* No report’s on Monday due to the Labour Day holiday

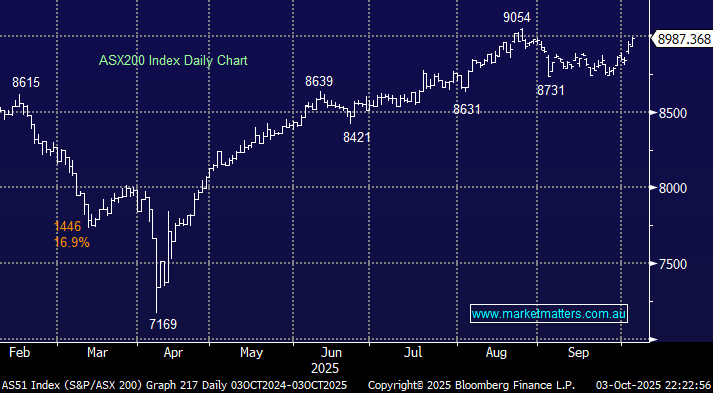

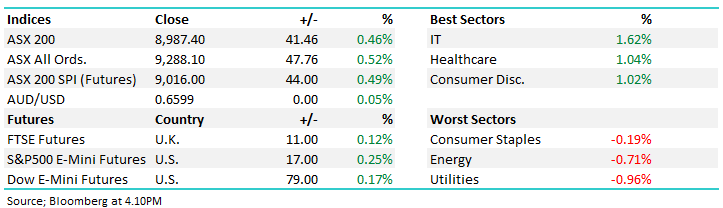

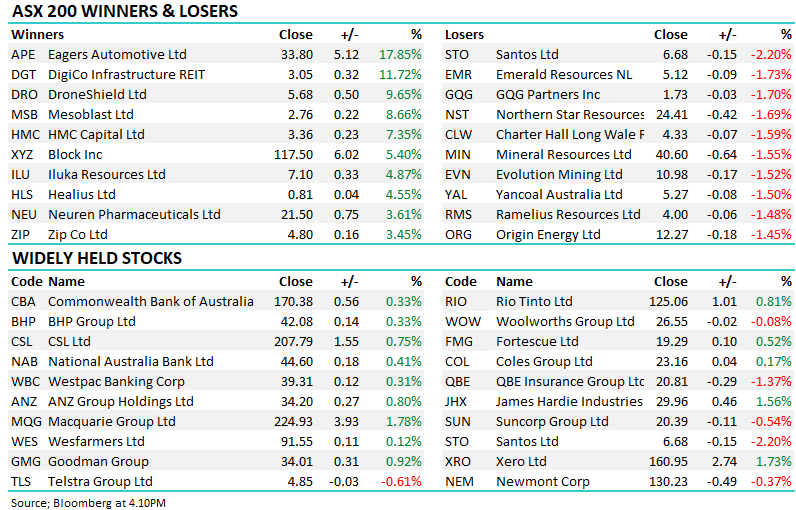

The ASX200 ended last week up +2.3%, with the first three days of October already recouping all of September’s decline. The healthcare sector made a welcome return to the winners’ enclosure, ably supported by the influential miners and banks, while the energy sector was the only meaningful drag on the index. Only a flat week by the heavyweight iron ore miners reined in performance, although their sector peers worked hard to address their slumber, with 18 members of the materials sector closing out the week up more than +5%.

By Friday’s close, the winners’ enclosure was haemorrhaging at the seams while candidates for the losers’ corner were thin on the ground. Defence, copper, gold and rare earths were standouts, although from an index perspective, the “Big Four” banks’ average gain of more than 3% had the greatest impact on the market overall.

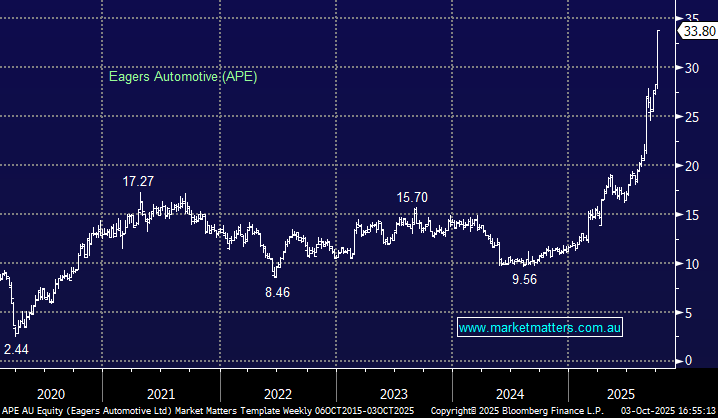

Winners: DroneShield (DRO) +52.3%, APE Eagers (APE) +19.4%, IDP Education (IEL) +15.8%, Austal (ASB) +13.4%, Digico (DGT) +11.3%, Sandfire (SFR) +9.5%, Perpetual (PPT) +8.3%, Iluka (ILU) +7.6%, CSL Ltd (CSL) +7%, and ANZ Bank (ANZ) +4.2%.

Losers: Karoon Energy ()KAR) -8.1%, Boss Energy (BOE) -5.7%, New Hope (NHC) -5.1%, Viva Energy (VEA) -4.3%, WiseTech (WTC) -4.1%, Charter Hall (CLW) -4%, News Corp (NWS) -3.4%, Santos (STO) -3.2%, and NEXTDC (NXT) -3.1%.

It was a week where news flow was dominated by the RBA and the US government shutdown, but neither had an impact on the equities bull market:

- Russia’s drone incursions into Europe on the weekend ignited the defence stocks but had no negative impact on the broad market.

- The RBA left interest rates unchanged on Tuesday while delivering mildly hawkish commentary.

- Mid-week, a halt to BHP’s China-bound iron ore shipments weighed on the “Big Australian”, although it ended the week down less than 2%.

- The ASX has kicked off October with the “look & feel” of strong overseas funds flowing into the large-cap names.

Overseas markets ended the week in mixed fashion, as US big tech took a breather. In Europe, the French CAC advanced +0.3% while the UK FTSE outperformed, closing +0.7% higher. In the US, a bout of selling into the close left the indices mixed, the tech-based NASDAQ retreated 0.4% while the rate-sensitive Russell 2000 small-cap index advanced +0.7%.

- The SPI Futures are calling the ASX200 to open up +0.3% on Monday, which will be thin trade, taking it back above the psychological 9000 level.