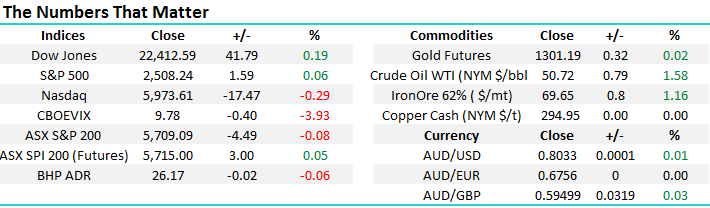

Don’t fight the Fed – interest rates are going up

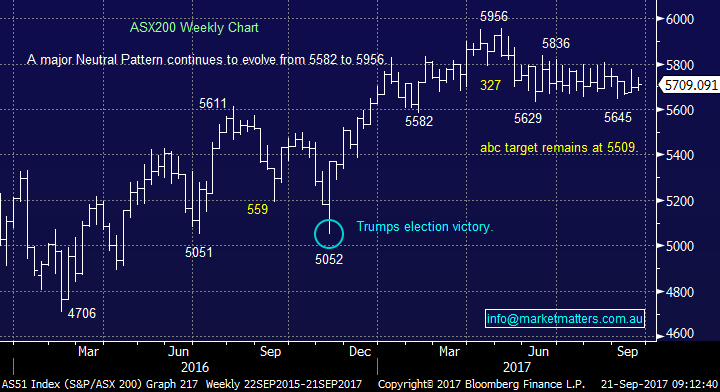

Yesterday, the ASX200 closed marginally lower after being smacked around 50-points in the first 40-minutes of trade. It’s hard to get a handle on this characteristic which is regularly hitting the local market in the mornings, but the early selling is focused on the futures market, hence someone / people are selling the whole ASX200 as opposed to one particular sector – our best “guess” would be a hedge fund (s) are picking our index to continue with its underperformance relative to its peers. The ASX200 is up +0.8% in 2017 compared to the Dow up +13.4%.

The big news overnight was the Fed has flagged one more interest rate rise in 2017, followed by an additional 3 in 2018. We will look at this in more detail later in the report, but we wonder how the Australian economy would / will cope when interest rates do start to climb. Housing prices are already struggling and will potentially follow the UK, whose prices have now fallen for the last 5 consecutive months. A 10% correction in property in theory is nothing, just back to where they were recently, but the sentiment is likely to tighten people’s purse strings even more, potentially choking our already lacklustre economy. The RBA are walking a very tricky tightrope and we feel for them, the $A well above 80c is not helping!

On balance, our view for the ASX200 remains intact with a test towards the 5500 area still feeling likely before the local market can make another assault on the huge psychological 6000 area into 2018.

ASX200 Weekly Chart

Global Indices

US Stocks

US equities had another very quiet night following a Fed statement, probably just want the central bank wants. Our view is the market is ready for a minor correction but importantly no sell signals have recently emerged.

Overall there is no change to our short-term outlook for US stocks, where we are targeting a ~6-7% correction for the NASDAQ.

US NASDAQ Weekly Chart

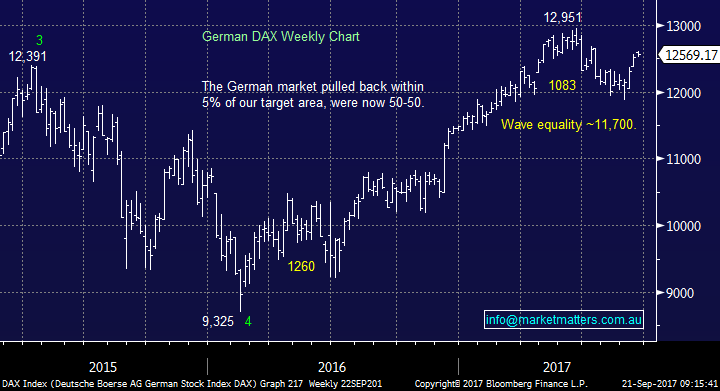

European Markets

No change here, we are 50-50 following the last 2-weeks of strength. We would be very keen buyers of weakness under this month’s low, but the correction since June may already have run its course.

