Gold’s Breaking Out, What to Buy? (NCM, NST, EVN)

News is flashing across our Bloomberg that Korea is firing missiles at Japan, if this is correct, today’s report may unfortunately be one day too late!

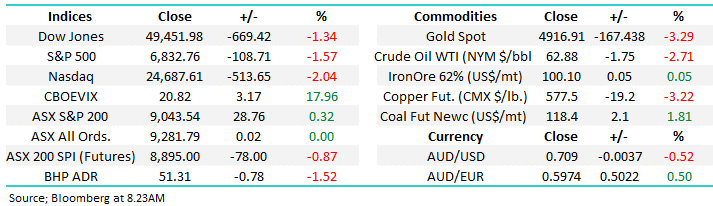

The story remains the same, but it definitely felt a little different yesterday as the market failed to bounce in afternoon trade after falling almost 50-points / 0.9% in the morning. Although the market’s low was yet again formed around 11am, as has often been the case over the last 14-weeks, there was a noticeable absence of buying to regain the day’s losses. Interestingly, the ASX200 closed only 35-points above its 4-week low and a further 56-points above its 12-week low i.e. One or two bad days and we might finally see a break out to the downside.

Yesterday’s weakness was relatively evenly spread across the market, although we did see some distinct liquidation in a few resource stocks, led by OZ Minerals (OZL) which fell another 3.76% making it a 10.2% correction in just 3-days, another great illustration of the volatility within this sector. We didn’t pull the trigger on our trading idea because the momentum simply felt too strong, we may reconsider buying OZL ~$8 in the coming days if the opportunity arises.

Overnight US stocks were quiet, a few headlines around Amazon and price cuts which should put some shudders through Aussie retailers, while Four Corners ran a program on the Blood Plasma industry overnight, which could cast a shadow over CSL this morning. This morning though, US Futures are trading down around 0.50% following the escalating tensions between Nth Korea and Japan. This should see the ASX 200 move towards the lower extremity of its 15 week trading range.

ASX200 Weekly Chart

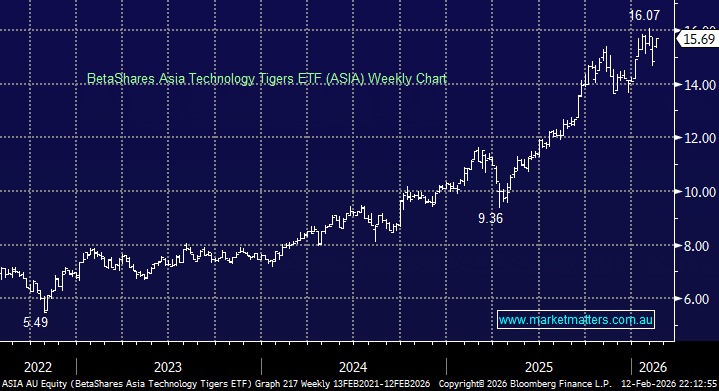

US Stocks

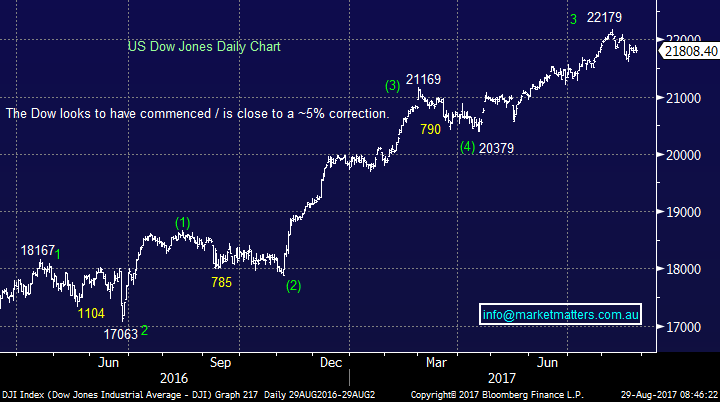

US equities were mixed overnight with weakness led by the financials, probably ahead of this Friday’s important employment data which will give economists a solid gauge on the timing of the next interest rate increase by the Fed. We still see a greater than 1000-point / 5% correction by the Dow moving forward, similar to May-June 2016. However very short-term, the market looks very 50-50, which is not surprising ahead of this Friday.

We remain mildly bearish US stocks targeting a correction of ~5% over coming weeks / month as sell signals continue to slowly emerge.

US Dow Jones Daily Chart

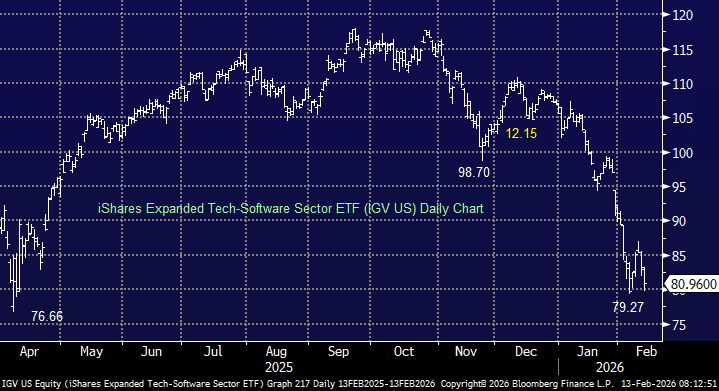

Gold

Gold surged almost $US20/oz. last night to its highest level since November 2016, we are now bullish targeting ~$US1450/oz assuming the precious metal does not fail and fall back under $US1290/oz. i.e. excellent 7-1 risk / reward on the underlying commodity, now it’s time to look at the stocks in the sector.

