New 2017 highs for the ASX200 as the “shorts” get squeezed. (IGO, CYB, TLS)

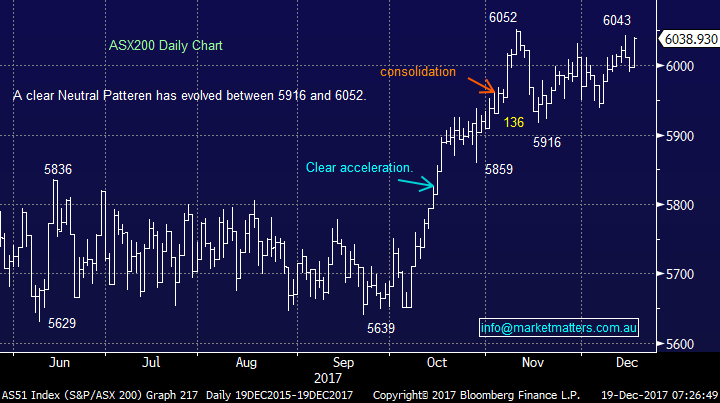

The ASX200 enjoyed a classic December day yesterday rallying 42-points / 0.7% to challenge the year’s high of 6052. This morning following another strong night on Wall Street the market is looking to open around the 6060 level finally reaching a fresh 2017 high as it follows our anticipated short-term path for December / January.

Investors / traders should not underestimate the capabilities of local stocks over the next few weeks, if we purely play some catch-up with US stocks it would be a decent move i.e. this December the ASX200 is up +1.2% compared to the Dow +2.1%.

The takeover offer by Oracle for Aconex (ACX) set the positive tone locally yesterday, especially with over 10% of ACX’s stock sold short, we again question whether some other heavily shorted stocks may find some love as the hedge fund managers lick their wounds – as we often say the market often moves in the path of most pain for all players!

Overall there is no change to the view of MM with a 6125-6150 target area to say goodbye to 2017, just under 2% above yesterdays close and what would be a healthy +8.1% return for the year not including dividends.

Today we are going to focus on 3 stocks in the Growth Portfolio we are considering selling, including one which is heavily shorted.

ASX200 Daily Chart

Three stocks we are considering selling

1 Independence Group (IGO) $4.34

Gold and Nickel company IGO has had a roller-coaster year including 3 decent corrections since May alone of 18.1%, 18% and 14.7%, plus a major fall of 43.2% from late 2016. Only the most blinkered investor would fail to acknowledge that IGO is a volatile stock that is in the active / trading basket.

Also, IGO is the second most shorted stock on the ASX with a huge 18.8% of its stock short-sold. It’s hard to imagine this number growing whereas just a little covering could easily see a pop higher.

MM is considering taking profit on our IGO if we see strength over $4.63.

Independence Group (IGO) Daily Chart

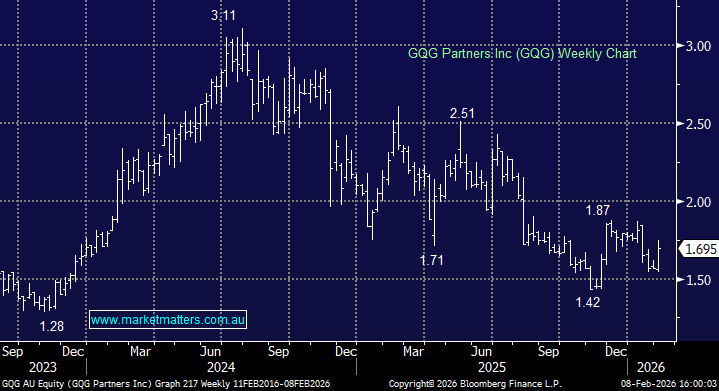

2 CYBG Plc (CYB) $5.76

CYB has rallied strongly this financial year gaining ~22% and looking after MM very nicely in the process.

We are currently long from $5.45 and can easily picture the stock receive a nice push towards $6 if we get some classic end of year window dressing. The stock is no longer the hidden gem it once was now being on a number of analysts top lists for 2018, hence we believe it’s time to be a touch fussier.

