Electrical appliance manufacturer BRG has struggled in 2025, falling over 37% from its January high. There are two significant reasons for this year’s underperformance:

- BRG manufactures most of its products in China, exposing it significantly to escalations in the US-China tariff war.

- BRG generated almost 50% of its revenue from the Americas in 2024, a region with mounting economic risks.

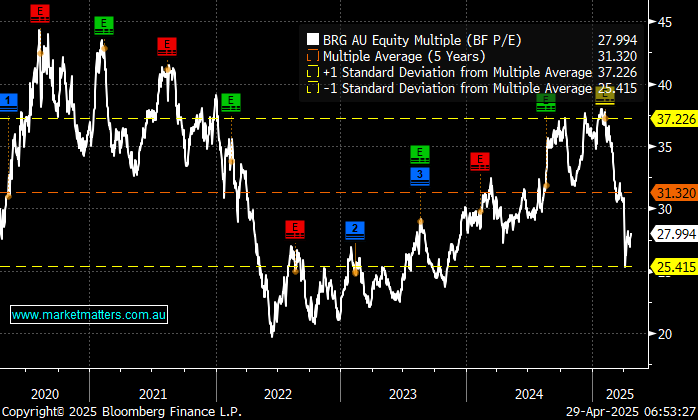

However, BRG reported well in February, attributing the recent share price weakness to the risks around tariffs and waning economic strength, but with the stock trading more than 10% “cheap” compared to recent years, the risk/reward has improved and is slowly becoming interesting.

The risks to the global economy are very real and BRG is at the pointy end of things, but it’s slowly being priced accordingly. This is a good business that will look attractive in the event of further weakness or if we see a rapid resolution to the US-China trade war/embargo.

- We feel the current valuation of BRG is about right considering the looming risks, though another foray toward $24 would pique our interest.