Gold ($US) Monthly Chart

In the Weekend Report delivered yesterday we showed the lack of activity by gold ETF’s for the last 6-months in our “Standout chart of the week” section, our timing is looking pretty good / lucky this morning! Last night this gold ETF rallied 3.6% to fresh 3-month highs, if we are correct it has much further to go.

Market Vectors Gold ETF Monthly Chart

Now let’s look at Australia’s 3 largest gold stocks by market capitalisation – locally the gold sector is a very small percentage of the ASX300, making up well under 2% of the index, hence our 5% exposure to Newcrest Mining (NCM) is already an overweight position from a portfolio perspective.

1. Newcrest Mining (NCM) $22.36 – Technically NCM looks poised to at least reach $25, assuming it can now hold over $22. Unfortunately, we did not manage to average lower, but at least now we have an excellent buy signal. This morning we will add a further 2.5% of the MM Growth Portfolio into Newcrest with a limit price of $22.80 – recognising that the stock may open above this level.

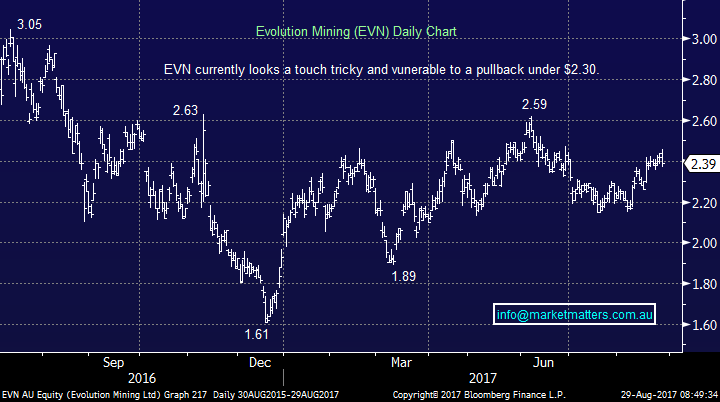

2. Evolution Mining (EVN) $2.39 – EVN is a touch messy technically, but another challenge of the $3 area looks likely.

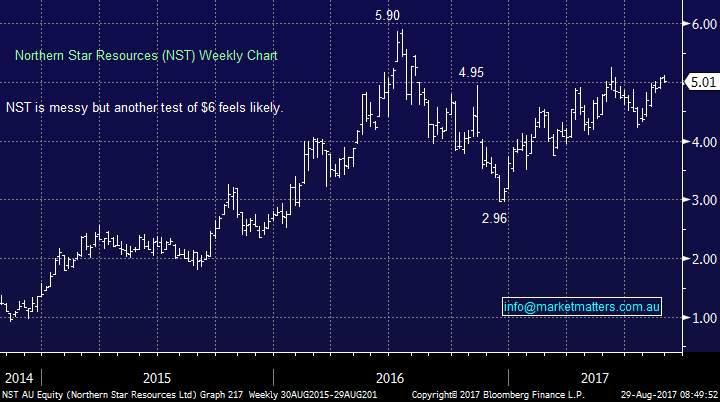

3. Northern Star Resources (NST) $5.01 – Similar to EVN, NST is touch messy technically but another challenge of the $6 area looks likely.

On the fundamental basis, we have all 3 companies trading on a similar valuation which fortunately sits on the “trading buy” side of the ledger.

Our preference assuming they all open up ~3% is to buy NCM early, expecting that today will be a rare occasion when the local market does not fade strength.

Newcrest Mining (NCM) Weekly Chart

Evolution Mining (EVN) Daily Chart

Northern Star Resources (NST) Weekly Chart

Conclusion (s)

MM is not a one tricky pony, we are happy to buy strength although we do acknowledge less often. Today is likely to be one of those examples.

We are planning to increase our NCM exposure from 5% to 7.5% early today however with a 22.80 limit price

There is also the potential for an “options trade” for the sophisticated trader - buy the October $23 - $25 call spread, with the $22.80 limit on the stock being acknowledged

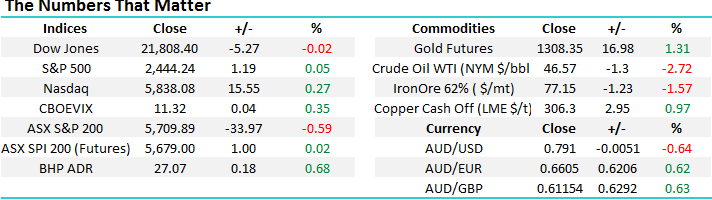

Overnight Market Matters Wrap

· Focus will be on this morning’s news that North Korea fired missiles in Japan’s territory.

· Domestic corporate earnings today are AGI, CTX, MTR and SDA.

· The ASX 200 is expected to follow the current selloff in the US Futures market, possibly pointing down 0.7%.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/08/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here