German DAX Weekly Chart

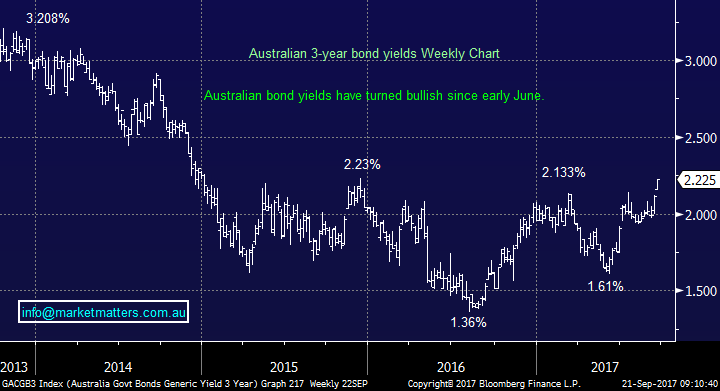

As we said in this morning’s title “Don’t fight the Fed”, is something you will often here professionals quote for a reason, they have significant influence and usually get what they want. We remain bullish interest rates and not surprisingly after last night’s statement from Janet Yellen, US 10-year bond yields rose leading to the anticipated / expected sector rotation within the US market:

1. The financial sector rallied +0.6%.

2. Both the Utilities -0.74% and real estate -0.3% sectors declined.

We remain very bullish the US banking sector, targeting further gains of ~10% adding to the 8% appreciation over the last 2-weeks. During this same period, the local banking index has rallied ~3.5% illustrating the reasonable correlation.

At this point in time 3 things come to mind:

1. The Fed news is now in the market, so we would not be surprised to see some consolidation from the banks in the short-term.

2. The MM Growth Portfolio is aligned with our positive banking view, but as always, we will be prepared to take some profits into the anticipated strength if / when it unfolds.

3. We do not want exposure to stocks / sectors which will be negatively influenced by higher interest rates / bond yields - nothing new here.

US 10-year bond yields Weekly Chart

US S&P500 Banking Index Weekly Chart

In a morning report a few days ago, we wrote:

We remain very comfortable with our view the Australian and global interest rates are set to rise - we are targeting ~2.5% for the local 3-year bond yield i.e. 0.5% higher.

Considering local 3-year bond yields will today trade at their highest level since late 2015, our target of 2.5% maybe too conservative, time will tell but it remains our initial objective.

Australian 3-year bond yields Weekly Chart

Two stocks we have been discussing / watching a lot recently are likely to be impacted by this fresh wave of economic optimism and hence higher interest rates:

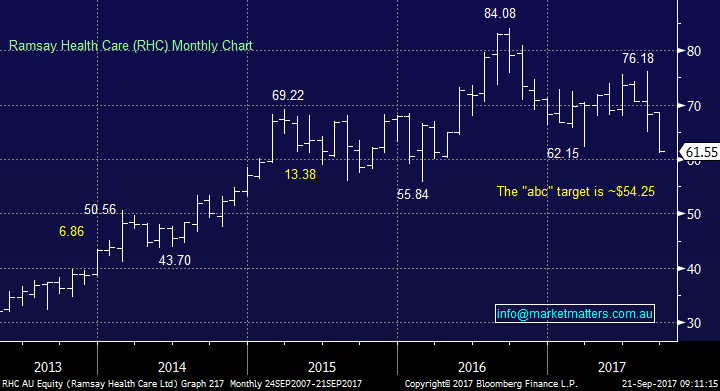

1. Ramsay Healthcare (RHC) $61.55 – We remain negative RHC ideally targeting $55 but we will consider accumulating under $60 depending on the markets position overall.

