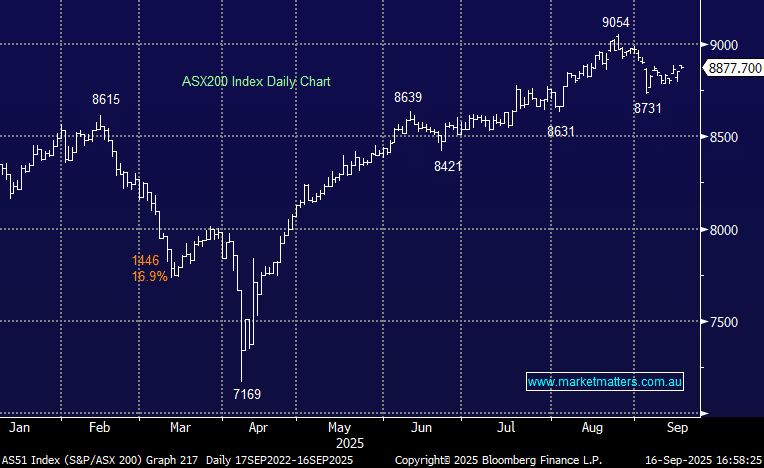

Rate-sensitive tech stocks have wobbled recently, both in Australia and the US, as the “AI trade” has experienced some profit-taking since Nvidia’s result last month – the S&P’s largest stock has slipped more than 9% in recent sessions. The local tech sector is now only up +2.6% year-to-date, underperforming the index, which has advanced over +7%. The often-volatile local group has struggled since the reporting season, with some standout declines over the last week, including Macquarie Technology (MAQ) -12%, Megaport (MP1) -9.3%, Xero (XRO) -8.2%, and WiseTech Global (WTC) -7.1%.

However, it’s not all about bonds and interest rates. With the tech sector at the pointy end of the “risk-on” trade, and in recent sessions, as investors became more defensive, this is where a lot of the profit-taking/selling was focused. If we are correct, the bull market isn’t finished; it’s just taking a well-deserved rest and will take another leg higher into Christmas. Hence, today, we’ve focused on where and how MM is looking to increase our risk/tech exposure over the coming weeks.

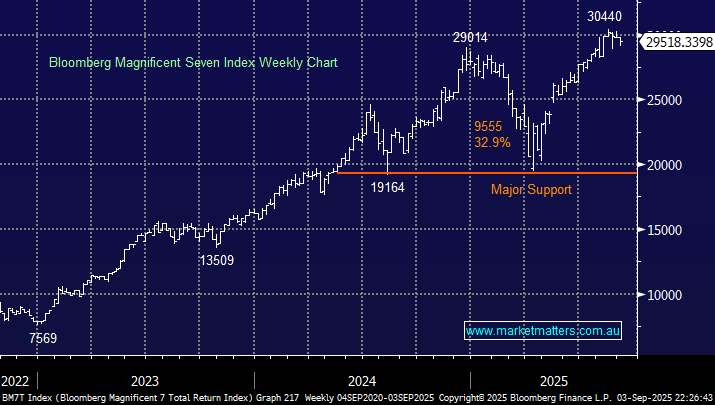

- We like the risk/reward towards the Magnificent Seven in the 28,500 area, or ~3% lower.

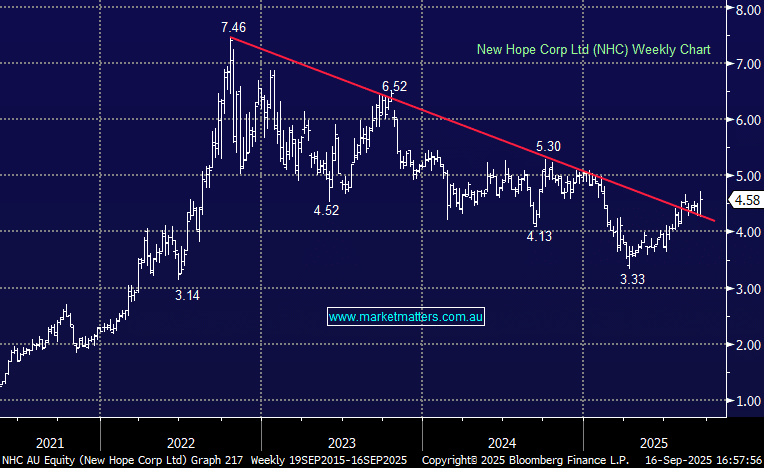

Three stocks we are considering averaging/buying in the coming weeks are covered below. There’s a time for research and a time for action, with the latter close at hand. Hence, today’s report is all about clear and concise levels where we are looking to buy.