The ARKK Innovation ETF is an actively managed fund run by high-profile Cathie Wood. This is one of the most well-known/famous active ETFs in the world, garnering attention for phenomenal gains, but also huge draw downs. In 2021 the ETF fell 24%, then lost 67% in 2022, showing this is not for the faint hearted.

- Longer-term performance; 0.23% pa for 5-years, 13.75% for 10-years and 13.52% since inception – the risk adjusted return profile is quite poor.

ARKK say they are all about targeting long term capital growth, investing in companies at the forefront of disruptive innovation, such as AI, robotics, energy storage, blockchain and genomics. Cathie Wood is a massive Tesla/Elon fan and backer, and this is shown through a 9.8% holding in Tesla – the fund’s biggest investment (which was down 8% overnight), Coinbase 7.6%, Roku Inc 6.6%, CRISPR Therapeutics 6.5%, and ROBLOX 6.1%. This should be thought of a higher beta actively managed fund, packaged up as an ETF.

- The ARKK ETF has a sensible costs structure of 0.75% given the type of portfolio & strategy.

This is very much at the pointy end of innovation, and if it maintains an active approach in the rapidly evolving world, and gets its big picture trends right, then it should perform well. However, this relies on Cathie Wood and her team picking such trends, and our primary concern with this fund is that Cathie seems to have so much conviction in here views, and defends them so aggressively, by the time she is proven wrong (which will happen in some areas), it will already be too late.

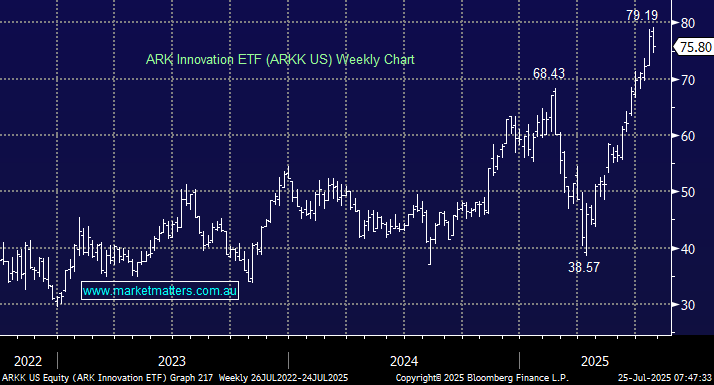

Short term, ARKK looks set to follow the MM roadmap into Christmas, posting new highs in the months ahead, but this is a highly volatile investment, and should be considered high risk.