A trifecta suddenly points to higher interest rates

Yesterday the ASX200 drifted lower as a 0.7% advance from our banking sector was not enough to offset active selling in both the resources and healthcare sectors. Very quickly we’ve seen the rotation from resources to banks take hold in the market, with BHP set to open today around $26.60 / over 4% below this month’s high, while the recently out of favour CBA is now almost 5% above last week’s low, which was also the low for 2017.

The major change in sentiment has been around interest rates and we believe this has further to run through 2017 / 8. The MM Growth Portfolio is currently holding 40% in Australian banks compared to their market weighting of only ~25%, in other words we are 60% overweight the banks and importantly happily so!

The overall ASX200 index remains neutral as its 17th week of trading between 5836 and 5629 comes to an end. Overnight we saw markets totally ignore North Korea / Kim Jong Un who threatened to use nuclear weapons to “sink” Japan and reduce the US to “ashes” for supporting the latest UN sanctions. The Fear Index (VIX) has given up all of its worries around this geo-political issue, it’s amazing how often stock markets focus intently on an issue day to day for a period only to totally ignore it a few weeks later.

ASX200 Daily Chart

US Fear Index (VIX) Weekly Chart

US Stocks

US equities had another quiet night with no great points of interest. We are very cautious US stocks at current levels but would need to see a pullback / close under early Novembers 2490 low to generate some sell signals from a technical perspective i.e. only 0.5% lower.

Overall there is no change to our short-term outlook for US stocks where we are targeting a ~5% correction i.e. a further 130-points for the S&P500.

US S&P500 Weekly Chart

European Markets

Last night the UK FTSE fell 1.1% to its lowest level since May, an eye catching move as the local ASX200 is often very correlated to the FTSE. However, there was local news which assisted this drop as the Bank of England signalled the possibility of stimulus reduction moving forward. We still see another 4-5% downside for the FTSE.

UK FTSE Weekly Chart

Over the last few days the economic picture has been transformed dramatically by 3 separate and unlinked events:

1. Yesterday’s Australian employment data was very strong, adding over 54,000 new jobs in August, implying all is not as bad as many feared with our local economy.

2. US inflation surprised on the upside coming in at 0.4% for August, assisted by fuel costs.

3. The Bank of England’s rhetoric last night sent a strong signal on looming interest rate rises.

A number of traders are now looking to late this year for a 0.25% rate rise in the UK as they look to join Canada and the US in the rate increasing club – Canada has already raised interest rates twice since July alone. Locally the RBA is walking on a tightrope as they’re probably keen to increase rates in 2018 but fear 3 standout consequences:

1. Higher local interest rates may send the $A much higher than its already strong 80c, harming our competitiveness on the world stage.

2. Local house prices already feel precarious at current levels and a significant correction would harm consumer confidence and potentially cause a negative ripple effect through our economy.

3. Australians are already sitting on record debt levels, if the interest rate and hence repayments increase too fast the economy may be choked before it even gets going.

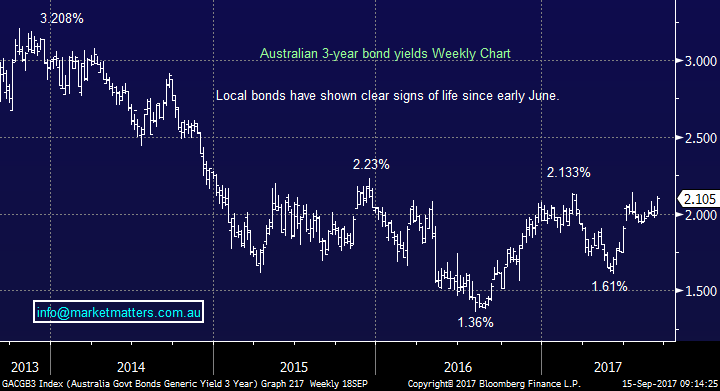

We remain very comfortable with our view the Australian and global interest rates are set to rise - we are targeting ~2.5% for the local 3-year bond yield i.e. 0.5% higher.

