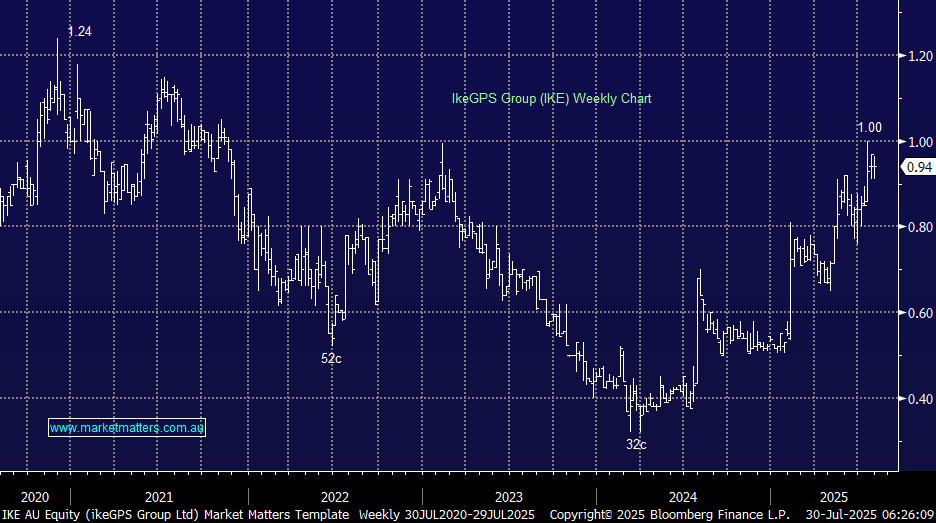

IKE is a niche, high‑growth software business focused on the North American utility and communications infrastructure market. Its main solution is a platform called PoleForeman, which is used to design, manage, and maintain power pole and communications networks, helping utilities and telecom companies digitise their field operations. They recently raised $18m via a placement at 81c and have a Share Purchase Plan (SPP) currently in play (ending 7th August) to raise another $2m, with Shaw and Partners & Unified Capital acting as joint lead managers (paid a 5% fee for doing so!)

This means IKE is fully funded and now in a good position financially to underpin its next level of growth. While this is a small company (micro-cap) valued at ~$180m, it does have a solid and growing user base of primarily utilities and telecommunications companies that pay an ongoing subscription fee, with the amount linked to how many users (seats) they have. They use the platform for things like determining whether existing poles can handle additional equipment, plan and design upgrades or new deployments of power and telecom networks, modelling capacity, spacing, and alignment for efficient network expansion, or to automatically generate reports to meet local safety and compliance requirements.

- At a high level, the macro driver is the progressive upgrades and expansion of the North American power grid and telco networks, as we gear up for a future where the energy transition meets exploding demand for data transmission.

The PoleForman product is the key, as pole loading and clearance analysis generally requires field engineers with specialised skills, which leads to slow turnaround and high costs. PoleForeman digitises and automates the workflow, reducing labour, errors, and permitting delays, while it also acts as the entry point onto the platform where broader services are offered. This is the key difference between a product seller and a platform creator i.e. all the tech companies want to be a platform, and for good reason.

It’s important to note that IKE is not cash flow positive; they burnt $1.5m last quarter, and they don’t forecast earnings (EBITDA) breakeven until the 2H26. This also relies on subscription growth of ~37% YoY, accelerating from the +28% they just reported, which management indicated is achievable based on the current pipeline and early July trading.This is an interesting (new) company to MM and one worth highlighting to members with a high risk tolerance. They generated revenue of NZ$25.2m in FY25, and this is tipped to be above $NZ30m in FY26. It has strong growth momentum, supportive industry tailwinds, and a solid balance sheet, now with around $30m in cash. NB: Liquidity is low here.