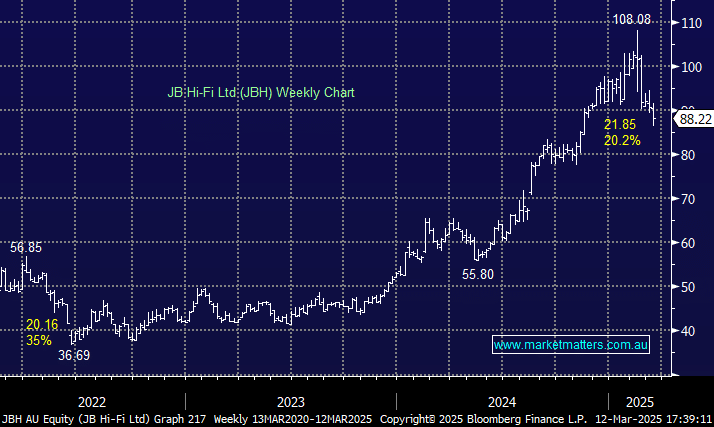

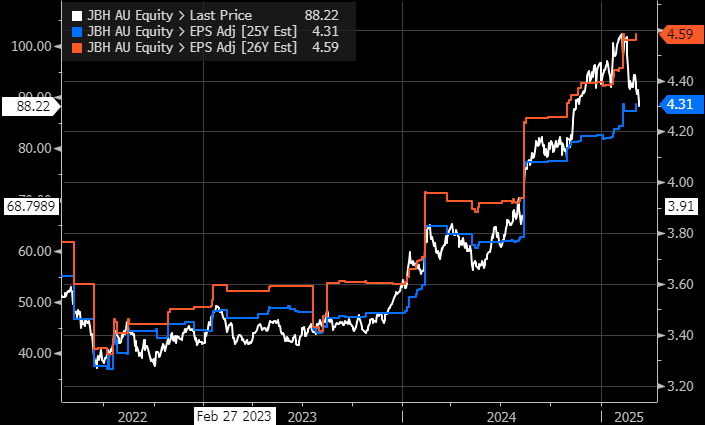

JBH soared through 2024 as the business performed strongly, and analysts consistently upgraded their earnings forecasts, taking the share price along for the ride. However, arguably, Australia’s premier retailer got too expensive, and we caution even after correcting over 20%, it’s still trading on the expensive side of history. The company’s single-digit revenue and earnings growth is enviable for any established business, which led to its most expensive multiple in history, a common story across the ASX in early February.

- We are huge fans of JBH as a business. The question is, where is the risk/reward now attractive?

This is an excellent example of how MM will often scale in and out of positions: We are happy to start buying JBH around $88. However, we would leave $$ to increase exposure to a deeper pullback if it eventuates instead of panicking around paper losses. Pundits often quote “Plan your trade and trade your plan,” a very sensible approach to trading and investing, although it’s not associated with the latter as much.

- We like JBH around $88 but would remain flexible to average if it dips closer to $80.