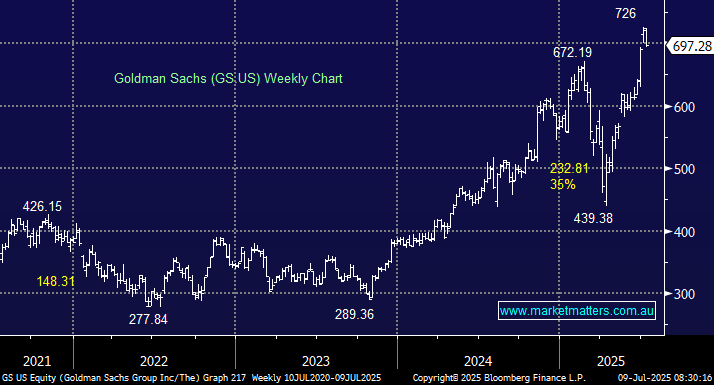

Commonwealth Bank (CBA) is not the only financial institution trading on a valuation well above its historical norm. Goldman Sachs now trades at a 44% premium to its usual book value, and nearly 30% premium to its usual PE valuation. While uncommon, it’s not without precedent. GS has traded in a broad valuation range since listing in 1999 – on its first trading day, it actually finished up over 40%, which equated to 5x book value at the time. Book value is the total of all assets minus all liabilities, or in other words, total shareholder equity. GS is currently trading on 2x book, relative to its 5-year average of 1.4x and for context, CBA now trades on 4x book, which is an all-time high valuation, comfortably surpassing the 3.3x it reached just prior to the GFC.

- These big swings in valuation are a consequence of changes in the market, potential/forecasted profitability, and, importantly, investor sentiment. At MM, we start to get uncomfortable when a stock trades at such a material premium to what’s played out in recent history. It prompts us to pause and really think about what’s playing out, the potential reasons for it, and especially what could be the next catalyst for the share price to keep the run going.

Unlike some technology companies, biotech’s and others that can drive incredible earnings growth from a product or breakthrough, banks are not typically that sexy. They are big volume businesses, so efficiency benefits can have a meaningful impact on earnings (think AI driven productivity), they are heavily regulated, implying less regulation (such as around regulatory capital as we’re seeing in the US now) is positive, and they are influenced by macro trends, particularly around borrowing costs, benefitting from higher long term interest rates relative to short term interest rates, commonly known as a steepening yield curve (they borrow short via deposits and lend long via mortgages). These are clearly tailwinds for the global banking sector right now, and they’re driving valuations to levels we’ve not seen for a long time, and in some cases, ever.

- The last point around a steepening yield curve is the reason that Texas-based Fisher Investments spent $1bn buying CBA – it was all down to a steepening yield curve, and CBA being the most liquid way to play it.

Distilling this down, in the context of Goldman Sachs, which we own in the International Equities Portfolio, and banking more broadly, we think it’s very clear that banks have a strong wind at their backs. If CBA has taught us anything in 2025, it’s that positive tailwinds can push valuations well above where you and I believe they should be, but fighting the trend using valuation as the only argument is fraught with danger. Goldman’s is on 15x earnings and looking rich, but it’s not extended to the point where we are prepared to fight the tape entirely – CBA on 30x was!