The tune remains the same, for now

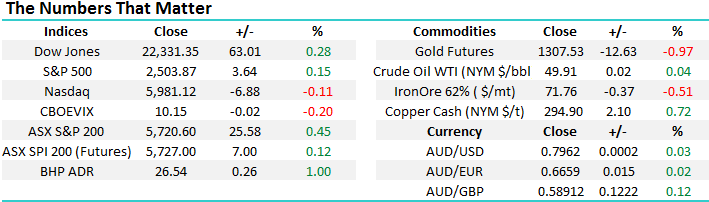

The ASX200 has remarkably continued into its 18th week of trading in the very tight range between 5629 and 5836.There has been at least 2/3 occasions when we felt a breakout was imminent only to be proved wrong as the market reverted back towards to its 5730 mid-point, exactly where we are likely to open today. Recently the local banks and financials have enjoyed some positive momentum while the resources have suffered a mild pullback, nothing to write home about but when the market continues to tread water it’s the main standout. We expect the resources will find some love today following BHP’s mild reversal on Monday to close in the black, this may give us the opportunity to take profit in Alumina (AWC) – in the US BHP closed up 27c.

Over the last few days we have witnessed some cracks emerging in asset prices with the below 3 catching our eye:

- The Sydney property auction clearance rate falling to its lowest level since 2015.

- A “luxury car index” used by Commsec which has proved to be a reliable indicator for the health of the economy, including housing, suffered its largest drop in 5 years.

- The price of Bitcoin fell 40% in two weeks although it has since regained over half of this decline.

For now equities are holding up extremely well but considering we’ve had an asset price appreciation bull market since Quantitative Easing (QE) commenced following the GFC the transition to Quantitative Tightening (QT) is highly likely to have a meaningful impact in the opposite direction at some point in time, the timing of any such reaction will clearly be the key.

Our preferred scenario for now remains a small correction back towards 5550, only around 3%, before rallying into Christmas / 2018. However it would appear that the market needs a definitive catalyst to break out of the current trading range.

ASX200 Weekly Chart

US Stocks

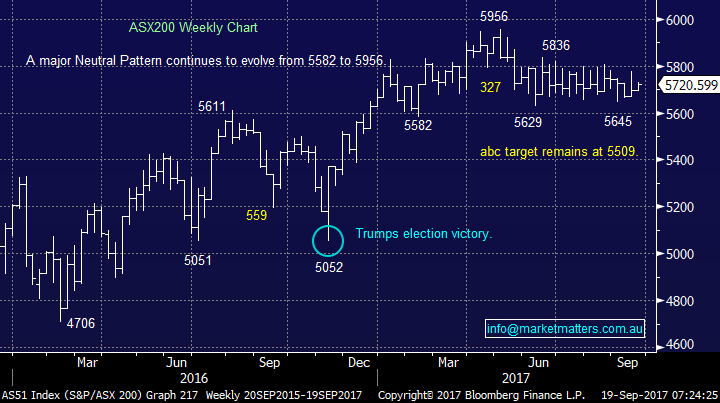

US equities rallied overnight with 6 out of the 10 sectors of the S&P500 closing in the black, the financials led the way gaining over 1.2% while the interest rate sensitive stocks were the largest drag.

Today we read that Toys “R” Us are expected to file for bankruptcy, bad news for kids at Christmas and another warning for retail stocks in today’s internet / Amazon environment.

There is no change to our short-term outlook for US stocks, we are targeting a ~5% correction i.e. a around 130-points by the S&P500.

US S&P500 Weekly Chart

With markets fairly quiet we thought today was an ideal time to have a quick looks at 4 large well known US stocks from a technical perspective to gauge any insights to where our market may be headed into 2018.

Alcoa (US)

Alcoa US manufactures metal products but importantly is highly correlated to our own Alumina (AWC) from a share price perspective. The stock has appreciated 300% since early 2016 in a very similar manner to our own resources sector. However the stock has now reached our target area and we feel there is a strong risk that it corrects back to the lows of 2017 hence we are looking to take profit on our AWC holding allowing us to sit back and evaluate what comes next i.e. the easy money has gone!

Alcoa (US) Monthly Chart

Apple (US)

Apple has also enjoyed an excellent run since around Christmas 2016 but technically the short-term picture is fairly clear and negative. We are bearish Apple over coming weeks targeting a correction back towards 145 i.e. around 10% lower.

