Blackstone is one of the world’s largest alternative investment firms, specialising in private equity, real estate, hedge funds, and credit. As of the end of December 24, they managed a staggering $US1.13 trillion, which was up nearly 10% from the year prior. Private Credit is getting a lot of airtime locally of late, with ASIC focussing on the relatively new, booming part of the Australian market, and this is also a significant growth area for Blackstone within their credit & insurance business, which manages $US355bn, positioning Blackstone as the world’s largest third-party private-credit provider.

There are three main things we like about Blackstone, underpinning its position in the International Equities Portfolio;

- They are an asset manager, and markets go up over time, so they have a natural tailwind for growth over the medium to long term.

- Alternative assets outside of traditional listed public markets, are growing significantly, and BX is in a great position to take advantage of this growth in things like private credit, private equity and real estate.

- Blackstone is big and diversified across geography, asset class and strategy, ensuring there is always something that is attracting inflows. Diversity reduces risk.

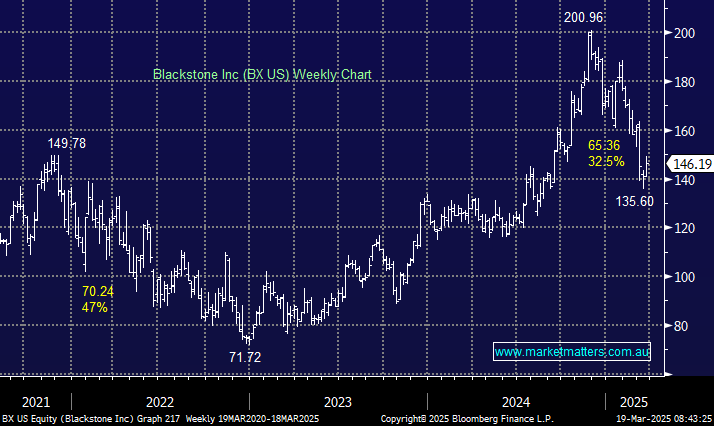

As an asset manager, the short-term ebbs and flows of the market have a more pronounced influence on the share price of BX US, and recent market weakness has led to a stock pullback of over 30%. Our position in BX was purchased late in 2022 at ~$US100/sh, and is now up 48%, having been up nearly 100% prior to recent weakness.

- UBS last week upgraded Blackstone to Buy and $US180 price target, pricing it in 26.5x FY26 estimated earnings. We agree with their rationale. While we are already long the stock, if we had no position, we would be using recent weakness to establish one.