What’s the Next Likely Twist for our Gold Stocks? EVN, NCM, NST, RRL

Yesterday saw another lacklustre day for the local market which only closed down 0.2%, with school holidays clearly having a significant impact on the day to day volumes / interest – the SPI futures which often leads the ASX200 only traded ~50% of the turnover we witnessed during some of the aggressive selling last week. From a stock / sector perspective the only standouts which caught our eye were the diversified financials falling -0.9% while the energy sector rallied 2%. The local market closed only 41-points above its 20-week low but this currently feels a huge 0.7% away following such an entrenched period of sideways almost boring activity.

With the index feeling like rigor mortis has set in we continue to find ourselves looking at the market from a very specific stock / sector perspective, especially with 3 stocks we have been looking to accumulate trading very close to our targeted buy areas i.e. Aristocrat (ALL), Challenger (CGF) and Telstra (TLS).

A quick update of our current thoughts around the major sectors in the ASX200:

- Banks – buy weakness, especially if it coincides with a spike lower by the ASX200 towards the 5500 area.

- Financials – similar to buy the banks, we are buyers of weakness.

- Growth stocks – we are buyers of some into weakness e.g. Aristocrat Leisure (ALL).

- Energy sector – net positive with Santos (STO) our preferred stock closer to $4.

- Supermarkets – no interest.

- Retail – no interest unless we see a panic sell off.

- Healthcare – generally no interest at current levels.

- Resources – currently very cautious and happily on the sidelines – today we will focus on the gold sector.

- Retail stocks – no interest at present.

- The “yield play” – no interest at present.

*Watch for investing alerts*

ASX200 Daily Chart

US Stocks

Last night, the broad based S&P500 closed unchanged with a small bounce in technology stocks unable to awaken the market from its slumber. Perhaps a reaction to Donald Trump’s looming tax proposal will create some interest as further noises around North Korea are clearly falling on deaf ears.

There is no change to our short-term outlook for US stocks, we are targeting a further ~4.5% correction for the tech NASDAQ back towards the 5600 area.

US NASDAQ Weekly Chart

The Australian gold sector

We have focused on the gold sector again today following our decision not to buy Regis Resources (RRL) on Monday as it hit a fresh 4-week low – plenty of questions were forthcoming! Let’s consider the 4 main factors behind this decision:

- We are net bullish gold stocks, but still see a 40% possibility they break under 2016 lows where we would want to be buyers, not very scared longs – see Market Vectors Gold ETF (GDX) Monthly Chart.

- We are already holding 7.5% of the MM Growth Portfolio in Newcrest Mining (NCM) so further additions will be fairly aggressive – we are not scared of this at the correct time.

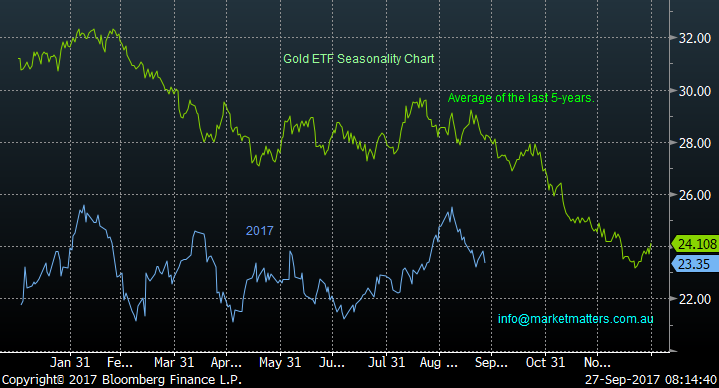

- Seasonally gold stocks usually drift / fall into Christmas, hence in December we are far more likely to pull the trigger.

- We see a small bounce in the $US unfolding similar to last night which is likely to send gold lower – this just unfolded sending gold down $US15/oz. and US gold ETF’s down 2%.

Hence taking into account the above points we have been exercising some restraint with adding to our gold exposure – for now. Importantly if we do press the buy button in the next few days / weeks, it’s likely to only be for a ~3% purchase leaving room to average at lower levels.

The local sector has fallen around 15% in under 4-weeks while gold has fallen under 5%, illustrating how quickly the sector comes in / out of favour and also why we regard it as more of a trading sector – happily one where we have enjoyed some great returns over the last 4-5 years.

