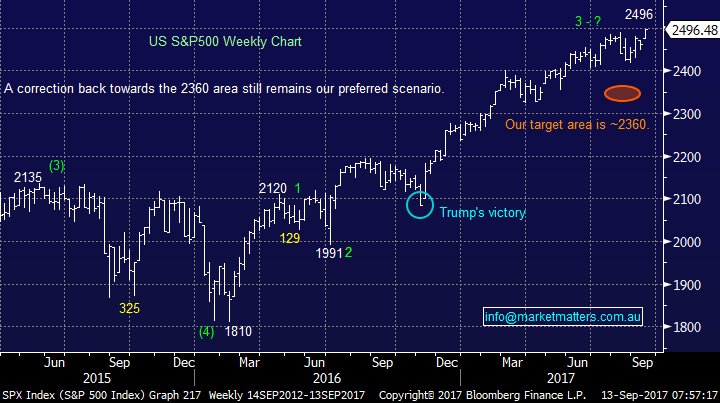

Bond yields are clearly the conductor in this orchestra (TCL, SYD, WBC, RIO)

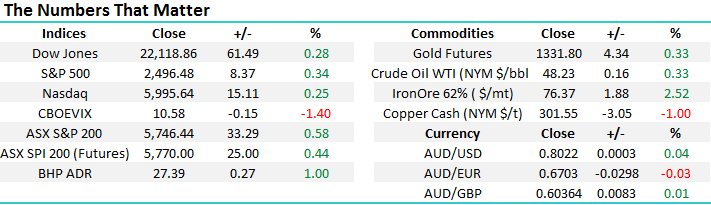

Local stocks are enjoying a great week, only a few days after threatening to break down to multi-month lows – a familiar story. The banks have come back into favour very quickly with CBA gaining 3.7% and Westpac 3% this week alone. While we’ve seen some wobbles within other areas of our market from a weightings perspective the ASX200 is dominated by the banks / financials and hence when they’re strong our market usually rallies. This morning following further solid gains from overseas markets we are set to open up around 30-points, back towards the upper end of the multi-week trading range.

Sector rotation is presently the main game in town as the overall index goes basically nowhere e.g. over the last month the diversified financials are down well over -2% while energy / resources are both up over +7%. With the RBA cash rate at 1.5% an almost 10% relative return in one month is not to be sneezed at. As we have said repeatedly during 2017 the bull market for stocks / assets which commenced back in March 2009 is maturing rapidly and this will lead to both increased volatility and opportunity. Sector rotation is not trading, its simply switching / moving funds as valuations become stretched or suppressed by market sentiment – something fund managers do regularly as they strive for market outperformance.

On an index level we’ve been ideally looking for a pullback towards 5500 but the longer the market remains in the current trading range the more uncertain we become. US stocks have reached fresh all-time highs which we targeted a few weeks ago and if they now follow our ~5% retracement script a decent pullback from local stocks remains a possibility. From a statistical perspective corrections by markets usually happen in both price and time, perhaps on this occasion the excessive time we’ve spent around 5700 will offset any pullback in price towards 5500.

ASX200 Weekly Chart

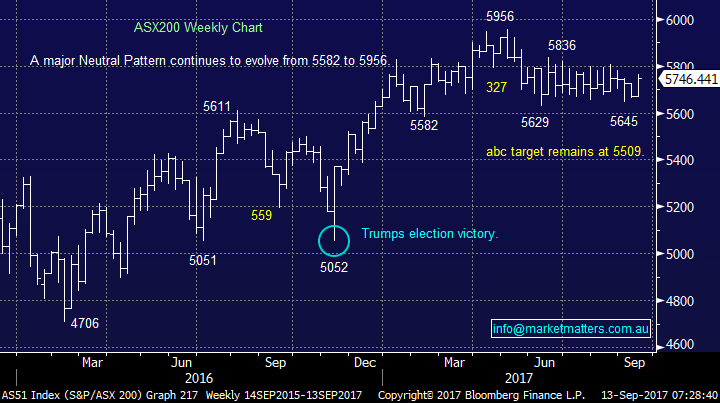

Last night the Global World Index made the fresh all-time high which we flagged yesterday. In the short-term we are now neutral / bearish but importantly no sell signals are yet evident. It remains important to remember at MM we are still targeting around 9% further upside prior to a correction of the whole bull market advance since March 2009. Hence the game remains the same, until further notice:

“Buy weakness, ideally 5% pullbacks, and sell any surges to fresh all-time highs” – Market Matters.

