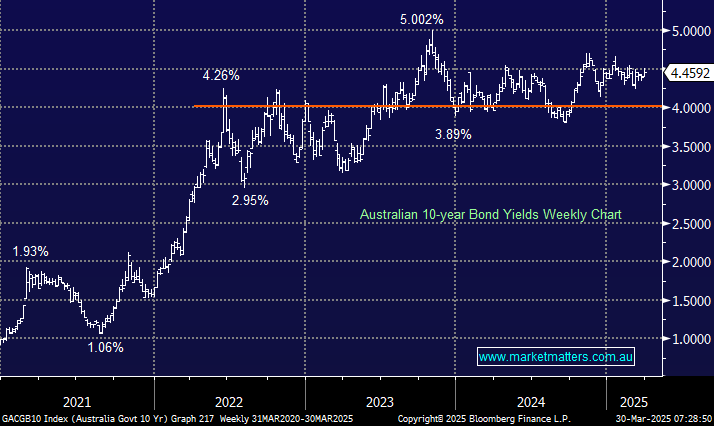

Last week saw Australia’s inflation-adjusted bond yields jump to their highest in over a decade as the yield on the nation’s inflation-indexed 10-year government bonds touched 2.38%, the highest since 2011. The real yield has risen by almost 30 basis points this quarter, following a 39-basis-point increase over the previous three months.

- As we looked at earlier, rising real yields should be supportive of the ASX banking sector through 2025, although probably not today!

NB: Real yields are the interest rates on bonds or investments after adjusting for inflation. They represent the actual purchasing power that an investor gains from holding a bond.

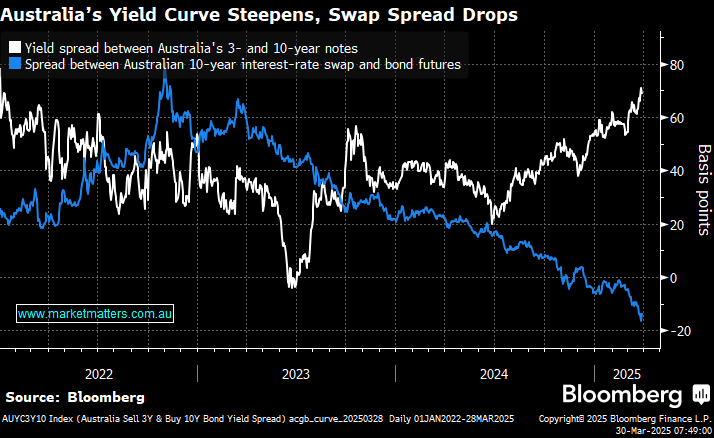

In a traditional fashion, the government unveiled tax cuts and other incentives this week, ahead of the May 3 election, focusing on cost-of-living concerns to help Prime Minister Anthony Albanese secure a second term in office – the outcome is a coin toss at this stage. Authorities plan to fund these initiatives through a 50% increase in debt issuance for the fiscal year starting in July. This additional debt supply has made long-dated bonds cheaper compared to their shorter-dated cousins. The yield spread between 3 and 10-year notes widened to 71 basis points on Friday, the most since March 2022.

Interestingly, the local 10s have hardly moved this year, given all the action unfolding in the shorter-dated 3s. Credit markets are now pricing in at least three rate cuts in 2025 as economic concerns build. We continue to believe this is too dovish, considering the conservative nature of the RBA, but as we’ve said before, we hope we’re wrong – three rate cuts before Christmas will ultimately be supportive of stocks unless we slip into a deep recession.