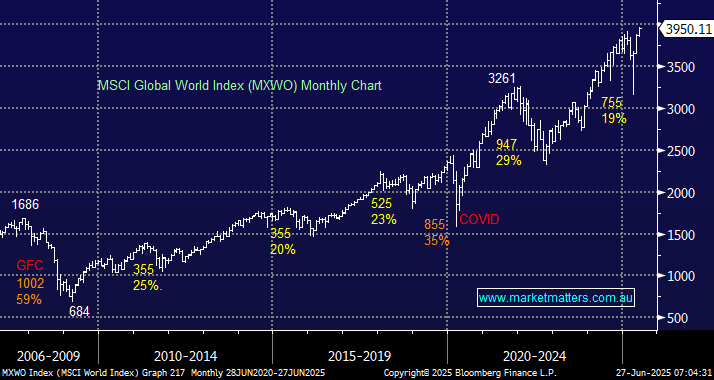

As global equities breakout to fresh all-time highs just a few months after their deep sell-off around Trump’s “Liberation Day”, we consider how to add value through the second half of 2025. Firstly, buying leveraged ETF’s at all-time highs is not what we’re suggesting, and we believe that an opportunity like the deep-seated value “screaming buy” of April will not be on offer; instead, it’s going to be more of a three steps forward, two back advance, posting new highs, affording shorter, sharper buys for nimble active investors/traders. With six months left until Christmas, we would be surprised if the market provides more than two decent risk/reward opportunities for the bulls as the index squeezes higher.

- Leveraged ETFs are one vehicle active Investors or traders can use to take advantage of quick 5-8% equity market rallies in the coming months.

This morning, we’ve examined three ASX-traded and two US listed ETFs to gain leveraged exposure to rising stock markets. Before considering these vehicles, currency-hedged or unhedged, there are a few factors to understand. Leveraged ETFs aim to deliver 2x or 3x the daily return of an index. But they reset daily, and that’s the key problem:

- Over time, due to compounding, the ETF loses value even though the index hasn’t.

- When the underlying index goes up and down significantly, the leveraged ETF’s daily gains and losses don’t perfectly offset. Over time, this drag from volatility reduces returns.

- Daily rebalancing to maintain target leverage adds trading and funding costs, which eat into returns.

The simple conclusion is that Leveraged ETFs are designed to take advantage of short-term swings in markets, but we’re less keen on their structure for long-term investing.