MSCI Global World Index Quarterly Chart

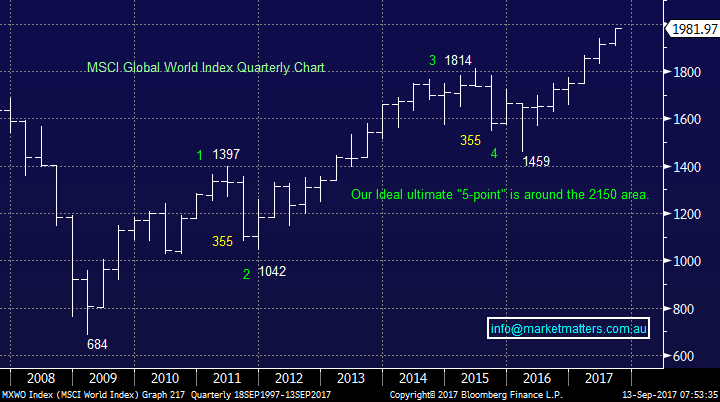

US Stocks

US equities rallied strongly overnight will 8 out of 10 sectors of the S&P500 closing in the black, the only two sectors to close negative were real estate and utilities i.e. stocks who generally struggle when interest rates / bond yields rise.

There is no change to our short-term outlook for US stocks, we are targeting a ~5% correction i.e. a around 130-points by the S&P500.

US S&P500 Weekly Chart

The main move which caught our attention yesterday was the continued strength by US bond yields. We remain bullish US 10-year bond yields and while last week’s low of 2.05% may not have been the low for 2017 we believe it’s very close at hand, if not already in place. If we are correct with our bullish US bond yield outlook the implications are significant for relative stock market sector performance moving forward with arguably the below 3 points the most important:

1 “The yield play” is about to endure significant underperformance, last night’s 1.7% fall by the utilities in the US should be just the beginning.

2 The banking sector whose margins increase in a higher interest rate environment is poised to come back into favour.

3 The resources who have enjoyed a great year to-date are likely to struggle at least for a few months, investors who have moved to this sector as the new “yield play” may have been way too late to this particular party!

We will quickly look at these 3 points as we consider optimum investing decisions for the rest of 2017.

US 10-year bond yields Weekly Chart

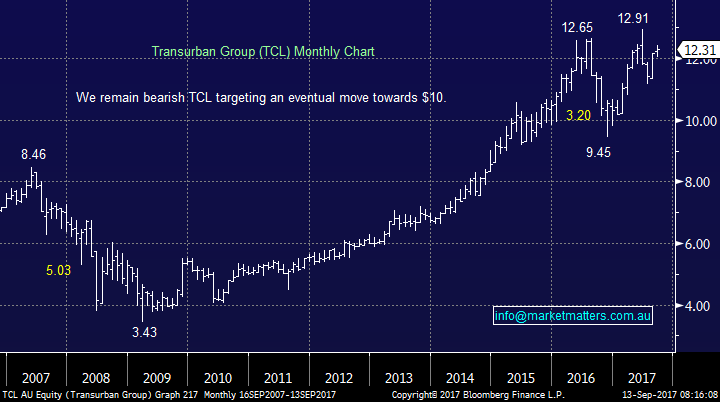

The “yield play” we believe is the last place we would be invested for the next 3-6 months. The volatility that stocks like Sydney Airports (SYD) and Transurban (TCL) have experienced during 2016/7 feels like a warning, it’s hardly the swings of conservative bond proxies i.e. down 26% and then up 37%.

We are bearish TCL and SYD looking for another ~20% decline.

Transurban (TCL) Monthly Chart

We continue to like the unpopular banks for at least the next 3-months, last night’s 2% advance by the US banking sector should help our local banks initially today, although they probably need a rest after the strong gains over the last 2-days. Importantly we remain very bullish US banks targeting well over 10% gains moving forward, a great indicator to the local sector.

While the local banks are unlikely to enjoy the growth over the next 5-years as the last 5-years we believe they represent good value at current levels. Also as November approaches some very attractive dividends / yields are on the table e.g. National Australia Bank (NAB) yields 6.44% fully franked and Westpac (WBC) 5.94% fully franked.

US S&P500 Banking Index Weekly Chart

Westpac Bank (WBC) Weekly Chart

The resources are looking a little tired and we believe Mondays weakness is a warning that a period of underperformance has commenced, or is just around the corner. There is still no reason to believe the recent weakness in BHP is the end of its rally from $22.06 which commenced in June, our target remains over $28 although one could argue it traded there last week as the stock went ex. a ~53c fully franked dividend. Also, RIO looks extremely close to out ~$70 target area and as we look for triggers to take profit on our resources holdings a saying from legendary investor Baron Rothschild again comes to mind:

“I will tell you my secret if you wish. It is this : I never buy at the bottom and I always sell too soon” – Baron Rothschild.

While we still see a little further upside from our large cap. mining stocks, we do intend to sell this strength i.e. AWC and BHP.

RIO Tinto (RIO) Weekly Chart

Conclusion (s)

For the remainder of 2017, we see outperformance by banks / financials over the “yield play” stocks and to a lesser degree the resources sector.

Overnight Market Matters Wrap

· The US share markets continued its winning streak overnight, with the broader S&P 500 ending its session at record highs.

· The Telcos outperformed, followed by the financials, while the Real Estate and Utilities lagged and closed in the red sea.

· Iron Ore rallied overnight by 2.52%, helping BHP in the US to close an equivalent of 1% higher from Australia’s previous close.

· The ASX 200 is expected to rally 26 points above the 5770 area as indicated by the September SPI Futures this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/9/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here