Australian 3-year bond yields Weekly Chart

As most of you hopefully know by now we are bullish banks from current levels assuming asset and primarily housing prices do not fall too far / too fast – banks margins improve in a higher rate environment. While we do not believe that housing prices / stocks should ever be compared to bitcoin as an asset class the 33% drop by the crypto currency over the last 2 weeks should be a warning that global asset prices are very elevated, and this appreciation has been significantly helped by historically low interest rates which are slowly starting to increase.

Bitcoin Currency (XBT) Weekly Chart

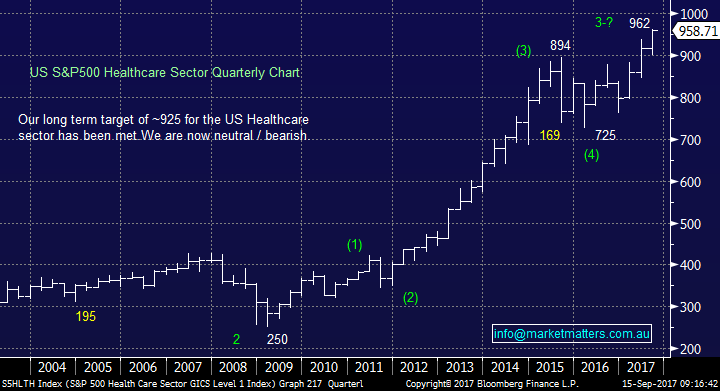

We’ve discussed at length recently the impact of higher interest rates on the likes of banks and “yield play” stocks but one area we’ve not mentioned is the popular and “highly owned” healthcare sector. Yesterday we received a question from a subscriber asking why Ramsay Healthcare (RHC) was so weak, a question we thought should be touched on today.

High interest rates usually have a negative impact on the healthcare sector and unfortunately our views are not too encouraging:

1. We remain negative RHC targeting the mid $50 area, over 10% lower. The stock is trading on a high valuation which is not too compelling as interest rates rise. Plus, the stock is very owned / popular which could easily add to its recent underperformance.

2. The US healthcare sector has reached our target which has been in place for ~2-years. We are neutral / negative eventually targeting a 20% pullback.

We’ve generally avoided the sector over recent months with the exception of our 5% purchase of Healthscope (HSO) which is currently ~3% underwater – we are watching this position carefully considering our view of the sector.

Ramsay Health Monthly Chart

US S&P500 healthcare sector Quarterly Chart

Conclusion (s)

We continue to believe global interest rates are set to rise which should be positive banks while housing prices hold firm but bearish both the “yield play” and healthcare sectors.

Overnight Market Matters Wrap

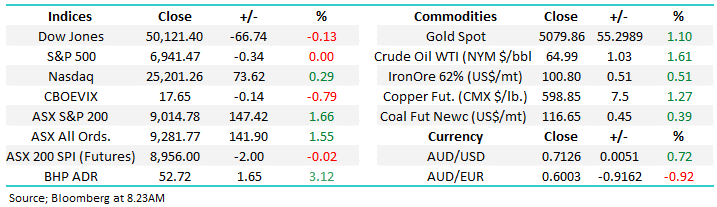

· Flat equity markets and mixed commodities point to a steady to slightly firmer opening this morning on the Australian market with talk of further global rate hikes once again weighing on sentiment.

· In the UK the Bank of England for the first time flagged a potential rate hike within months after their policy meeting. In the US an inflation reading of 0.4% once again raised expectations of a hike before the end of the year.

· Commodities were mixed after yesterday's slightly weaker than expected China data - retail sales industrial production and fixed asset investment - with iron ore slumping over 3%. Both BHP and RIO were around 2% lower in us trading while gold firmed. The A$ hovered below 80c.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/9/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here