Subscriber Questions

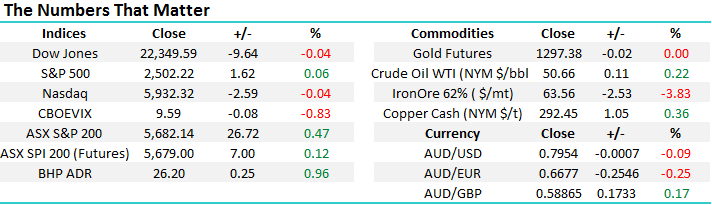

As we enter our 20th week of the ASX200 range trading between 5629 and 5836, MM continues to wonder what catalyst will be required to break this almost unprecedented period of sideways consolidation. Over the weekend, we received more geo-political news, but it feels unlikely to be of enough importance to send our market to a fresh level of equilibrium, at least for now.

1.More ongoing strong comments between North Korea and the US / Trump but perhaps Russia summed up best when they said that the US cannot strike at Kim Jong-Un simply because he does have a nuclear capability, unlike say Iraq.

2. The New Zealand election has left the main parties trying to do a deal with the unpredictable Winston Peters to obtain a workable majority.

3. Angela Merkel won the German election with relative comfort but the “far right” has returned to parliament with well over 10% of the vote.

4. Australian banks have been pressured to remove ATM fees, ~$500m from their bottom line.

For now at least the only game in town remains sector rotation with the banks / financials still our preferred sectors. However our preferred scenario does remain weakness back towards the psychological and important 5500 area for the ASX200.

ASX200 Weekly Chart

With regard to US stocks, we still anticipate an eventual pullback towards the 5600 area for the tech NASDAQ, or around 5.5% from Friday’s closing level.

US NASDAQ Weekly Chart

Question 1

“Recently a few stocks that you have been keen on have spiked into your buy area before rallying almost instantly rallying not allowing time for purchased, any ideas?” Thanks Phil B.

Morning Phil, this has arguably been the most frustrating factor of recent months with the exception perhaps of the market not moving. As we have said before MM only send out alerts when we are buying in the market with our own $$ and are close to / actually getting filled with either our buy or sell orders. A classic example recently was last Thursday when Aristocrat dipped under $20 but for well under 5 minutes making it almost impossible for us to buy any meaningful volume of stock, let alone send an alert out to subscribers. We never claim a purchase / sale if it did not actually occur plus an alert was sent out to subscribers.

However there is nothing to stop the active subscriber from leaving orders in the market at our buy / sell levels to pre-empt our alerts which can take a little while to write / despatch and then be received. Looking at 2 stocks that have been close to our buy levels over recent weeks:

- Challenger (CGF) $12.25 – we are looking to accumulate under $12, potentially in 2 tranches.

- Aristocrat Leisure (ALL) – ideally we are still looking to buy under $20 but we may be tempted to buy a part position earlier.

Challenger (CGF) Monthly Chart

Aristocrat Leisure (ALL) Weekly Chart

Question 2

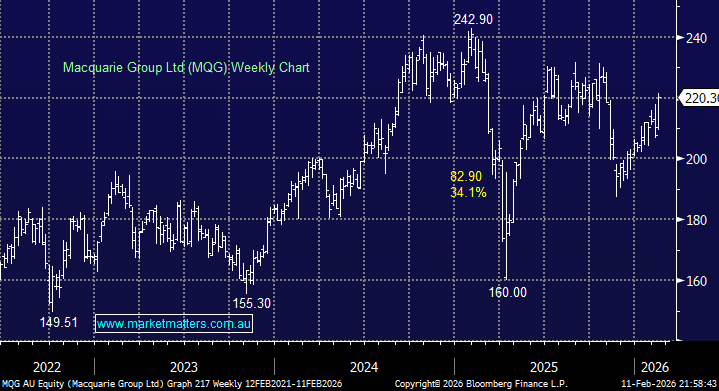

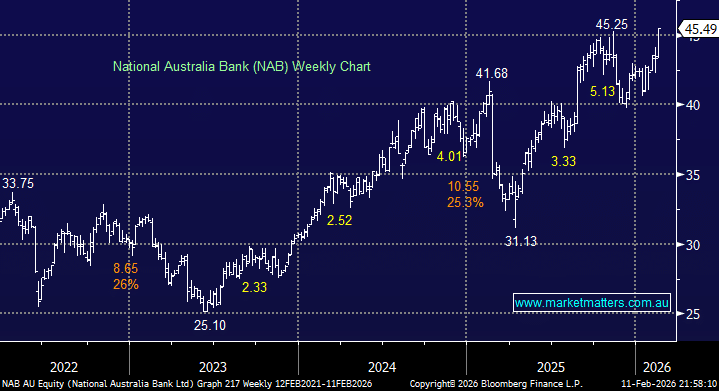

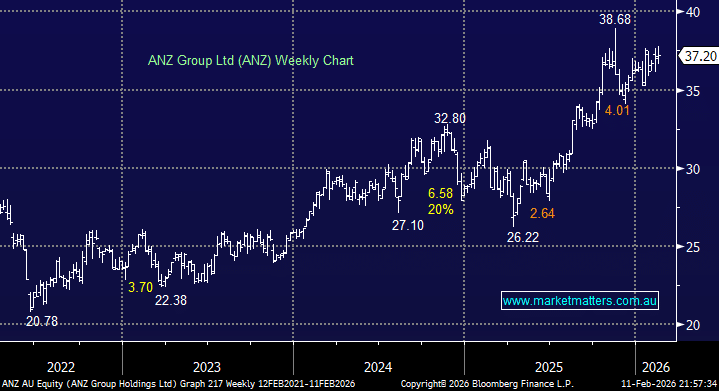

“Hi Team, will you consider switching from CYB after its great rally (thanks) into one of the large banks for a dividend in November?” – Thanks Mark H.

