The SLF ETF aims to track the ASX200’s Property Trust Index. Of the twenty-two stocks held, the largest five holdings are Goodman Group (GMG) 38.1%, Scentre Group (SCG) 11.2%, Stockland (SGP) 7.9%, GPT (GPT) 5.4%, and Vicinity Group (VCX) 5.4%. This ETF has yielded 2.7%, with small franking, while its performance has been solid, largely running in line with GMG over recent years.

- The QFN ETF has a relatively small 0.16% expense ratio, but again, if account size allowed, we would be more inclined to buy an individual spread of ASX property stocks, considering its huge dependency on GMG – unless you’re very bullish on GMG!

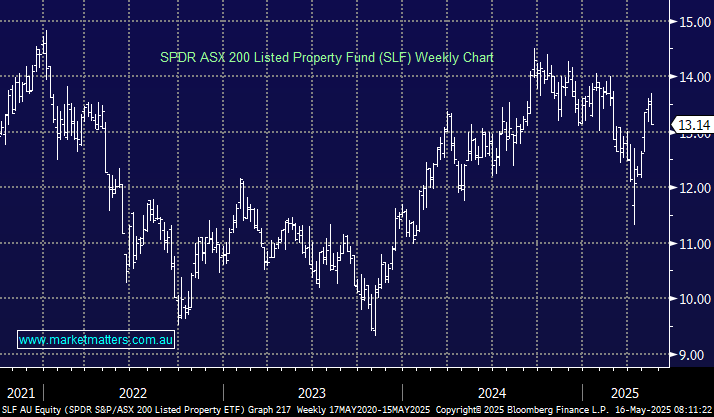

The SLF also looks set to follow the MM roadmap into Christmas, testing/breaking its 2024 high, but the RBA needs to become dovish to see outperformance.

- We are mildly bullish on the SLF ETF, initially targeting a break of its 2024 high, around 10% higher.

Further information on the ETF can be found in the Fact Sheet Here