Trade ideas are provided as a guide only. Market Matters is not investing in these ideas as we do our other suite of portfolios available here. If trades are updated through the week, these updates will be advised in the morning note and will be flagged as an alert on the home page of the website. Separate emails or SMS messages will not be sent for Shawns Trade Ideas. The ideas are General in nature only.

- Existing positions and past trades can be found on the MM website.

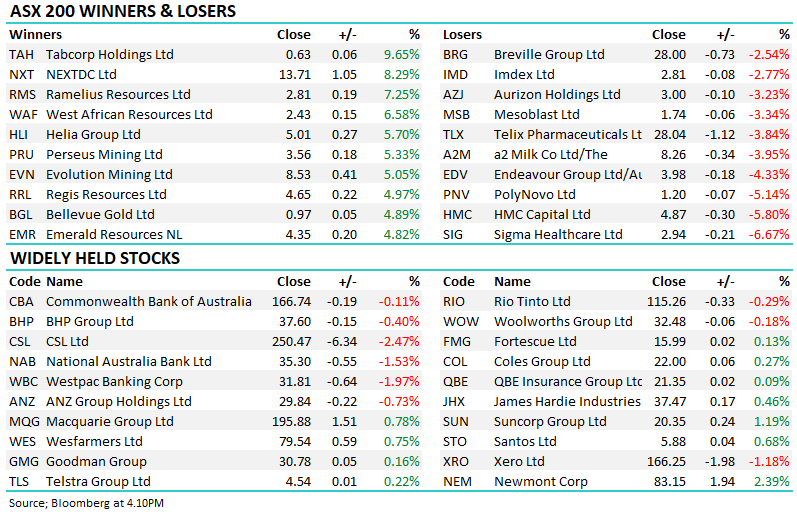

We are holding two equity positions, although they are very different to the traditional S&P500 and ASX200 single-stock ideas:

- We are long the iShares Large-Cap China ETF (IZZ) at $50, with stops to $48 – Chinese equities.

- We are long the BetaShares Quality ETF (IIND) at 11.60 with stops at $11 – Indian equities.

This morning, we are looking to venture into a more traditional domain.

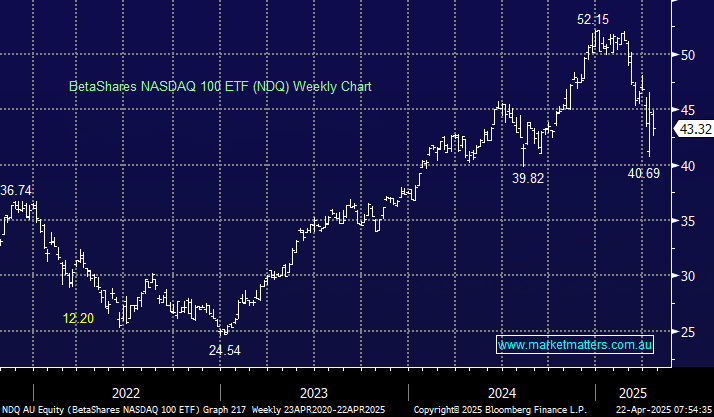

As discussed above, MM likes the US tech into the current sharp sell-off, believing the risk/reward has swung in the bulls’ favour. I am now looking for at least a 10% bounce after the recent 25% correction.

- I believe the US tech sector will trade higher in the next few months and at Christmas, aligning with MM’s overall view.