Morning Mark, a great question because it’s something we have pondered over the last week – great minds think alike! We are looking for CYB to initially reach around $5.30 / 5% higher. Hence we are obviously in no hurry to sell the position. However, we do have a significant 10% exposure to CYB so we may be tempted to switch say a quarter of this position to one of the “big four” going ex-dividend in November i.e. ANZ, NAB and Westpac.

In conclusion if the relative strength of CYB continues a partial switch will look increasingly attractive and we will evaluate at the time i.e. over the last month CYB is up 7.7% while Westpac (WBC) is down 1.5%.

CYBG Plc (CYB) Weekly Chart

Question 3

“Dear MM, Ramsay Healthcare has fallen hard since you’ve been negative and today in the Australian Financial Review hedge funds are talking about “shorting” it, do you like this idea?" -Thanks Vince B.

Hi Vince, a very topical question with a fairly simple answer. While we remain net negative Ramsay Healthcare (RHC) we believe the “easy money” from being short has well and truly gone with the stock now almost 20% lower over the last 2-months alone. Remember MM will actually be buyers around the $55 region hence it clearly feels too late to be going short from our perspective.

Also, by time a hedge fund announces to a newspaper they are shorting a stock you can almost guarantee they have already established a decent position hence they want the stock lower.

Ramsay Healthcare (RHC) Weekly Chart

Question 4

“Hi MM, why aren’t you buying Fortescue now its corrected over 15%?” – Thanks Steve R.

An interesting question Steve and another subject we’ve been considering closely over the last few days. Fortescue (FMG) has been by far our most successful vehicle at MM since our inception hence we watch it very closely. Unfortunately we are boringly “50-50” just here with our concern the rapid deterioration in the underlying iron ore price. Undoubtedly today FMG looks attractive from both a valuation and yield perspective but the picture will become far less attractive if iron ore were to fall another 30% just as it has since February.

For now at least we are going remain patient with regard to FMG, our ideal buy level is significantly lower around $3.50 and / or if the iron ore price again panics back under the $US40/tonne level – never say never on these volatile resource plays.

Fortescue Metals (FMG) Weekly Chart

Iron Ore Monthly Chart

Question 5

“Hi Team, can you explain your view / plans on gold at present, sorry but I’m a little confused.” - Cheers, Mike B.

Morning Mike, don’t apologise about being confused, it’s our job to ensure you fully understand all our views. We think it’s probably best to explain in bullet form:

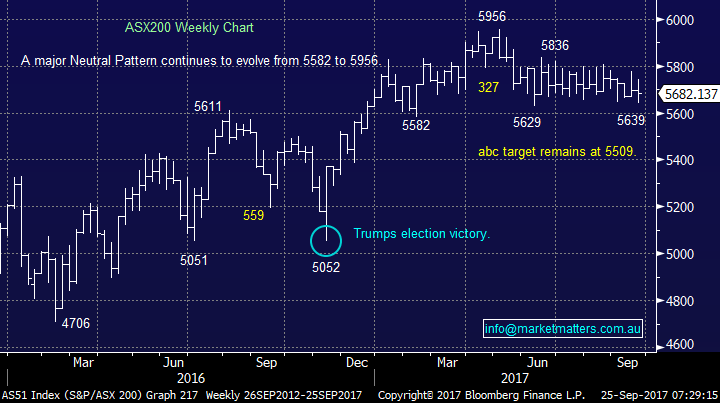

- We are looking to increase our gold exposure but we are very aware that seasonally gold drifts into Christmas.

- Also, we can see a bounce in the $US Index which is usually overall negative for gold.

- Clearly North Korea remains an important wild card.

- Hence we are likely to slowly accumulate, if / when the opportunity arises within the sector.

- Our favoured first purchase is probably Regis Resources (RRL) around $3.70 i.e. a 15% correction.

Gold ETF seasonality Chart

Regis Resources (RRL) Weekly Chart

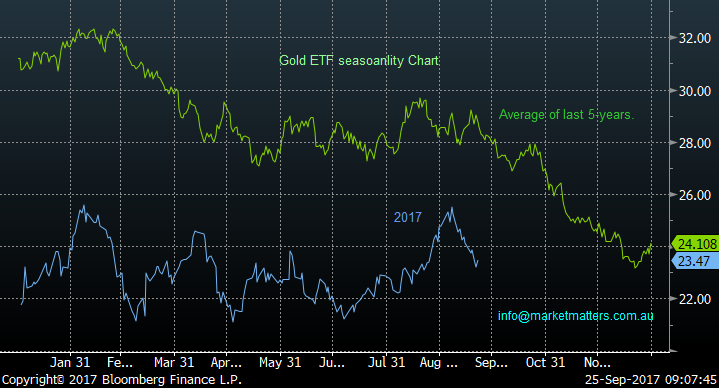

Overnight Market Matters Wrap

· The US equity markets closed mixed with little change last Friday despite concerns with North Korea remains heightened.

· The Volatility Index confirms this, trading at ultra-low and complacent levels at 9.59.

· BHP is expected to outperform the broader market today, after ending its US session an equivalent of 0.96% higher from Australia’s previous close.

· The December SPI Futures is indicating the ASX 200 to open 11 points higher towards the 5695 area this morning. A quiet session however is expected

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/09/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here