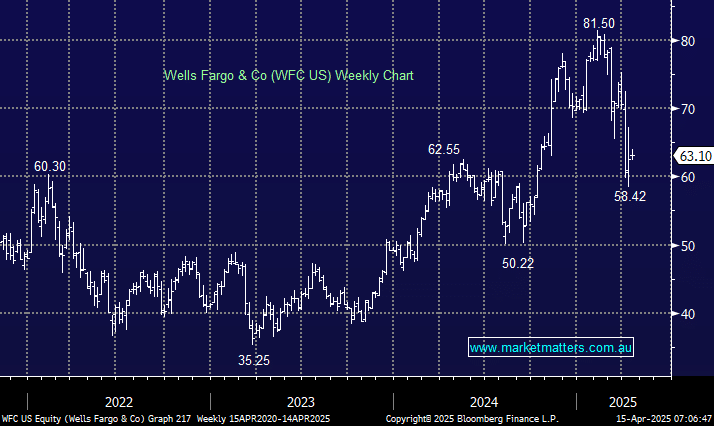

WFC shares declined on Friday after the bank reported lower-than-expected quarterly revenue and a decline in net interest income, the key measure of what a bank makes on loans.

- Revenue fell 3% to $20.15 billion, an almost 3% miss to expectations.

- Net interest income fell 6% year over year to $11.50 billion.

- WFC also bought back 44.5 million of its own shares, worth $3.5 billion, in the first quarter, good timing!

CEO Charlie Scharf delivered a similar message to Jamie Dimon, highlighting the economic uncertainty caused by the Trump administration’s actions to restructure global trade.