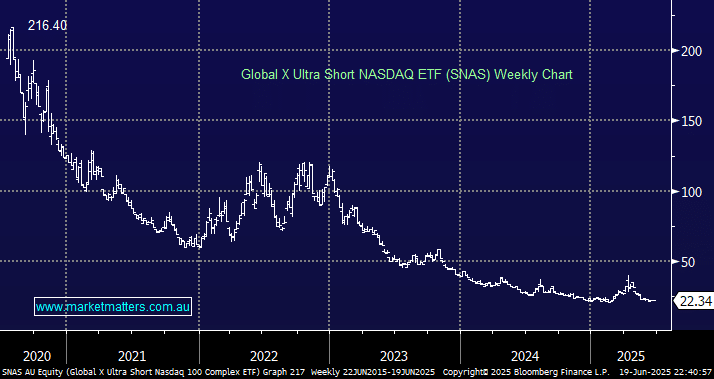

The SNAS ETF looks to provide investors with a 2x leveraged inverse return on the tech-based NASDAQ 100 with fees of 1%. We believe the tracking has been “ok” with this currency-hedged ETF, over the last 3-years, the NASDAQ has advanced 28% while the SNAS ETF has declined almost 43%, not perfect but certainly in the correct direction! When the NASDAQ plunged ~26% around Liberation Day, the SNAS spiked up over 90%. Still, the tracking was based on the futures market, which continued to fall after the NASDAQ stocks had closed – a crucial point: while liquid, in line with the futures market, this position can only be traded when US stocks are closed (i.e. during Australian hours) – often when extremes occur.

- We believe it’s too early to consider the SNAS, again, it may be an option at some stage through 2025/6.