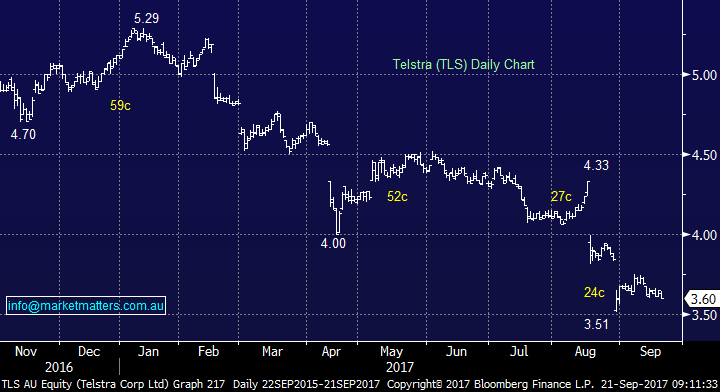

2. Telstra (TLS) $3.60 – Along with the banks probably the most popular dividend “play” in Australia and hence vulnerable to higher interest rates. We are likely to add to our holding under $3.50.

Ramsay Health Monthly Chart

Telstra (TLS) Daily Chart

Eventually higher interest rates may be the catalyst we are looking for to cause a ~20% market correction in 2018 /9 but short-term the economic optimism, leading to the same higher interest rates we feel will underpin stocks.

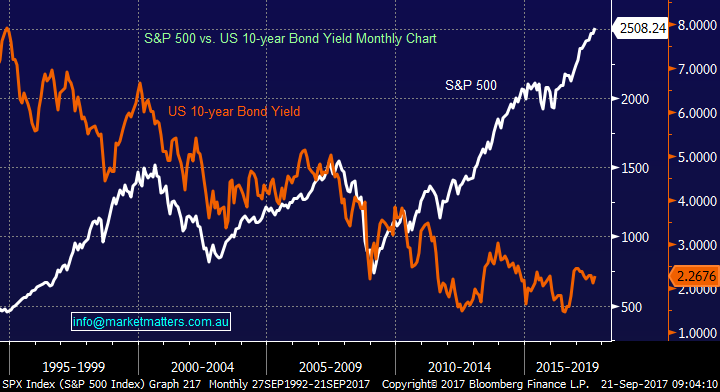

The S&P500 has rallied significantly since the mid-1990’s while global bond yields have fallen e.g. US 10-years from around 8% to under 1.5% last year. There is likely to be an “uncle” point where higher interest rates e.g. term deposits offer a decent alternative for investors to the share market.

US S&P500 v US 10-year bond yields Monthly Chart

Conclusion (s)

We continue to believe global interest rates are set to rise which should be positive banks while housing prices hold firm, but bearish both the “yield play” and healthcare sectors.

*Watch for alerts*

Overnight Market Matters Wrap

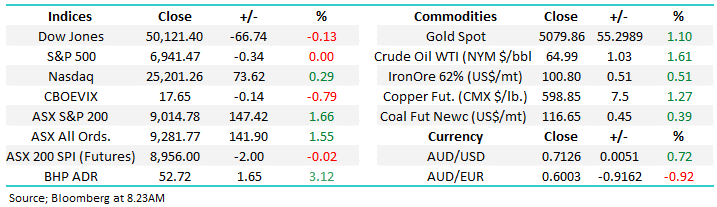

· As expected, a volatile session was experienced in the US overnight with the Dow and S&P 500 climbing back from their intraday lows to close in positive territory following the unchanged of its key interest rate.

· The Fed announced that the balance sheet run off would start next month. The odds of a rate rise in December rose to 67% (from 58% yesterday) and we should expect three hikes in 2018.

· The December SPI Futures is indicating the ASX 200 to open 13 points higher, around the 5715 area with volatility expected this morning due to September Index Expiry.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/09/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here