Apple (US) Weekly Chart

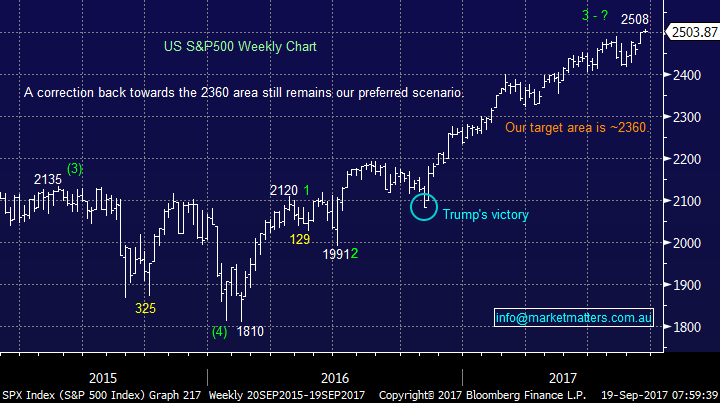

Google (US)

Google is a bit tricky just here but if it was to correct hard back towards ~750, the lows of 2016, we would be very keen buyers – obviously unlikely at this stage.

Google (US) Monthly Chart

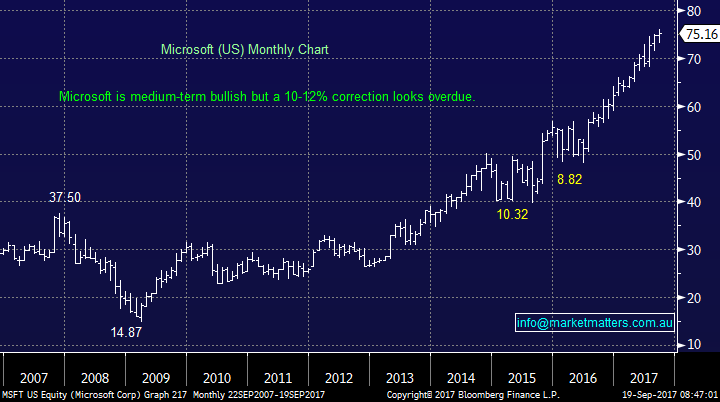

Microsoft (US)

Microsoft is a great / clear chart pattern at this point in time which is bullish medium-term but potentially getting close a to 10-12% correction short term which should provide an excellent buying opportunity if / when it eventuates.

Microsoft (US) Monthly Chart

Conclusion (s)

No real change, we prefer banks / financials over resources into Christmas / 2018 and on an index level our preferred scenario is a pullback towards 5550 in the coming weeks.

The 4 US stocks we reviewed are all at risk of a short-term correction but the bull market medium-term looks intact.

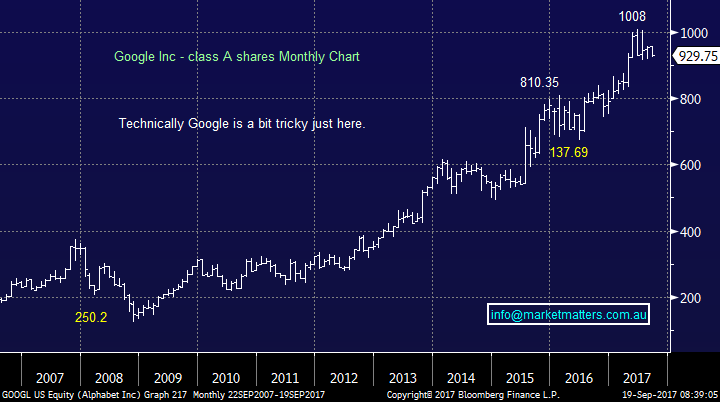

Overnight Market Matters Wrap

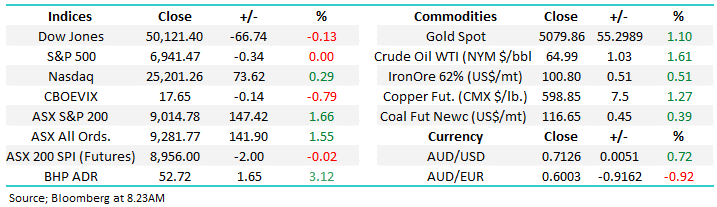

· The US equity markets closed with little change overnight as investors sit on the sideline waiting for important economic data this week (current account balance tonight and FOMC meet on Thursday.

· Gold futures lost ground overnight, off 0.97% however geopolitical tensions may soon rise as we see further drills over the Korean peninsula and Australia’s 6 warships heading north towards the South China sea for military exercises.

· The September SPI Futures is indicating the ASX 200 to open 7 points higher, towards the 5730 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/09/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here