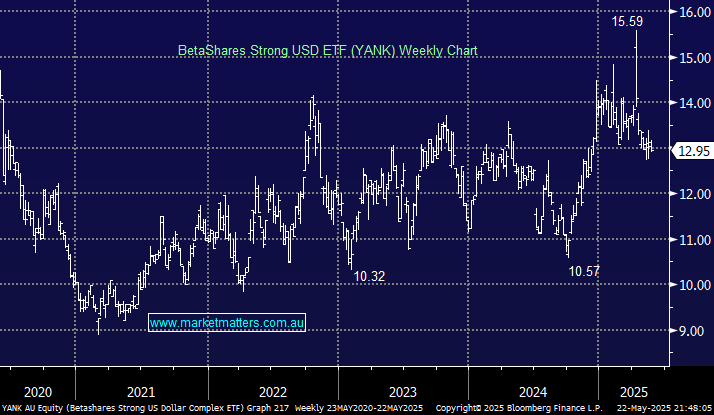

The aptly named YANK ETF is also traded on the ASX, it is effectively the opposite to the AUDS looking to track the $US against the Aussie, i.e. it rallies when the $A falls against the Greenback – not our preferred scenario over the coming years. The YANK ETF offers ~2x leverage on the $A while charging a 1.38% expense ratio, which is not too bad considering the assets being controlled. Hence, if the $US rallies by 2% against the $A, the YANK ETF will increase by ~4%.

- We are bearish on the $US through 2025/6, targeting the 70c area, which should see the YANK trade down towards the $11 area.