Oil surged the most in more than three years after Israel carried out airstrikes against Iran, raising fears of a wider war in a region that accounts for a third of global crude production. After surrendering some of the early gains, crude futures still closed over 7% higher, the biggest one-day jump since March 2022. Not wanting to be out of the news, US President Donald Trump urged Tehran to make a deal “before it is too late,” in a post on Truth Social.

Israel temporarily knocked out a natural gas processing facility linked to the giant South Pars field, Iran’s biggest, in an attack on Saturday, and targeted fuel storage tanks during strikes as part of its campaign against Tehran’s nuclear program. While the attack was concentrated on the Islamic Republic’s domestic energy system rather than exports to international markets, traders are likely to become increasingly nervous about what comes next. Sceptics among us would say this is reminiscent of Iraq’s weapons of mass destruction, and we note that the conflict heralded a significant stock market low although stocks had fallen into the invasion.

Iran exports around 1.7mbd of oil (with ~500m of spare capacity, should sanctions be lifted) or ~1.6% of global supply. As yet there are no press reports of actual oil production being hit or targeted and as we’ve written numerous times, President Trump wants a lower oil price, At this stage, OPEC has around 6mbd of stated spare capacity which leaves some wiggle room. One escalation scenario would be potential disruption to the Straits of Hormuz through which 22% of global oil is shipped. However, it’s worth noting that Iran exports nearly all of its oil through the Straits of Hormuz and any disruption could potentially impact the exports of other countries such as Qatar.

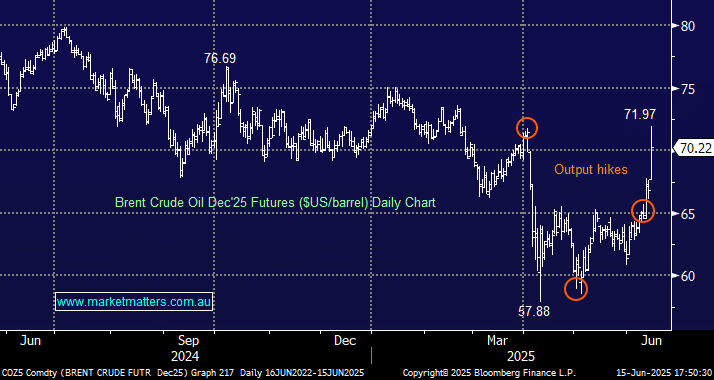

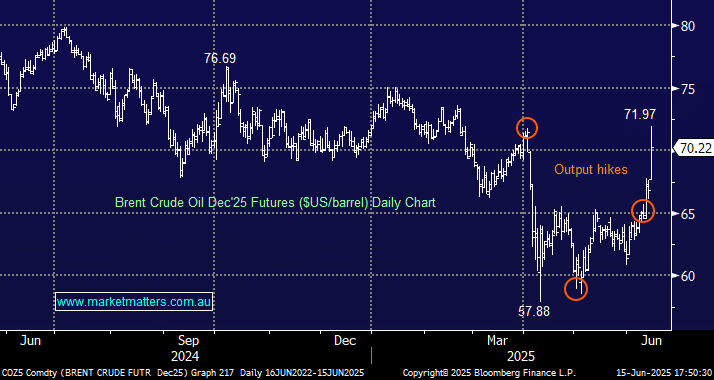

- Oil was gaining strength in the face of bad news; now it has a meaningful tailwind that looks capable of pushing it another 5-10% higher.