier in the week. The main numbers:

1 Full year net profit was down 5% to $340m.

2 Revenue was up 9% to $1.06bn.

3 A final dividend of 21c fully franked was announced.

Looking forward increasing costs rising faster than revenue is far from exciting. We like SEK as a business but not at these prices, with the 2018 est PE close to 28x. We would only have interest in SEK under $15.

Seek Ltd (SEK) Monthly Chart

2 Challenger Ltd (CGF) $12.00

The flagged capital raising by CGF and concerns over growth in the next few years has pressured CGF over recent days but the current valuation of 17.4x est. 2018 earnings is not scary, hence we like the stock into further weakness.

We reiterate our targeted buying area which was close for a few seconds yesterday - we remain buyers of CGF under $11.50.

Challenger Ltd (CGF) Monthly Chart

3 CSL Ltd (CSL) $125.27

Yesterday CSL bounced from $119 to $123.40 in ~10 minutes so don’t beat yourself up if you missed a good short-term opportunity. The blood plasma giant reported good numbers but again not good enough for a company very highly owned and trading on a high valuation i.e. 28x 2018 earnings.

We think CSL is a great company but we remain in the minority believing we will be able to buy the stock under $100 in the next 2-years. Note CSL has now corrected 17% from its 2017 high.

CSL Ltd (CSL) Monthly Chart

Conclusion (s)

We remain buyers of any major market weakness and although our ideal target for the ASX200 is ~5500 we may slowly deploy some of our ~20% cash holding in the Growth Portfolio before this area.

We still like CGF ~ $11.50, but have no interest in SEK and CSL at current prices.

As a side note, Rio Tinto is likely to be strong this morning and may trade back up above $63.50

Overnight Market Matters Wrap

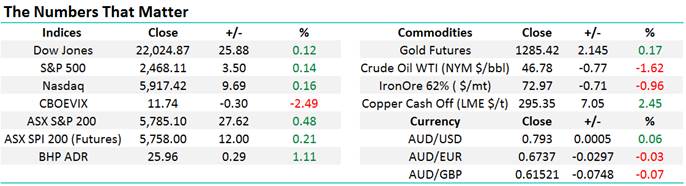

· The SPI is up 12 points as all three US indices made modest gains, circa +0.15%.

· Minutes from the Fed’s latest meeting showed officials were concerned about low inflation and still split about the timing of future rate rises.

· US retail stocks bounced as investors pin their hopes on strength in consumer spending.

· LME metals were extremely strong while iron ore and oil fell, gold rallied to $US 1283/oz.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/08/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here