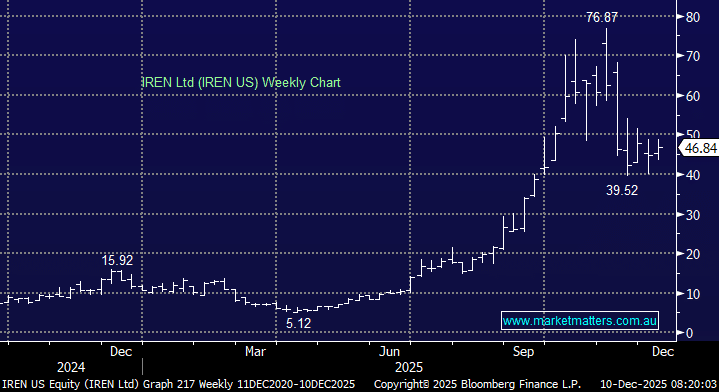

We’ve owned IREN briefly in the International Equities Portfolio, having bought a small (~2.5%) position at ~$US12 in June, taking a very rapid ~200% profit by September at $US38, only to see the stock roar to a high above $US76. This is a high growth, high risk stock, capable of big moves. In the last month or so, IREN has tracked back to ~$US40, consolidating the strong advance. We like the technical structure of IREN into this recent pullback and believe it has a strong chance of re-rating again on the upside.

- Of the 14 brokers that cover IREN, 10 have it on a buy with a consensus price target of $US86.67, headlined by bullish calls from Macquarie ($US95 PT), Bernstein ($US125 PT) & Cantor Fitzgerald ($US135 PT).

As a refresher, IREN is an Australian company listed in the US that has successfully moved from a bitcoin miner to an AI-cloud powerhouse. They were a purely crypto-mining operation; however, they’ve successfully used cash flow from crypto to transition into a full-fledged AI cloud and high-performance computing (HPC) provider. Its data centres, energy infrastructure and GPU capacity are being repurposed to meet soaring demand for AI compute.

- Unlike many peers, IREN owns land, power supply (renewable energy), data-centre infrastructure, and computing hardware. That vertical integration gives it cost control, scalability, and reduces counterparty/colocation risk – often a constraint for AI infrastructure firms.

The shift to AI cloud has already translated into rapid revenue growth; the company expects a multi-hundred per cent increase in cloud revenue over the next 12–18 months as GPU capacity ramps, and demand for AI services continues to surge. They’ve signed big contracts with large players, most notably, a $US9.7 billion, five-year GPU cloud services deal with Microsoft, giving the tech giant access to IREN’s Nvidia-based AI infrastructure.

Beyond Microsoft, IREN says it has secured multi-year cloud-services contracts with “leading AI companies” for GPU deployments using Nvidia’s Blackwell GPUs. As of the latest disclosures, IREN reports contracts covering 11,000 out of its 23,000-GPU fleet, implying these customers collectively represent about US $225 million in AI-Cloud annualised recurring revenue (ARR), expected to ramp up by end-2025. This gives the business a meaningful baseline of demand and earnings.

- The exact timing and terms for conversion from contracted capacity to actual revenue generation is still unknown, and while IREN expects much of the contracted capacity to be live by the end of 2025 / early 2026, there is execution and delivery risk in this ramp-up.

Two things have been at play to see IREN shares pull back recently: A decent decline and high volatility in crypto markets, and a significant balance-sheet reshaping, which involved a placement of ~39.7m shares at $US41.12, creating some dilution. The placement was part of a broader restructure of debt that reduces refinancing risk, lowers coupon expenses, and supports continued expansion of IREN’s data-centre footprint across renewable-rich regions in North America.

The details of the deal are fairly complex. However, it delivered net proceeds of US$2.27bn, allocating US$2.07bn to debt repurchases and US$0.20bn to general corporate purposes and working capital. From our perspective, the transaction is a clear balance-sheet upgrade, limiting dilution while positioning IREN for its next phase of AI-driven growth.

- We view recent weakness as a buying opportunity, and plan to add a small position to the International Equities Portfolio.