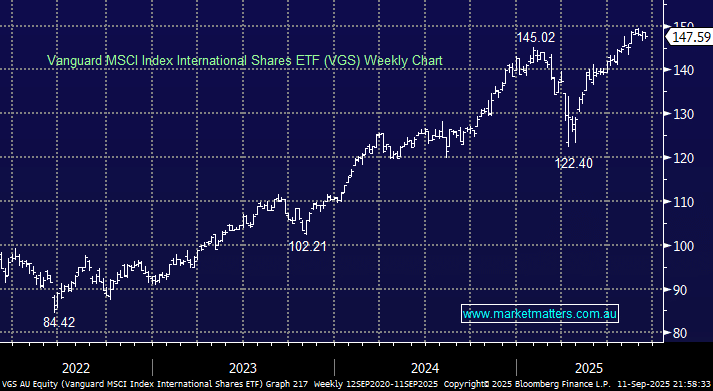

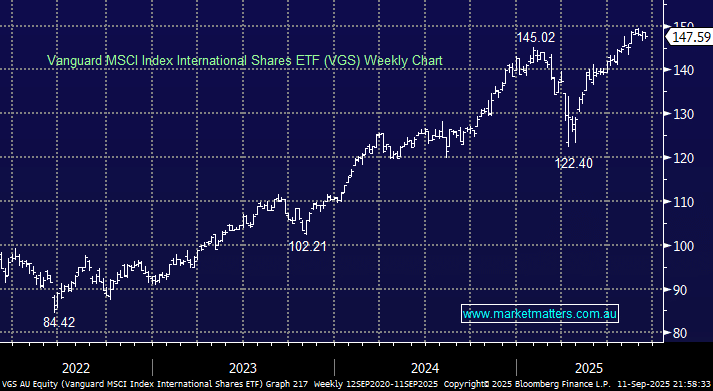

We like global equities into Christmas as we’ve discussed through 2025, again there are a number of ASX-traded ETFs available but our favourite is the Vanguard VGS which is the largest at $12.7bn and has a low 0.18% cost – note its not hedged to FX moves.

- The VGS ETF is tech, around 30%, and US-dominated, but it delivers a global flavour; it currently holds 71% in the US, 5.3% in Japan, 3.6% in the UK, 3.2% in Canada, and 2.6% in France.

- The ETF tracks its benchmark, the MSCI World ex-Australia Index in $A, very well: Over the last three years, it has gained +20%, while its benchmark is up +19.4%.

The global market has run strongly, and valuations are elevated, but with rates set to fall and the AI Trade going from strength to strength, we continue to like the VGS ETF.

- We like the VGS as we approach 2026: we own it in the MM Core ETF Portfolio.