ARU is a relatively small $480mn stock that is the critical minerals company behind the Nolans Project, a fully integrated “ore-to-oxide” rare earth operation focused on neodymium and praseodymium (NdPr), essential for magnets used in EVs, wind turbines, electronics, and defence. The company is aiming to start production in the early 2030s, but it is well funded for the journey, having secured over US$1.1 billion in debt and equity commitments from Germany, Canada and the Australian Government. Lots of water to go under the bridge here before the company starts to enjoy rare earth revenue, hence the speculative nature of the stock.

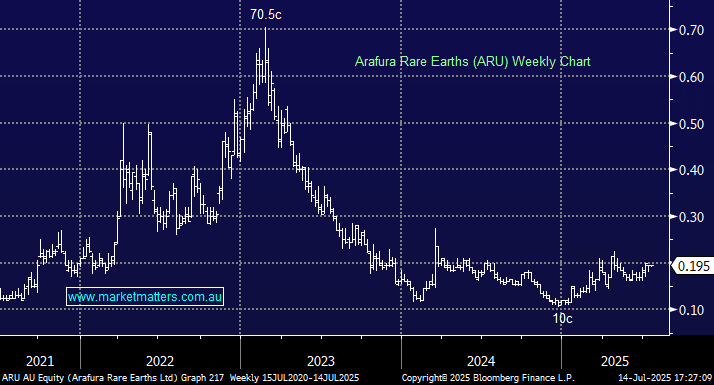

- We like ARU for a “specie” move up towards 30c, but it’s likely to be largely driven by sentiment around rare earths.