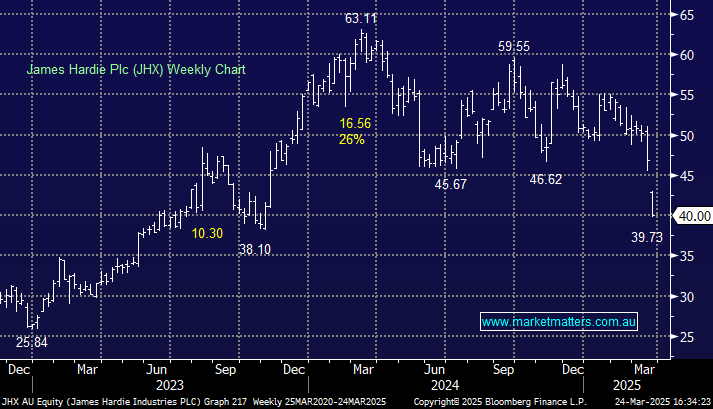

JHX –14.53%: announced the acquisition of outdoor building products company AZEK Group (AZEK US) for A$14bn. The market didn’t like it for a few obvious reasons, despite the acquisition being earnings accretive from the get go;

- It’s a big acquisition and most similar deals in recent years from Aussie corporates have added significant risk to the acquirer – think Orora (ORA) buying SaverGlass.

- JHX has paid a big multiple for AZEK, 22x earnings, nearly twice the current trading multiple of JHX.

- The timing of this deal is risky, insofar as uncertainty around tariffs, though, we’d argue that both companies are largely immune given their localised approach to sourcing and manufacturing.

Terms of the agreement include:

- AZEK shareholders to receive US$26.45 in cash and 1.0340 ordinary shares of James Hardie for each AZEK share.

- Values AZEK shares at US$56.88 each, representing a 26% premium over AZEK’s 30-day volume-weighted average price prior to the trade

- Implied valuation for AZEK ~22x earnings vs. James Hardie trading at ~13x earnings

- James Hardie shareholders will own approximately 74% of the combined entity, with AZEK shareholders holding the remaining 26%.

- James Hardie to dual-list, issuing shares on the NYSE post-completion.

In the short term, we think the market reaction could well be right given the above, however, we can see the long-term strategic rationale for the tie up. We hate the world synergy, but there should be plenty on offer in this deal, JHX targeting cost synergies of US$350m p.a, and revenue synergies of $225m p.a.

They’re also buying a very good business, with AZEK booking a compound annual growth rate of 15% over the past 7 years, growing faster than James Hardie at 11% over the same period.

The deal will drive higher growth overall, but they’re paying for it, and that, along with integration risk, is the concern in the short term.