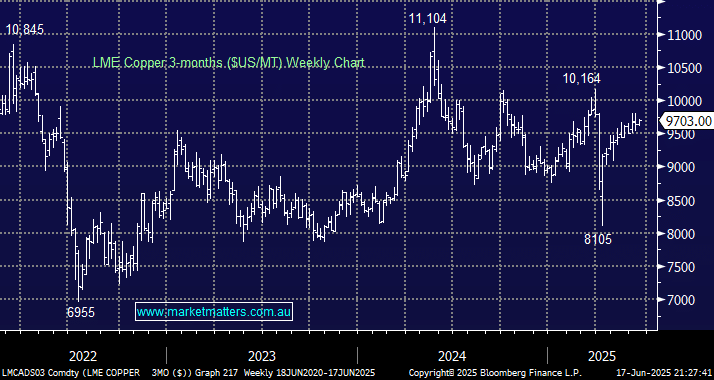

Copper (Cu) buyers are facing a major squeeze on the London Metal Exchange (LME), with the price of spot contracts spiking as traders compete to get hold of the dwindling volume of metal in the exchange’s warehousing network. Contracts expiring in one day just traded at the largest premium since a historic supply squeeze in 2021. The spike in spot contracts, known as a backwardation, is a sign that there isn’t enough metal in exchange warehouses to meet traders’ needs. It follows the dramatic 80% drop in readily available LME stockpiles this year. Cu’s advance has been orderly in recent weeks, but we believe a squeeze could be in the offing.

Fears that President Donald Trump will soon impose tariffs on Cu are driving the disconnect, with mid-July the touted timing for the tariffs, with 25% the favoured number by many.

- We continue to believe it’s a matter of when, not if, Cu breaks above $US10,000/MT.