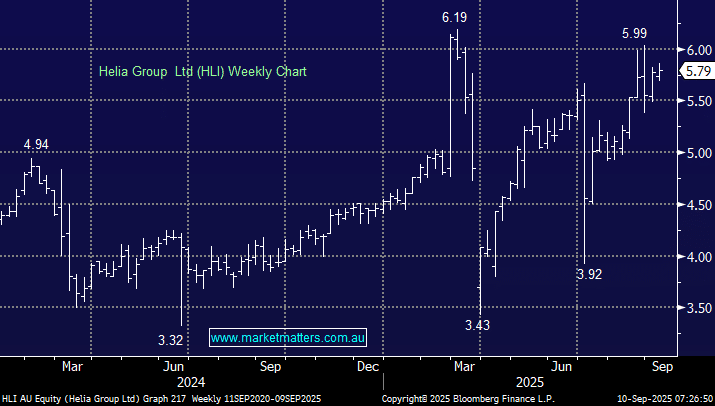

HLI has been a good position in the Income Portfolio over a short time frame, having only entered the stock in July after a sharp ~26% fall on news it lost the ING mortgage insurance contract – the second major lender to walk in short succession after CBA earlier in the year. Our thesis was that capital returns would cushion the earnings blow, and the market would ultimately look through the noise and focus on the potential for big dividends and buy-backs, and that thesis has largely played out. The share price has recovered well, with the position up over 40% from our entry point. However, from here, we think the risk/reward has flipped – and we’re now leaning towards taking profit and exiting the position.

While capital returns remain a core part of the story (~$2.20/sh of potential returns still valid), the back book continues to run off, and the core business is shrinking materially – CBA and ING accounted for ~60% of gross written premium. Macquarie recently downgraded HLI to underperform with a $4.10 price target, highlighting the ongoing structural pressures.

No new CEO has been announced yet, after CEO and Managing Director Pauline Blight‑Johnston announced she would step down after more than five years in the role. CFO Michael Cant has been in the job on an interim basis since 1 July. The business is clearly in transition mode, both operationally and strategically, and while we thought the initial knee-jerk reaction in the share price was excessive, the stock has now rallied sharply into what is a much murkier outlook.

HLI has served its purpose in the Income Portfolio – we stepped in during a dislocation, captured the re-rate, and picked up a 16c partially franked dividend, plus a 27c partially franked special dividend, worth a combined 50c equating a 10% yield on our entry price, in a little over 2-months.

- With the share price now back near pre-ING loss levels, we think more caution should now be applied.