This $US210bn California- based company is XRO’s big rival which recently powered to new highs after beating expectations with its 3Q earnings, revenue of $7.75 billion, marked a 15% year-over-year increase, plus the company increased its full-year revenue forecast to between $18.72 billion and $18.76 billion, up from the previous range of $18.16 billion to $18.35 billion. Adjusted earnings (EPS) guidance was also raised to between $20.07 and $20.12 – what’s not to like about quarterly beats and upgrades!

INTU has been enhancing its products with AI capabilities, such as “Intuit Assist,” an AI assistant integrated into TurboTax, QuickBooks, and Mailchimp, designed to automate tasks and enhance the user experience. Additionally, collaborations, such as the one with Google Cloud’s Document AI and Gemini, have bolstered Intuit’s AI offerings, contributing to increased investor confidence that they remain at the forefront.

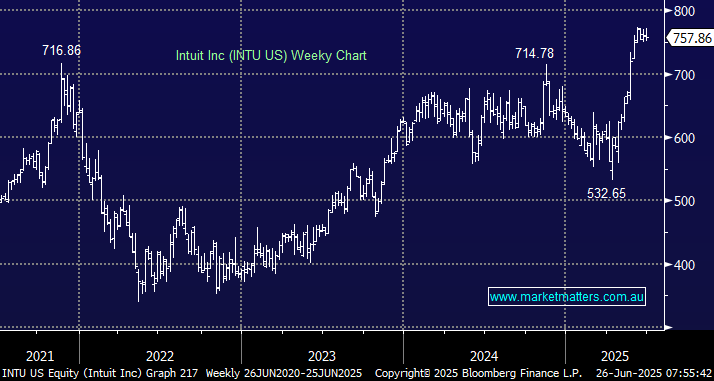

- We can see INTU trading towards $US800 as it delivers operationally in a strong equity market, tough competition for XRO.