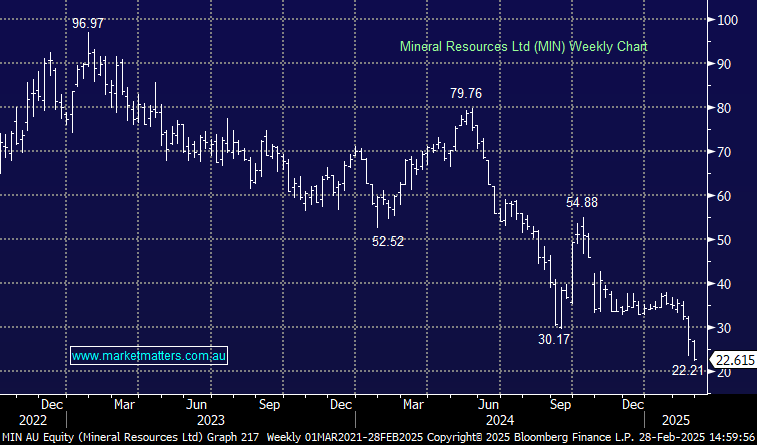

Mineral Resources (MIN) has been a poor position, currently down over ~60% from our original purchase price. Today the stock moved to a new 5 year low ~$22 coinciding with the end of the month and index rebalancing where they were taken out of the MSCI Australia Index.

When a stock moves by such a magnitude, the prevailing weighting in the portfolio declines. A 5% initial weight has declined to a prevailing weight of ~2%. The decision becomes, do we sell given it is now small, or add to it (averaging down), into weakness to give it a greater influence on portfolio returns moving forward.

We believe it’s the wrong time to sell the position given the embedded value in the underlying asset base, despite clear balance sheet concerns. We are therefore amending our target weight in the Active Growth Portfolio to 4%. While the target is a reduction from 5%, the implication of this decision is a doubling of our current position, reducing our average entry price. We will not increase this position further, with a 4% target weight our maximum allocation.

- As a guide, FY25 to date, MIN has detracted 3.4% from the returns in the Active Growth Portfolio.