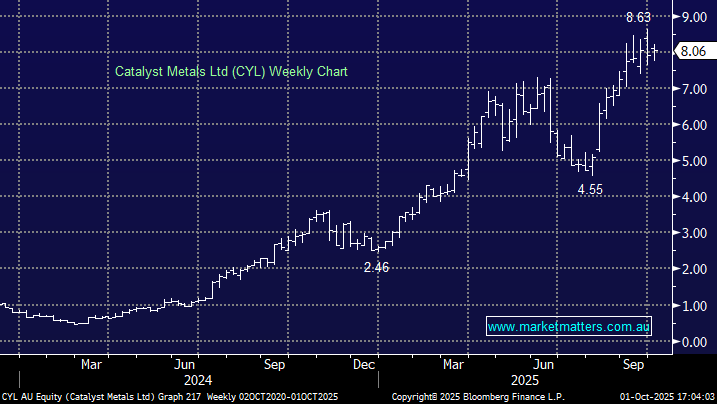

No surprise that a gold stock resides in the top three, although newcomer CYL is a name that some subscribers may not be familiar with, having entered the ASX200 last month. Gold stocks are entering the ASX200 en masse as the precious metal surges toward $US4000. Let’s hope they don’t follow a similar path to lithium stocks over recent years. CYL is a $2bn WA gold miner whose key assets are Plutonic Gold Mine (WA), Henty Gold Mine (Tasmania), and Four Eagles Gold Project (Victoria). The company’s numbers for FY25 were solid, but it’s a miner very much in ramp-up phase with revenue forecast to increase by almost 70% in FY26.

This is one debt-free local gold miner that’s executed well this year, achieving a 12% quarter-on-quarter improvement in production during Q4 FY25, with a 10% reduction in costs (AISC) compared to the previous quarter. The company reported AISC of $A2,317 per ounce, towards the lower end of the $A2,300–2,500 per ounce guidance range, very attractive numbers with gold trading around $A5900/oz. If CYL achieves its goal of doubling annual gold production from around 100,000 ounces to 200,000 ounces, the company will look good value at around $8.

- We like CYL, but its next 12 months will be determined by the volatile gold price; any dips towards $7.50 look good value on current numbers.