Interestingly, Americans who once snapped up gold bars and coins are selling. At the same time, their Asian counterparts show no letup in buying, a sign investors on opposite sides of the world have different outlooks on the global economy. The divergence suggests that US residents who stash bars and coins at home or in safe deposit boxes are more comfortable with US President Donald Trump’s tariffs, rising government debt, and geopolitical tensions, or they want to grab some big profits after the last few years’ advance. However, wealthier investors, sovereign funds and central banks continue to buy the haven asset aggressively.

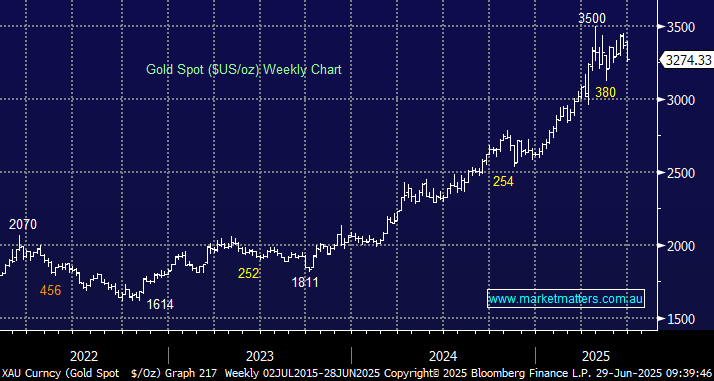

Friday night saw this selling by US “mums and dads” vindicated in the short term as gold fell by around $US60, positing fresh June lows in the process. Our preferred scenario is that the precious metal extends its downside move towards $US3100 as the washout of the crowded positioning continues. However, it’s important to reiterate that MM will be looking to increase our exposure to the sector if such a move unfolds.

- We can see gold testing the $US3100 area in the coming weeks/months.