There is a growing consensus that the office market has turned. In the past 6 months, we’ve checked in with key industry players, Dexus, Charter Hall, Mirvac, JLL, Cushman & Wakefield and others, and there is a belief the Australian office market demonstrated real signs of recovery throughout 2024 and that 2025 will see ongoing improvement in both leasing volumes and capital markets activity. Dexus stated in their February results, “Markets move in cycles, and we are now reaching a turning point for real asset markets.” Longer-term trends remain sound with demand underpinned by strong population growth.” A company will always ‘talk their own book’, however, a trend we keep a handle on is incentives, i.e. discounts given to get tenants, and these were lower on average for the 6 months to December 2024 vs the prior 6 months.

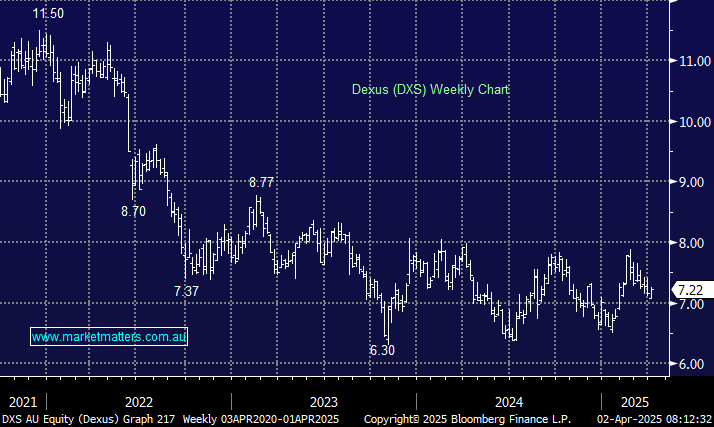

However, when we look at the share prices of the major players, investors appear less confident. Dexus is Australia’s No. 1 office landlord and stock we’ve owned in the past for the Income Portfolio, selling it in May of 2024 to switch into National Storage (NSR). Dexus was exited at $7.26 and today trades at $7.22, while we paid $2.28 for NSR, which currently sits at $2.23. These stocks essentially haven’t moved in the past year overall, though the usual optimism and pessimism have helped and hindered both at various times. With Dexus yielding ~7% vs NSR at ~5%, we would have been mildly better off holding DXS.

COVID has heavily influenced demand for office, though we’re now seeing more of a change of preferences than a structural shift to WFH. There is a clear move towards centrality, like Sydney’s Financial core and Melbourne’s Eastern and Western Cores. Businesses are consolidating into better-located office with more amenities (not less), reinforcing demand for good-quality assets in prime precincts i.e. “A grade” offices at the expense of lower quality “B grade”, a theme we’ve written about in the past, and we’re also seeing it on the ground in Sydney.

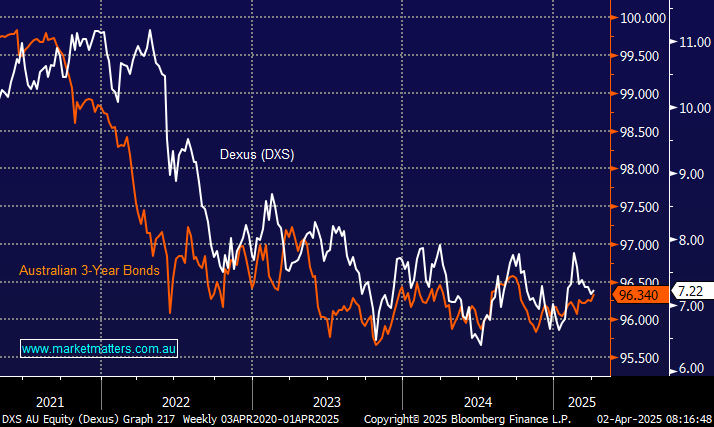

- There is also a macro tilt at play, with the DXS share price highly correlated to Australian 3-year bond prices. If we expect yields to decline, as we do, bond prices will move higher, which is a tailwind for the DXS share price.

From a valuation perspective, DXS trades around 1 standard deviation ‘cheap’ on 11.6x earnings and is expected to yield 6.86% (~20% franked), with the next dividend (Est 22c) due on June 27. This is when most property stocks trade ex-dividend, and they do tend to move higher into these distributions. DXS net tangible asset backing (NTA), which is the value of their portfolio sits at $8.81/sh as at the end of December, down 1.6% for the 6-months. While this value is based on independent valuations, we do think these are generous. However, with the stock price trading at a nearly 20% discount, there is a decent margin for error.

- We are keen on DXS at current levels, assessing it against our other property holdings held in the Income Portfolio, namely Centuria Capital (CNI) and National Storage (NSR).