Market Vectors Gold ETF (GDX) Monthly Chart

Market Vectors Gold Seasonality Chart

1 Regis Resources (RRL) $3.80

RRL looks very good buying around $3.70 in the short-term, but over the next 2-3 months lower levels would not surprise - potentially a good short-term trade.

Regis Resources (RRL) Weekly Chart

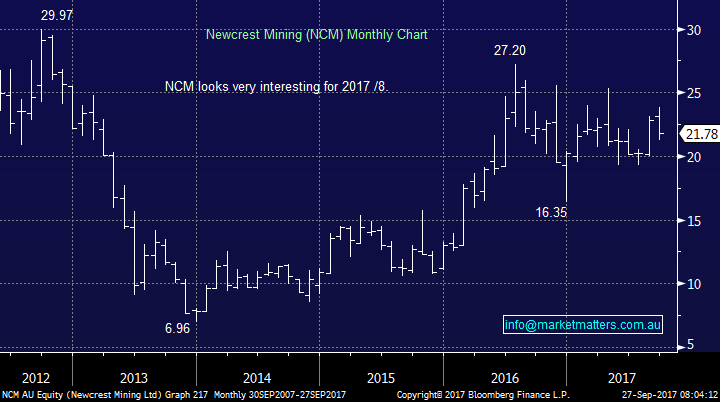

2 Newcrest Mining (NCM) $21.78

NCM looks good longer-term, but for now it remains bound between $16 and $27, we will only consider further additions towards the lower regions i.e. ~$17.

Newcrest Mining (NCM) Monthly Chart

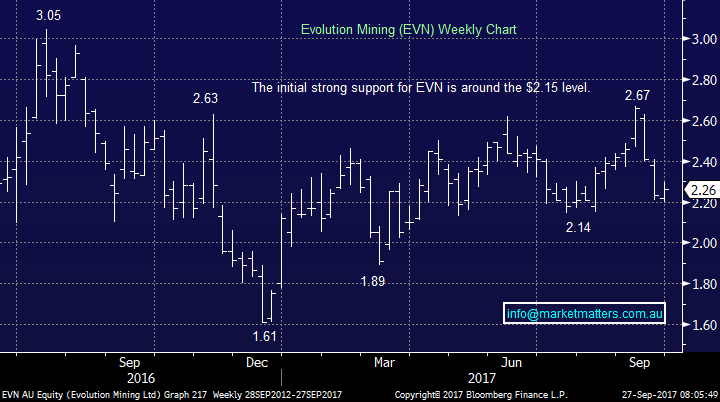

3 Evolution Mining (EVN) $2.26

EVN looks the weakest of the group and copped a downgrade from a major broking house this week – a test of $1.90 would not surprise.

Evolution Mining (EVN) Weekly Chart

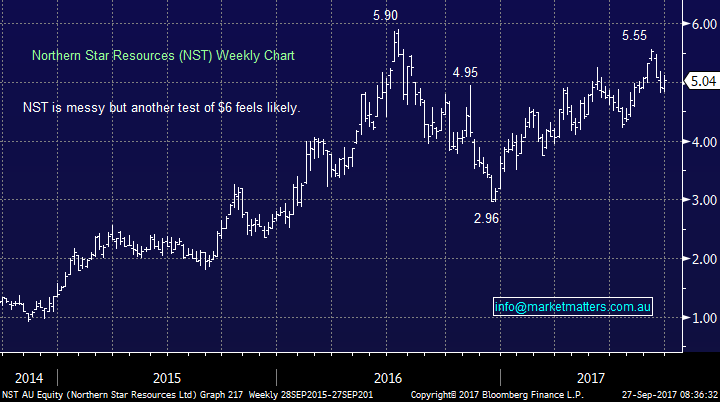

4 Northern Star Resources (NST) $5.04

NST looks good longer-term, but a test of $4.50 would not surprise into December.

Northern Star Resources (NST) Chart

Conclusion (s)

We remain keen to increase our gold exposure into weakness but believe caution is prudent at the current time / levels.

Overnight Market Matters Wrap

· The US lost early gains overnight, only to close with little change after comments from US Fed Chair increased the chances of an interest rate hike next month to 66.6%.

· Gold lost further ground, despite geopolitical tensions at its peak between the US and North Korea.

· Iron Ore rebounded from its recent lows, up 3%, although diversified miner, BHP is expected to underperform the broader market after ending its US session down an equivalent of 0.34% from Australia’s previous close.

· The December SPI Futures is indicating the ASX 200 to open 15 points higher, back towards the 5690 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/09/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here