This ASX-traded ETF provides investors with exposure to a diversified portfolio of global companies involved in renewable energy generation and clean energy technologies, including solar, wind and related infrastructure. It has enjoyed a solid year but has been left behind by more traditional fossil fuel stocks. This is very much a global ETF, which is useful as the ASX doesn’t provide any major companies in the space at this stage, unlike NZ, which contributes ~8% to the CLNE ETF.

- The ETF currently holds 39 stocks, with its 5 largest positions being Enlight Renewable Energy, Bloom Energy Corp, Nextpower Inc, Enphase Energy and Chubu Electric Power.

Its an interesting balance which investors need to strike between ethical investing and performance with the CLNE ETF clearly lagging its FUEL cousin since COVID. Until we see some meaningful advancement by the likes of solar and wind power generation we believe the FUEL ETF will outperform, but logic would say that solar will ultimately play a huge roll, it’s just the longer term economics are less certain at the moment.

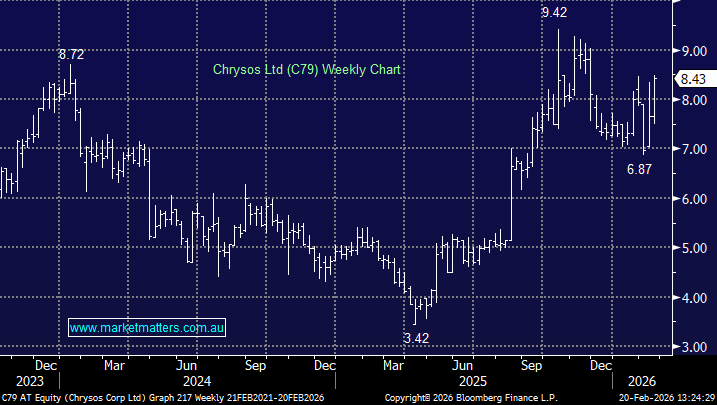

- We like the CLNE medium term but can see a pullback to the $7.75-8 area as upside momentum wanes.