MM will consider taking profit on our CYB around the $6 area.

CYBG Plc (CYB) Weekly Chart

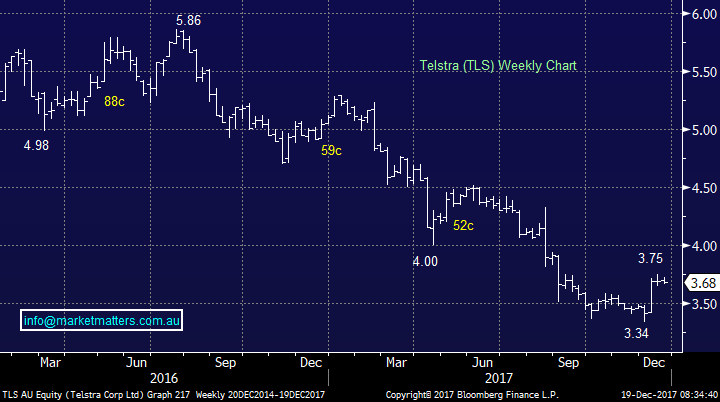

3 Telstra (TLS) $3.68

We have flagged our thoughts on TLS for a while but it’s important to keep them firmly in mind as we may find ourselves acting in coming weeks.

- We are currently sellers of TLS above $3.85.

- We may increase our position under $3.30.

MM simply believes TLS is now an active investment vehicle that will more than likely provide a few excellent opportunities per year to pick up its two 11c fully franked dividends.

Telstra (TLS) Weekly Chart

Global markets

US Stocks

US stocks continue to advance on optimism around the Republican tax bill. Just Imagine if we get the ~$US3 trillion sitting offshore returning to the US the degree of corporate activity, rising dividends and company buybacks that will potentially be unleashed.

No change, we still need a ~5% correction to provide a decent risk / reward buying opportunity, no sell signals have been generated to-date.

The feeling is traders are going short and then getting caught as the market fails to correct.

The current strong rally since Donald Trump’s election adds to our confidence with buying a decent ~5% pullback.

US S&P500 Weekly Chart

European Stocks

European stocks look to be failing after their recent break out to fresh 2017 highs, we remain neutral / negative Europe over the next few weeks.

German DAX Weekly Chart

Conclusion (s)

We remain short-term bullish the ASX200 and hence are continuing to refine our plans to increase cash levels into any unfolding market strength.

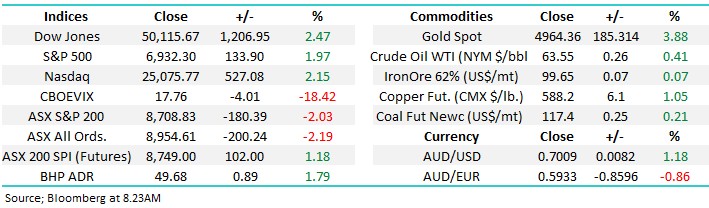

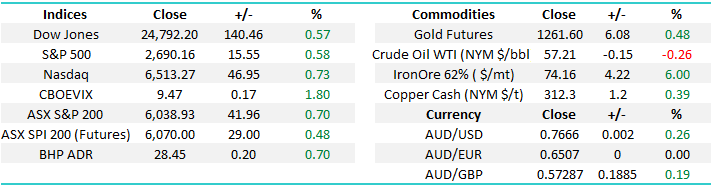

Overnight Market Matters Wrap

· The US equity markets hit an all-time high overnight with the Christmas rally mode clearly on.

· Continued progress with the US tax bill once again underpinned the positive tone in the US with European markets also joining the bull run with the German DAX leading the way rising 1.6% back towards its recent highs.

· The commodity market remained buoyant, with strong demand for iron ore boosting the price another 3.5% to over US$74/t lifting most of the industrial metals which led to BHP in the US closing an equivalent of 0.7% higher to $28.45 from Australia’s previous close.

· US Treasuries lost ground, with the 10 year bond yields back around 2.4%. The A$ is slightly firmer at around US76.7c.

· The December SPI Futures is indicating the ASX 200 to open 30 points higher towards the 5740 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/12/2017. 8.00 AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here